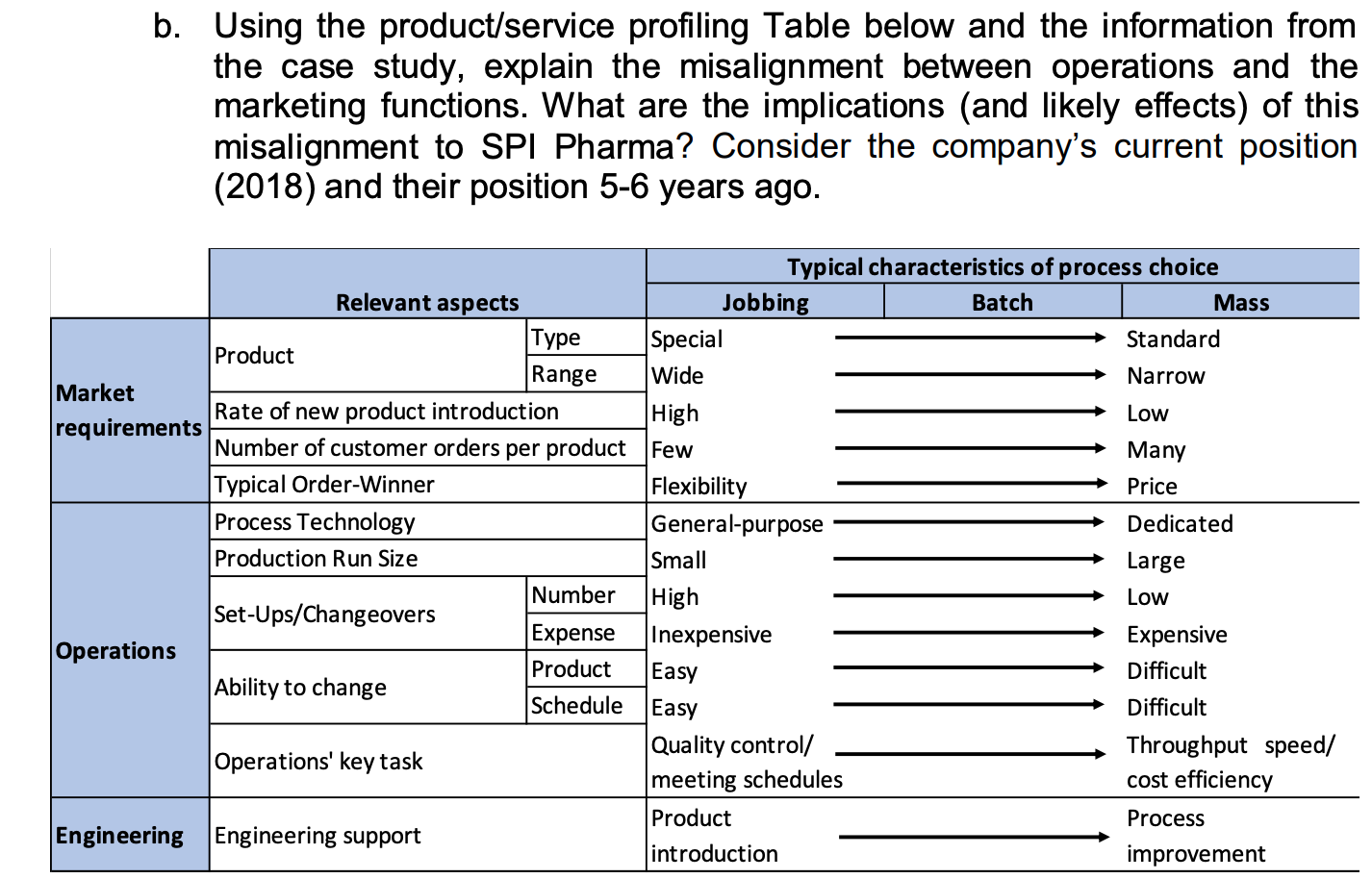

Question: Case study b. Using the product/service profiling Table below and the information from the case study, explain the misalignment between operations and the marketing functions.

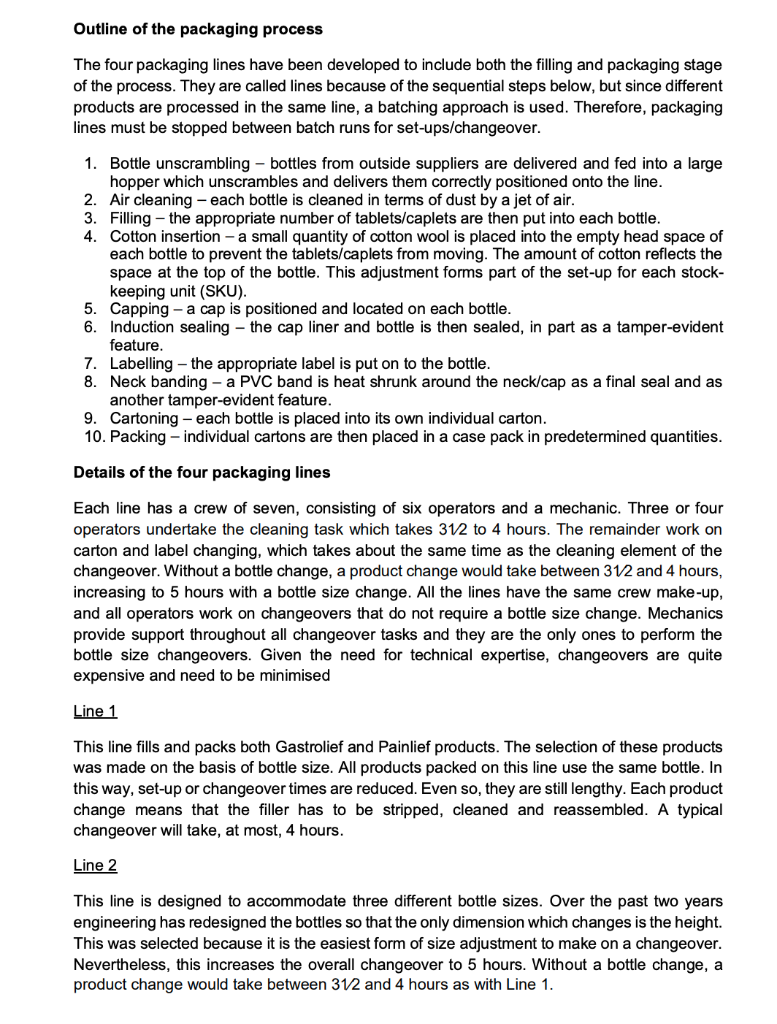

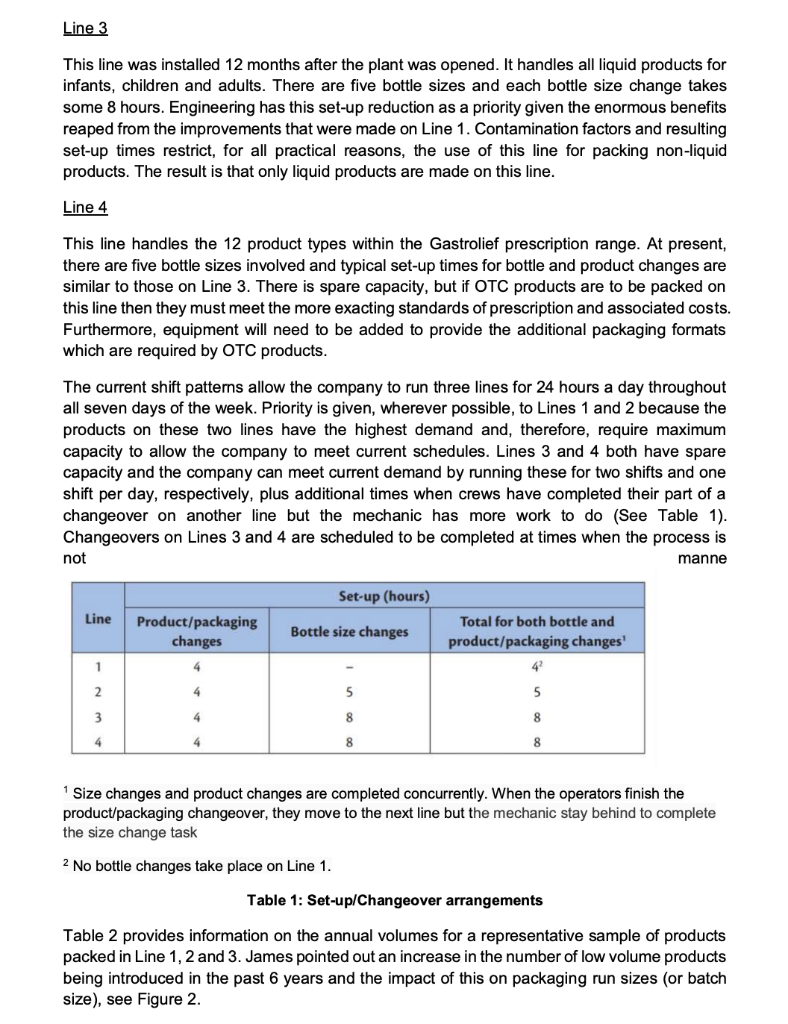

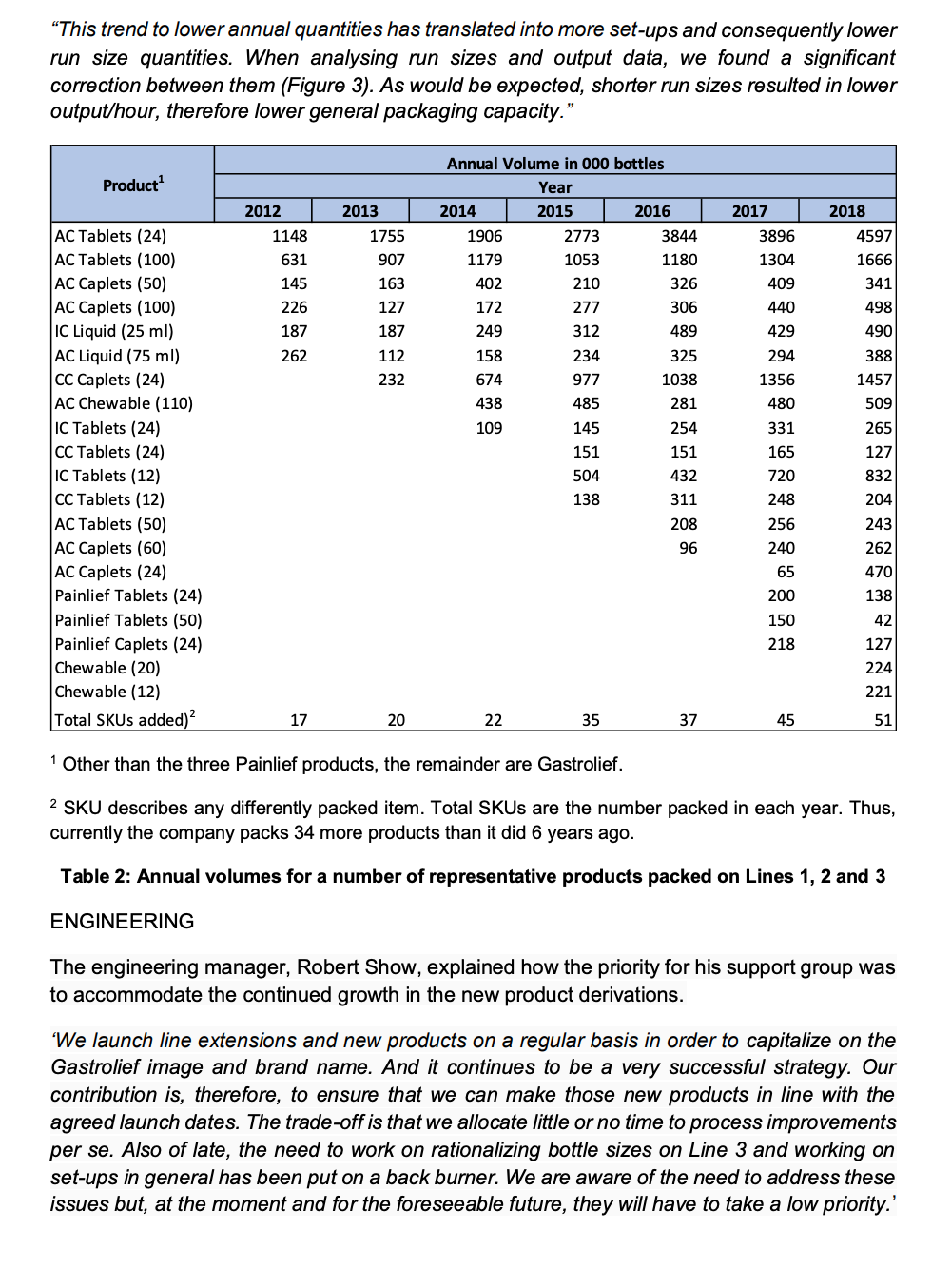

Case study

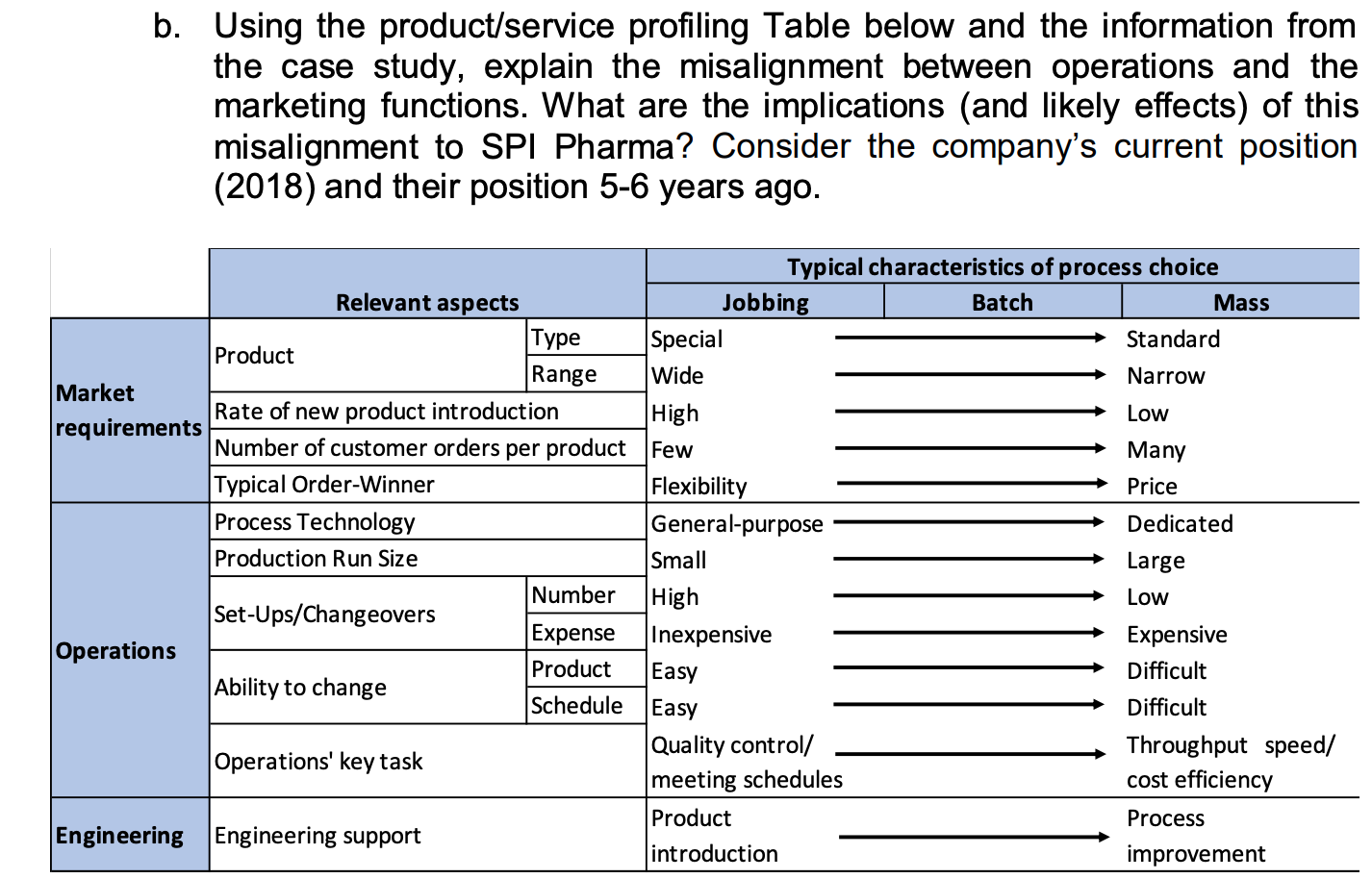

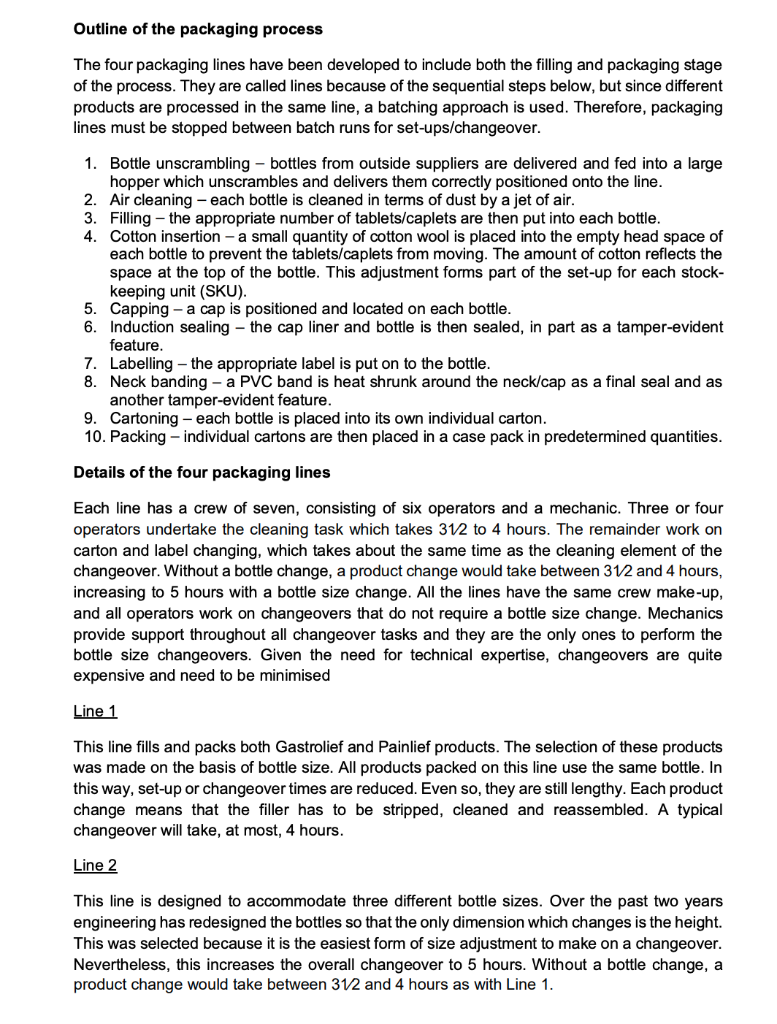

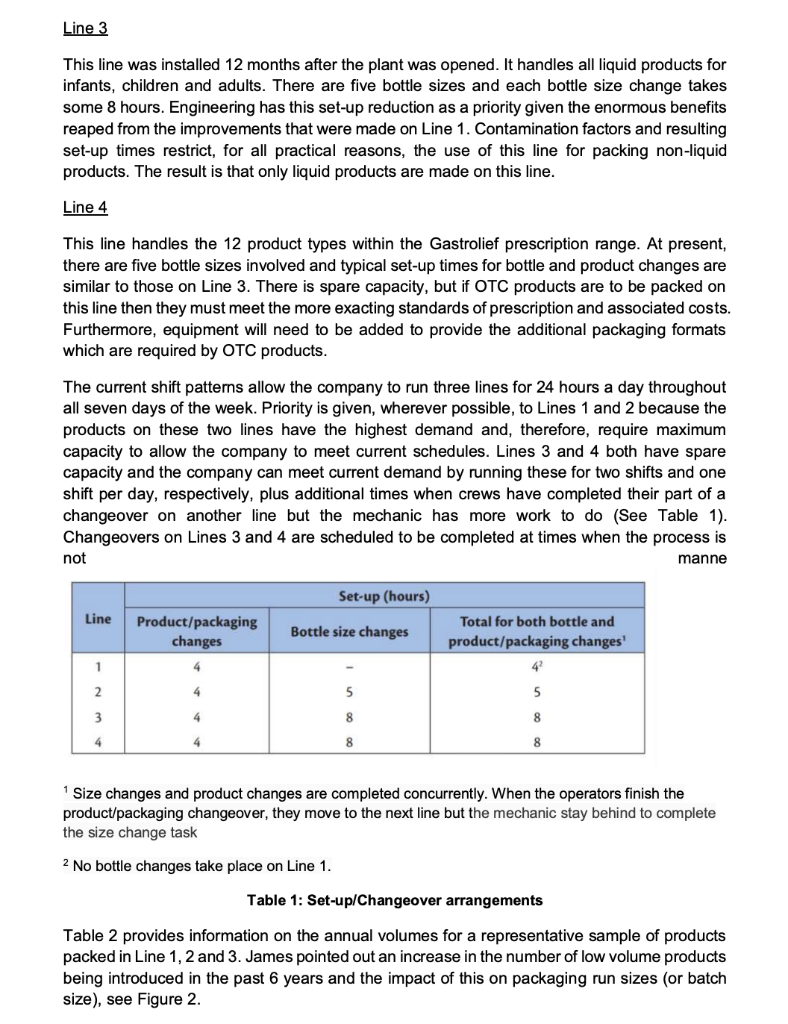

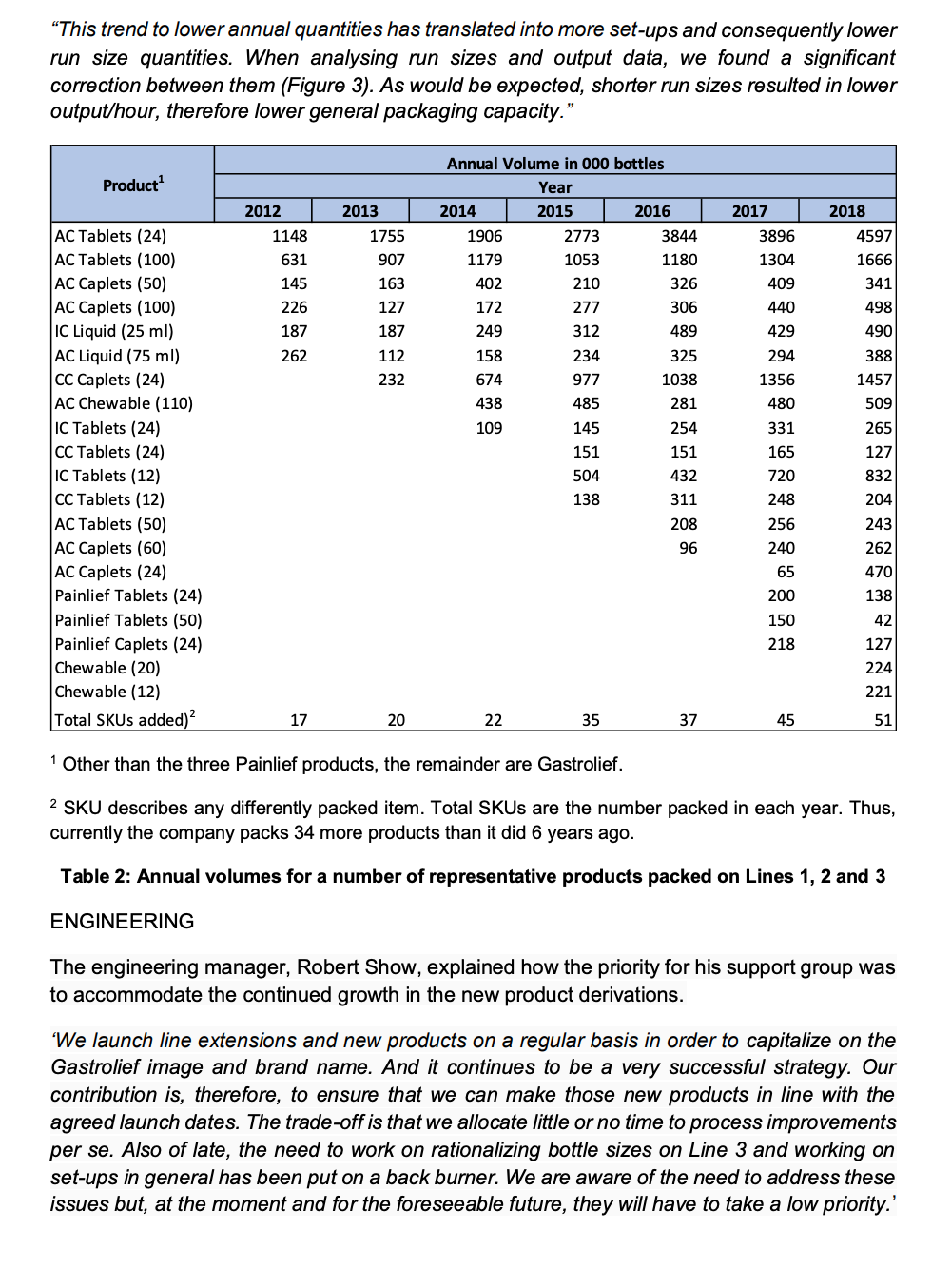

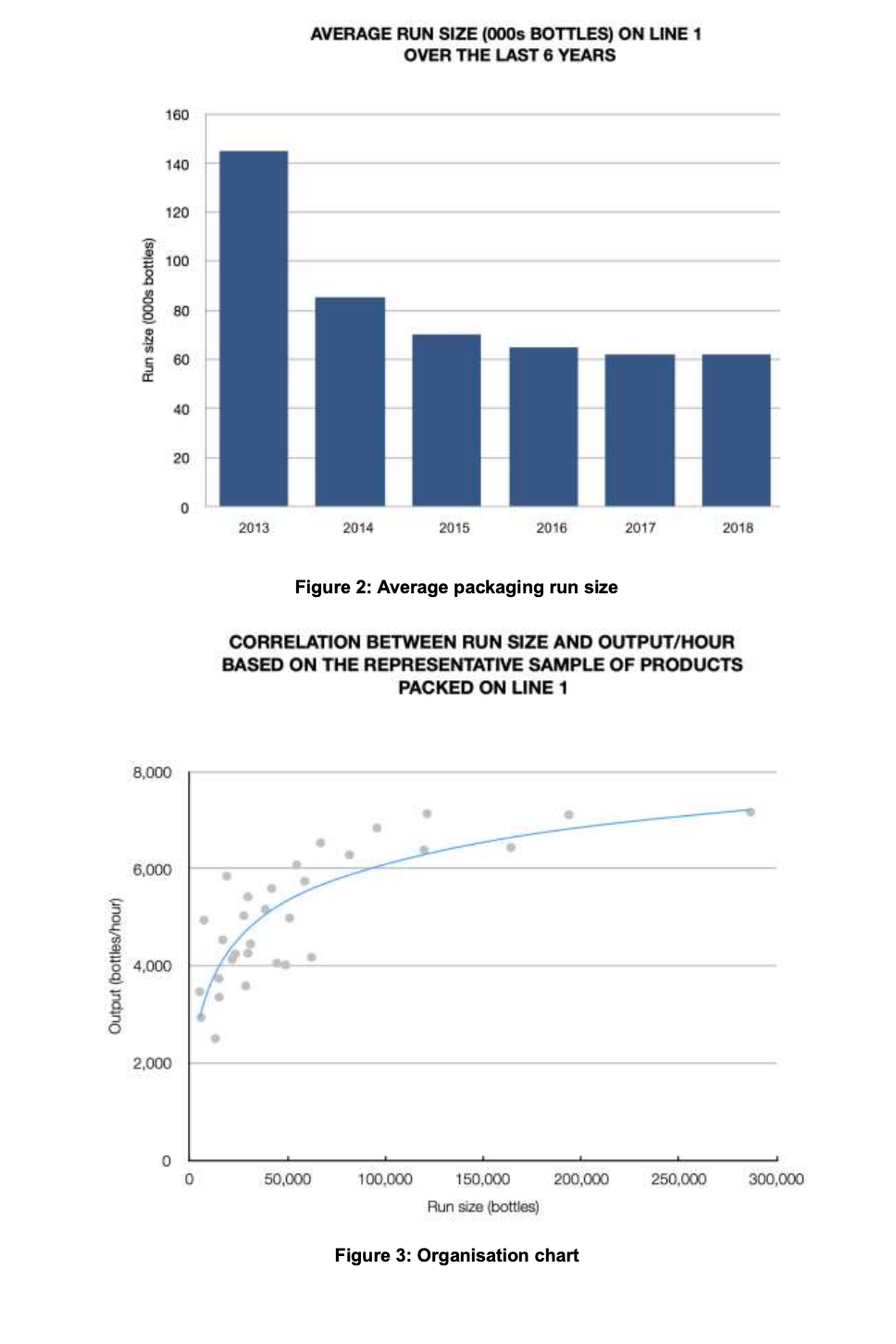

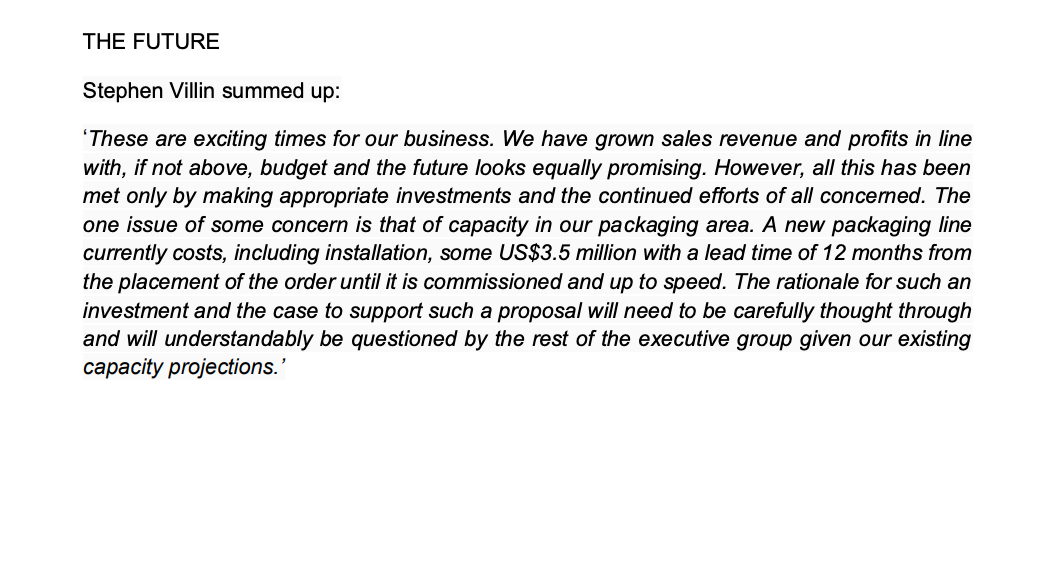

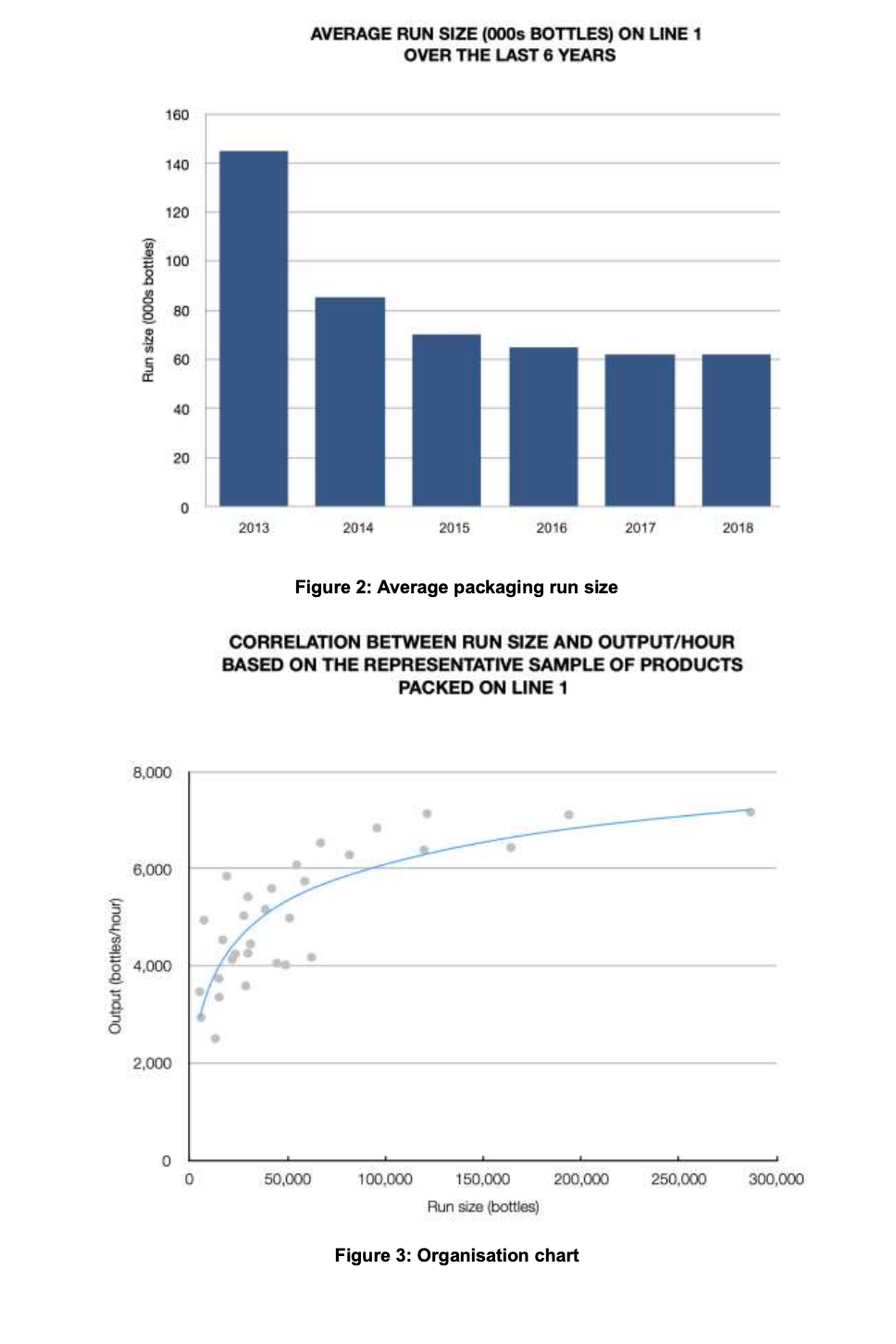

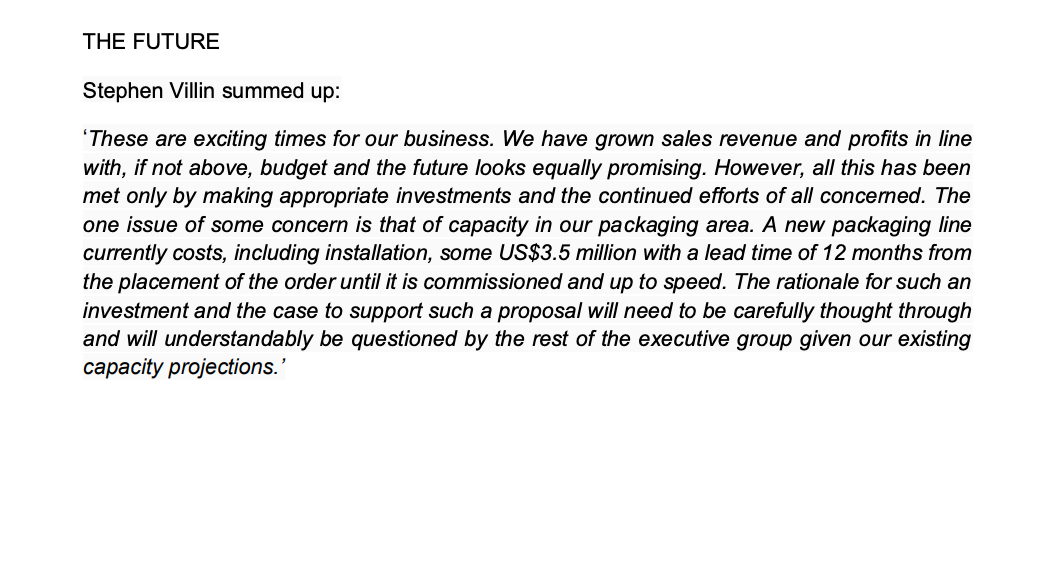

b. Using the product/service profiling Table below and the information from the case study, explain the misalignment between operations and the marketing functions. What are the implications (and likely effects) of this misalignment to SPI Pharma? Consider the company's current position (2018) and their position 5-6 years ago. Typical characteristics of process choice Relevant aspects Jobbing Batch Mass Type Special Standard Product Range Wide Narrow Market Rate of new product introduction High Low requirements Number of customer orders per product Few Many Typical Order-Winner Flexibility Price Process Technology General-purpose Dedicated Production Run Size Small Large Number High Low Set-Ups/Changeovers Expense Inexpensive Expensive Operations Product Difficult Ability to change Schedule Easy Difficult Quality control/ Throughput speed/ Operations' key task meeting schedules cost efficiency Product Process Engineering Engineering support introduction improvement Easy SPI Pharma Of increasing concern is the difficulty we are having in meeting our schedules and the growing customer order back-log which is resulting. For many months now there has been pressure to maintain schedules and we have been trying hard to overcome these problems. But, it appears as though it may be a permanent feature needing a long-term solution. The part which is difficult to reconcile, however, is that on paper we should have more than sufficient packaging capacity to meet current sales levels. And, no doubt, the rest of the board will also have difficulty in understanding this apparent discrepancy.' Stephen Villin, vice-president operations at SPI Pharma's plant in Allen, Texas, was addressing the managers responsible for production, engineering and materials (see Figure 1) at the weekly meeting to review current issues and progress on agreed developments. President Vice-President Vice-President Research & Human Development Resources Vice-President Operations Vice-President Sales & Marketing Vice-President Finance Engineering Manager Operations Manager Materials Manager Figure 1: Organisation chart BACKGROUND Nine years ago, SPI Pharma, needing to increase capacity, decided to build a new plant in Allen, Texas to make and pack Gastrolief, one of its successful stomach indigestion products. Within three years of making the decision, the plant was in full production and, six years later, it manufactures a wide range of derivatives under the Gastrolief brand name together with some of its Painlief products, one of SPI Pharma's pain-killing preparations. MARKETING 'Gastrolief has proven to be one of the most successful products we have developed in the past decade. This is certainly so, given the systematic way in which we have developed relevant variants in order to exploit the obvious sales potential. When the plant opened, we had two identical lines for packing our solid products. At this time, we had more capacity than we needed and our task, therefore, has been to identify new opportunities to increase sales and hence overall profits. Initially, we explored additional dosage forms which met the particular needs of consumers. Later, recognizing the level of acceptance of Gastrolief as a successful indigestion reliever for a wide cross-section of people, we decided to seek ways of capitalizing on the growing strength of its brand name. This led to adding further active ingredients in order to develop other products such as Gastrolief A (an anti-spasmodic preparation) and Gastrolief E (an anti-emetic preparation). And the whole strategy has been highly successful John Prynn, vice-president marketing gave further details of the way in which the product-line extensions and derivatives had been built on the Gastrolief image and, in turn, had added to the whole, thus leading to specific gains of both an 'individual and synergistic' nature. All products make very high margins. In fact, some of those which target specific markets will often attract a premium price and consequently even higher margins. All in all, we are a highly profitable business both in terms of total profit and as a per cent of sales.' OPERATIONS 'Since the opening of the plant some six years ago, we now make and pack OTC (over the counter) varieties of Gastrolief, some Painlief products and more recently prescription derivatives such as Gastrolief A and Gastrolief E. The latter were relocated here two years ago when the SPI Pharma Group reassessed its overall capacity requirements in the US and decided to close one of its plants. The outcome was that the prescription Gastrolief products were relocated and are now made and packed here.' James Lausong, operations manager, explained that the manufacture of pharmaceutical dosage forms is divided into two major groups of activities processing and packaging. Processing concerns the conversion of powdered ingredients into bulk tablet or liquid preparations. Equipment is dedicated to a single operation such as granulation, blending, tablet compression, coating and liquid mixing. These products are manufactured in bulk, normally in quantities dictated by the capacity of the particular piece of processing equipment. Filling bulk tablets and liquids produced in the processing phase of manufacturing takes place in packaging. Here tablets and liquids are bottled according to a range of sizes and on the relevant processes. There are now four packaging lines at the plant with specific products allocated to each line. 'When we opened up the plant, we installed the relevant processing capability and also packing Lines 1 and 2, with Line 3 scheduled to come on stream 12 to 15 months later. From the start, Lines 1 and 2 worked well and this confirmed our decision to invest in three identical processes. Staying with tried and tested equipment is a significant plus point as well as the benefits for engineering support and maintenance! James continued: 'When the other US plant was closed, we transferred the prescription product range and the existing packaging equipment from that plant to here, then modified and added to the process in order to bring it up to the same specification as the other three lines. The prescription range is only made on Line 4.' He added that when the Allen plant was planned, sufficient floor space and facilities were allowed for in terms of future growth. The growth in demand for Gastrolief has been rapid and this together with the transfer of products resulting from the plant closure has absorbed the excess floor space allowed for in the original plans. The capacity problems we are experiencing do not concern the processing stage of manufacturing. Here we have sufficient capacity. The problems are in packaging.' The discussion then turned to details on the packaging: Outline of the packaging process The four packaging lines have been developed to include both the filling and packaging stage of the process. They are called lines because of the sequential steps below, but since different products are processed in the same line, a batching approach is used. Therefore, packaging lines must be stopped between batch runs for set-ups/changeover. 1. Bottle unscrambling - bottles from outside suppliers are delivered and fed into a large hopper which unscrambles and delivers them correctly positioned onto the line. 2. Air cleaning - each bottle is cleaned in terms of dust by a jet of air. 3. Filling - the appropriate number of tablets/caplets are then put into each bottle. 4. Cotton insertion - a small quantity of cotton wool is placed into the empty head space of each bottle to prevent the tablets/caplets from moving. The amount of cotton reflects the space at the top of the bottle. This adjustment forms part of the set-up for each stock- keeping unit (SKU). 5. Capping - a cap is positioned and located on each bottle. 6. Induction sealing - the cap liner and bottle is then sealed, in part as a tamper-evident feature. 7. Labelling - the appropriate label is put on to the bottle. 8. Neck banding - a PVC band is heat shrunk around the neck/cap as a final seal and as another tamper-evident feature. 9. Cartoning - each bottle is placed into its own individual carton. 10. Packing - individual cartons are then placed in a case pack in predetermined quantities. Details of the four packaging lines Each line has a crew of seven, consisting of six operators and a mechanic. Three or four operators undertake the cleaning task which takes 312 to 4 hours. The remainder work on carton and label changing, which takes about the same time as the cleaning element of the changeover. Without a bottle change, a product change would take between 312 and 4 hours, increasing to 5 hours with a bottle size change. All the lines have the same crew make-up, and all operators work on changeovers that do not require a bottle size change. Mechanics provide support throughout all changeover tasks and they are the only ones to perform the bottle size changeovers. Given the need for technical expertise, changeovers are quite expensive and need to be minimised Line 1 This line fills and packs both Gastrolief and Painlief products. The selection of these products was made on the basis of bottle size. All products packed on this line use the same bottle. In this way, set-up or changeover times are reduced. Even so, they are still lengthy. Each product change means that the filler has to be stripped, cleaned and reassembled. A typical changeover will take, at most, 4 hours. Line 2 This line is designed to accommodate three different bottle sizes. Over the past two years engineering has redesigned the bottles so that the only dimension which changes is the height. This was selected because it is the easiest form of size adjustment to make on a changeover. Nevertheless, this increases the overall changeover to 5 hours. Without a bottle change, a product change would take between 312 and 4 hours as with Line 1. Line 3 This line was installed 12 months after the plant was opened. It handles all liquid products for infants, children and adults. There are five bottle sizes and each bottle size change takes some 8 hours. Engineering has this set-up reduction as a priority given the enormous benefits reaped from the improvements that were made on Line 1. Contamination factors and resulting set-up times restrict, for all practical reasons, the use of this line for packing non-liquid products. The result is that only liquid products are made on this line. Line 4 This line handles the 12 product types within the Gastrolief prescription range. At present, there are five bottle sizes involved and typical set-up times for bottle and product changes are similar to those on Line 3. There is spare capacity, but if OTC products are to be packed on this line then they must meet the more exacting standards of prescription and associated costs. Furthermore, equipment will need to be added to provide the additional packaging formats which are required by OTC products. The current shift patterns allow the company to run three lines for 24 hours a day throughout all seven days of the week. Priority is given, wherever possible, to Lines 1 and 2 because the products on these two lines have the highest demand and, therefore, require maximum capacity to allow the company to meet current schedules. Lines 3 and 4 both have spare capacity and the company can meet current demand by running these for two shifts and one shift per day, respectively, plus additional times when crews have completed their part of a changeover on another line but the mechanic has more work to do (See Table 1). Changeovers on Lines 3 and 4 are scheduled to be completed at times when the process is not manne Set-up (hours) Line Product/packaging changes Bottle size changes Total for both bottle and product/packaging changes 1 4 4 2 4 5 5 3 4 8 8 4 4 8 8 Size changes and product changes are completed concurrently. When the operators finish the product/packaging changeover, they move to the next line but the mechanic stay behind to complete the size change task 2 No bottle changes take place on Line 1. Table 1: Set-up/Changeover arrangements Table 2 provides information on the annual volumes for a representative sample of products packed in Line 1, 2 and 3. James pointed out an increase in the number of low volume products being introduced in the past 6 years and the impact of this on packaging run sizes (or batch size), see Figure 2. This trend to lower annual quantities has translated into more set-ups and consequently lower run size quantities. When analysing run sizes and output data, we found a significant correction between them (Figure 3). As would be expected, shorter run sizes resulted in lower output/hour, therefore lower general packaging capacity. Product 2012 2017 2018 2013 1755 3896 907 1304 1148 631 145 226 163 409 440 127 187 187 429 262 112 232 Annual Volume in 000 bottles Year 2014 2015 2016 1906 2773 3844 1179 1053 1180 402 210 326 172 277 306 249 312 489 158 234 325 674 977 1038 438 485 281 109 145 254 151 151 504 432 138 311 208 96 AC Tablets (24) AC Tablets (100) AC Caplets (50) AC Caplets (100) IC Liquid (25 ml) AC Liquid (75 ml) CC Caplets (24) AC Chewable (110) IC Tablets (24) CC Tablets (24) IC Tablets (12) CC Tablets (12) AC Tablets (50) AC Caplets (60) AC Caplets (24) Painlief Tablets (24) Painlief Tablets (50) Painlief Caplets (24) Chewable (20) Chewable (12) Total SKUs added)? 294 1356 480 4597 1666 341 498 490 388 1457 509 265 127 832 204 243 262 470 138 331 165 720 248 256 240 65 200 150 218 42 127 224 221 17 20 22 35 37 45 51 1 Other than the three Painlief products, the remainder are Gastrolief. 2 SKU describes any differently packed item. Total SKUs are the number packed in each year. Thus, currently the company packs 34 more products than it 6 years ago. Table 2: Annual volumes for a number of representative products packed on Lines 1, 2 and 3 ENGINEERING The engineering manager, Robert Show, explained how the priority for his support group was to accommodate the continued growth in the new product derivations. We launch line extensions and new products on a regular basis in order to capitalize on the Gastrolief image and brand name. And it continues to be a very successful strategy. Our contribution is, therefore, to ensure that we can make those new products in line with the agreed launch dates. The trade-off is that we allocate little or no time to process improvements per se. Also of late, the need to work on rationalizing bottle sizes on Line 3 and working on set-ups in general has been put on a back burner. We are aware of the need to address these issues but, at the moment and for the foreseeable future, they will have to take a low priority.' AVERAGE RUN SIZE (000s BOTTLES) ON LINE 1 OVER THE LAST 6 YEARS 160 140 120 100 Run size (000s bottles) 80 60 40 20 0 2013 2014 2015 2016 2017 2018 Figure 2: Average packaging run size CORRELATION BETWEEN RUN SIZE AND OUTPUT/HOUR BASED ON THE REPRESENTATIVE SAMPLE OF PRODUCTS PACKED ON LINE 1 8,000 6,000 Output (bottles/hour) 4,000 2,000 0 0 50,000 100.000 200,000 250,000 300,000 150,000 Run size (bottles) Figure 3: Organisation chart THE FUTURE Stephen Villin summed up: 'These are exciting times for our business. We have grown sales revenue and profits in line with, if not above, budget and the future looks equally promising. However, all this has been met only by making appropriate investments and the continued efforts of all concerned. The one issue of some concern is that of capacity in our packaging area. A new packaging line currently costs, including installation, some US$3.5 million with a lead time of 12 months from the placement of the order until it is commissioned and up to speed. The rationale for such an investment and the case to support such a proposal will need to be carefully thought through and will understandably be questioned by the rest of the executive group given our existing capacity projections