Question: Case Study: Assume that your group is working in Financial Department of a company that produces health care tools and equipment. Your company is considering

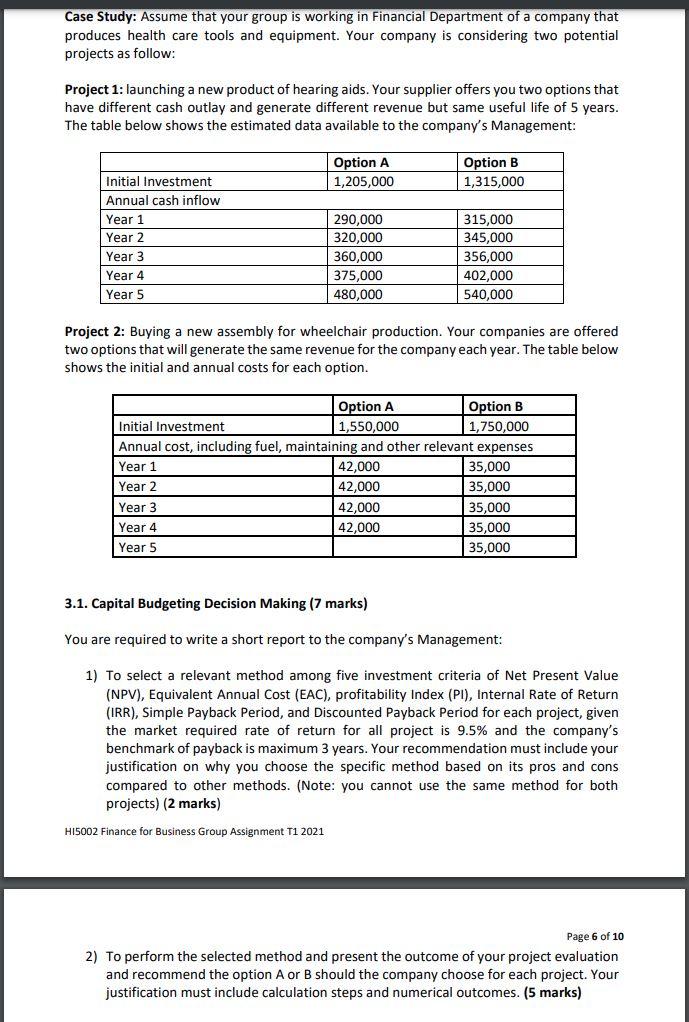

Case Study: Assume that your group is working in Financial Department of a company that produces health care tools and equipment. Your company is considering two potential projects as follow: Project 1: launching a new product of hearing aids. Your supplier offers you two options that have different cash outlay and generate different revenue but same useful life of 5 years. The table below shows the estimated data available to the company's Management: Option A 1,205,000 Option B 1,315,000 Initial Investment Annual cash inflow Year 1 Year 2 Year 3 290,000 320,000 360,000 375,000 480,000 315,000 345,000 356,000 402,000 540,000 Year 4 Year 5 Project 2: Buying a new assembly for wheelchair production. Your companies are offered two options that will generate the same revenue for the company each year. The table below shows the initial and annual costs for each option. Option A Option B Initial Investment 1,550,000 1,750,000 Annual cost, including fuel, maintaining and other relevant expenses Year 1 42,000 35,000 Year 2 42,000 35,000 Year 3 35,000 Year 4 42,000 35,000 Year 5 35,000 42,000 3.1. Capital Budgeting Decision Making (7 marks) You are required to write a short report to the company's Management: 1) To select a relevant method among five investment criteria of Net Present Value (NPV), Equivalent Annual Cost (EAC), profitability Index (PI), Internal Rate of Return (IRR), Simple Payback Period, and Discounted Payback Period for each project, given the market required rate of return for all project is 9.5% and the company's benchmark of payback is maximum 3 years. Your recommendation must include your justification on why you choose the specific method based on its pros and cons compared to other methods. (Note: you cannot use the same method for both projects) (2 marks) HI5002 Finance for Business Group Assignment T1 2021 Page 6 of 10 2) To perform the selected method and present the outcome of your project evaluation and recommend the option A or B should the company choose for each project. Your justification must include calculation steps and numerical outcomes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts