Question: Case Study Background TechMall.com, the brainchild of three ambitious professionals, is a classic Internet startup company in Madison, Wisconsin. Doug Liddle, a seasoned entrepreneur, identified

Case Study

Background

TechMall.com, the brainchild of three ambitious professionals, is a classic Internet startup company in Madison, Wisconsin. Doug Liddle, a seasoned entrepreneur, identified the early growth potential of Internet companies like Netscape, Yahoo, and Amazon.com. Eager to be a first mover, Doug contacted his friend, Steve Tambasco, who was heavily involved in sales and distribution of electronics and related equipment. Doug was certain his vision of the Internet future could somehow be merged with Steves excellent understanding of and connections within the electronics distribution industry. After a lot of research, both Doug and Steve were confident that an Internet channel of electronics merchants, essentially a virtual mall of cyber stores, could be successfully established and achieve early profits. They felt that electronics merchants and their customers would be some of the early denizens of e-commerce. Many of these merchants were focusing on the Internet, but they were not sure how to proceed to integrate the Internet with their businesses.

Doug and Steve identified two critical needs of these merchants. First, they needed a complete e-commerce solution that provided hosting, website development, registration in a key search engine, inventory management and fulfillment/shipping, and the ability to process customer payments. Second, these hopeful Internet merchants needed this complete e-commerce solution to be easy, stable, and relatively inexpensive.

Doug and Steve realized at this point that they needed to recruit individuals with Internet technical ability. Fortunately, as a result of some past business dealings, Doug had come to know a number of sharp software and database engineers. The brightest was a woman currently working as a project supervisor for a large local networking company in MadisonKristi Smith-Meyers. Doug made the lunch appointment. It turned out to be an obvious match. Kristi was anxious to move on with her career. Doug and Steve were also quite pleased to discover that Kristi had a lot of ideas about how the technology should work. Further, she was confident that she could assemble the necessary engineers for their new company.

With Kristi on board, they were ready to officially launch their Internet portal company or IPC. TechMall.com, Inc. was formed with Doug as CEO, Kristi as Chief Technology Officer or CTO, and Steve as Vice-President of Marketing. Kristi began establishing a server and building a host site. One by one, engineers were recruited from other companies and assigned the tasks of building websites, customizing a search engine package, and integrating the web store sites with the fledgling payment processing technologies coming on to the market. The biggest challenge turned out to be creating an inventory system that allowed merchants to build and maintain a unique mix of product and prices while seamlessly providing receiving and shipping capability from both the merchants own physical warehouse, as well as from key electronic parts distributors. Typical of many IPCs, TechMall initially offered its portal services free of charge to merchants during its beta test period. Merchants understood that the service they received in the TechMall portal during the beta period were subject to downtimes and other technical difficulties while the technology was being developed, and that there would eventually be service charges put in place once the technology was proven.

While Kristi focused on the technology, Doug began identifying investors in anticipation of their first formal round of funding. However, most of Dougs time was spent working with Steve on marketing. Steves connections in the electronics wholesale and retail industry, which were deep and wide, turned out to be a critical component of the companys eventual success. Steve understood that for TechMall.com to successfully orchestrate a first-mover strategy, it would need to identify and quickly bring large blocks of electronics merchants into its virtual mall. The process he followed was one of creating partnerships with merchant aggregators, defined as any organization that had already established business relations with significant numbers of electronics parts and products retailers. The potential merchant aggregators for TechMall included manufacturers, wholesalers/distributors, and industry organizations and associations. Even magazines and other consumer electronic trade publications were possible partners who could sell space in the TechMall virtual mall to their subscriber base. Steve scheduled meetings with key individuals at the various organizations where he presented TechMalls business plan, technology, and revenue sharing model. He knew exactly what issues were key to creating excitement in these organizations, and much of that excitement centered on the TechMall model of revenue residual splits, i.e., sharing revenue from merchant clients with the organizations that brought those clients into the TechMall portal.

Exhibit 1 depicts the structure of TechMalls relationships with its merchant clients and its merchant aggregators. In this relationship, the merchant aggregator establishes a partnership with TechMall to sell space in the TechMall virtual mall to its own collection of merchants. Once set up in the TechMall channel, the merchant client sells electronic goods and services to its own customers within the TechMall channel. TechMalls virtual mall technology facilitates delivery to the customer and, in a manner similar to the function of a traditional credit card processor, collects the sales price and remits the sales prices, less all transaction fees, back to the merchant client. In addition to the initial setup fee gathered from the merchant, TechMall also collects a fixed monthly maintenance fee (also called a Statement Fee) and a fee on each sales transaction (which is variable based on the dollar volume of the merchants transactions). All three types of fees are remitted directly to TechMall, which then splits these revenues with the appropriate merchant aggregator using a predetermined revenue split ratio.

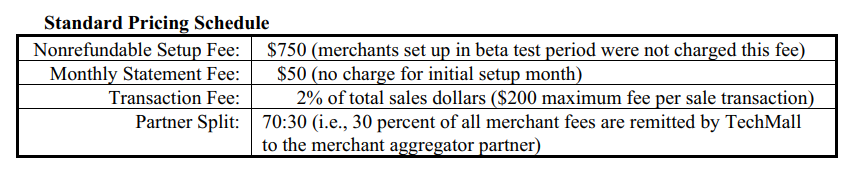

Doug, Steve, and Kristi all agreed that TechMall would roll out service charges to merchant clients once the technology was stable and there was a critical mass of at least 500 merchants registered in the TechMall system. As the first year of operations wound down, it was clear that the company would be able to start collecting revenues beginning with January of the following year. The price list was prepared based on market analyses and feedback from merchants already in the system. Steve essentially was in charge of developing the standard price list, though it is important to note that he and his marketing team retain the ability to amend fees and the partner split as needed in the process of negotiations with TechMalls partners. TechMalls partners (i.e., the merchant aggregators) use these negotiated fees in the process of selling merchant clients into TechMalls portal system. The TechMall revenue model is listed below.

Both Steve and Doug felt that the strength of this surprisingly simple model was the potential to create revenue and cash in both the early stage and the mature stage of TechMalls life cycle. As partners (merchant aggregators) worked to sell and set up their Internet-hopeful electronics merchants into the TechMall system, large setup fees were immediately generated. Later, as these merchants new e-commerce businesses grew and became successful, TechMall and its partners were positioned to grow and become successful with merchants by sharing two percent of the total sales value of each customer transaction. One important aspect of this revenue model is that TechMall is motivated to help merchant clients grow their businesses. Further, even if merchants with virtual stores within the portal struggled to grow their e-commerce business, TechMall expected to generate a decent ongoing revenue stream via the monthly statement fee. The initial financial results of this revenue model were impressive. Unlike many e-commerce companies, TechMall began generating significant operating profits and positive cash flows soon after starting operations.

The early months of TechMalls history were full of excitement and hard work. Once the revenue model was put in place in January of the second year of operations, there was little time to consider how well key internal aspects of the company were performing. Steves growing sales team was consumed with contracting new merchant aggregator partners while Kristi and her team put in 80-hour workweeks fueled by pizza and caffeine. Doug, as CEO, exhausted himself managing the growth as new employees were hired and new office locations were acquired. By the end of the second year there were more than 3,200 merchants set up in the TechMall portal. This number more than doubled to over 8,000 merchants by the end of the third year. TechMall soon began getting attention from big companies and investors in the e-commerce industry.

Sometime late in the third year of TechMalls operations, much of Dougs attention shifted from managing growth to discussions with attorneys who thought it might be time for TechMall to execute an IPO. In addition, inquiries were surfacing that indicated a merger or acquisition of TechMall could be on the horizon. Early in the fourth year, two large Internet portal companies contacted Doug within days of one another to invite him to consider selling or merging his company with theirs. Within 60 days of that first call, after surprisingly little serious due diligence on the part of the buying company, TechMall was acquired by Wahoo.com, a multifaceted Internet company out of Austin, Texas. On the day of its acquisition, TechMall was barely three and a half years old with a total of 42 employees. It had nearly 9,000 merchants in its virtual mall. The previous year, TechMall had reported revenues of $5.15 million and net income of $2.46 million. The total acquisition price was $55.5 million in cash and stock.

Sheri Brinker, an aggressive and extremely competent CPA from a local firm, entered this enviable company shortly after the acquisition as TechMalls first CFO. Wahoo.com, TechMalls new mother company, was a very well managed public company trading on the NASDAQ at a market cap of close to $4 billion. None of the three founders had any experience with a public company and public reporting responsibilities. And, due to the rich cash flow of the business, TechMall had never needed a loan. That fact, coupled with its investors enthusiastic faith in the company and its founders, meant that no CPA had actually done anything more with TechMall than file quarterly tax returns. Hence, it was made clear to Doug by Wahoo that TechMall needed someone with strong accounting skills and good finance experience to help merge the company into the infrastructure of Wahoos corporate reporting system. Although Sheri did not have much experience in accounting for e-commerce companies, she was the top candidate for the job.

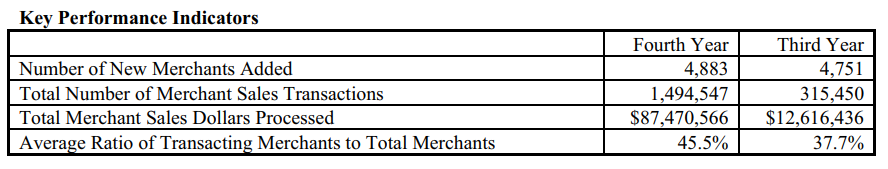

There was a lot of work to do during the acquisition year to get a formal financial control and accounting system established and to prepare TechMall for its first audit. One thing that Sheri didnt have to worry about, though, was TechMalls core business. Through its fourth year of operations, merchant aggregators continued to bring more electronics merchants into the TechMall portaland revenues, income, and cash continued to flow. The fourth year (TechMalls first year as a Wahoo subsidiary) came to a close. As Sheri worked through January of the following year to close the books and prepare financial statements for the auditors, it was clear that TechMalls stellar financial growth was slowing. Concerned, Sheri prepared the following preliminary key performance indicators in preparation for the weekly executive team meeting (below).

On one hand, these performance indicators suggested to Sheri that TechMalls financial progress was continuing, at least in terms of merchants actively transacting within the TechMall system. This progress appeared to be underscored by an improving balance sheet and a strong cash flow statement (see Exhibits 2 and 3).

On the other hand, growth in new merchants coming into the system was clearly flat, at best. And, despite the apparent strength of the balance sheet and cash flow statement, net income had declined sharply from the previous year (see Exhibit 4). Sheri noted that costs were increasing very fast. This increase was not particularly surprising to her given the fact that TechMall was transitioning from a small entrepreneur shop into a large company and a major player in the e-commerce industry. The infrastructure of the company was naturally growing as more employees were hired, technology was purchased, and facilities were expandedall of these costs apparently necessary to support TechMalls fast growth. However, Sheri was concerned that there may be fundamental weaknesses developing within the revenue stream that could have much more serious effect on both income and cash flow than the growing costs. Sheri received a lot of training as an accounting major at her university in cost analysis and management. However, she now found it ironic that there had been very little discussion of revenue management and analysis. So, without much direct benefit from her accounting texts, Sheri prepared to begin an analysis of TechMalls revenues. Still, perhaps there were one or two concepts she might be able to use from her old economics classes. As she reviewed her controllers extended report on monthly performance metrics for the last three years (Exhibit 5), Sheri tried to recall the concept of marginal decreasing returns and economies (or diseconomies) of scale. She wondered if TechMalls dramatic cost increases were economically justified. Perhaps more important, it appeared that as the company continued to add more merchants to its system, the marginal value of merchants in terms of revenue was decreasing.

Requirements:

TechMall.coms Revenues

Note Exhibit 3, Year 2 cash flows, the add total change in cash is an incorrect number. It should be $1,371,350.

1. What are the different revenue streams for TechMall?

2. What event cause revenue recognition for each of the revenue streams and how much does Tech Mall expect to earn from each incremental event?

3. Given the level of activity in each revenue stream, compare the amount of revenue expected from each revenue stream with their actual revenue. Is TechMall getting their expected revenue from each of the revenues streams?

4. If actual revenue isnt what TechMall expected, what might be causing the variation?

5. What can be done to better manage TechMalls revenue?

Standard Pricing Schedule Nonrefundable Setup Fee: $750 (merchants set up in beta test period were not charged this fee) Monthly Statement Fee: $50 (no charge for initial setup month) Transaction Fee: 2% of total sales dollars ($200 maximum fee per sale transaction) Partner Split: 70:30 (i.e., 30 percent of all merchant fees are remitted by TechMall to the merchant aggregator partner) Key Performance Indicators Number of New Merchants Added Total Number of Merchant Sales Transactions Total Merchant Sales Dollars Processed Average Ratio of Transacting Merchants to Total Merchants Fourth Year 4,883 1,494,547 $87,470,566 45.5% Third Year 4,751 315,450 $12,616,436 37.7% Standard Pricing Schedule Nonrefundable Setup Fee: $750 (merchants set up in beta test period were not charged this fee) Monthly Statement Fee: $50 (no charge for initial setup month) Transaction Fee: 2% of total sales dollars ($200 maximum fee per sale transaction) Partner Split: 70:30 (i.e., 30 percent of all merchant fees are remitted by TechMall to the merchant aggregator partner) Key Performance Indicators Number of New Merchants Added Total Number of Merchant Sales Transactions Total Merchant Sales Dollars Processed Average Ratio of Transacting Merchants to Total Merchants Fourth Year 4,883 1,494,547 $87,470,566 45.5% Third Year 4,751 315,450 $12,616,436 37.7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts