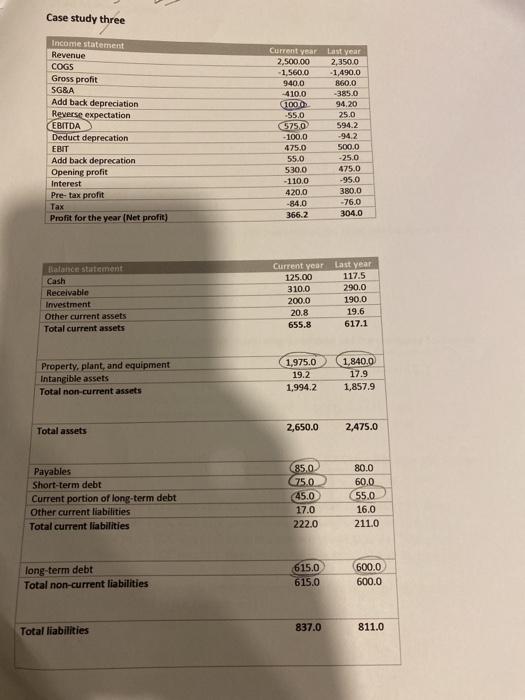

Question: case study can you answer and check!!! Case study three Income statement Revenue COGS Gross profit SG&A Add back depreciation Reverse expectation (EBITDA Deduct deprecation

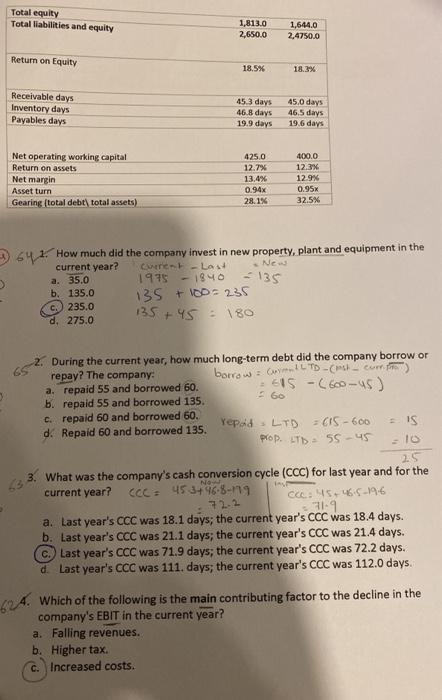

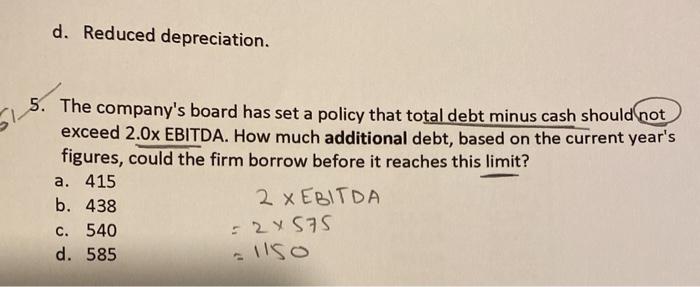

Case study three Income statement Revenue COGS Gross profit SG&A Add back depreciation Reverse expectation (EBITDA Deduct deprecation EBIT Add back deprecation Opening profit Interest Pre-tax profit Tax Profit for the year (Net profit) Current year 2,500.00 -1.560.0 940.0 -410.0 (1000 -55.0 5750 -100.0 475.0 55.0 530.0 -1100 420.0 -84,0 366.2 Last year 2,350.0 - 1,490.0 860.0 -385.0 94,20 25.0 594.2 -942 500.0 -25.0 475.0 -95.0 380.0 -76.0 304.0 Balance statement Cash Receivable Investment Other current assets Total current assets Current year Last year 125.00 117.5 310.0 290.0 200.0 190.0 20.8 19.6 655.8 617.1 Property, plant, and equipment Intangible assets Total non-current assets 1,975.0 19.2 1,994.2 1,840.0 17.9 1,857.9 2,650.0 2,475.0 Total assets Payables Short-term debt Current portion of long-term debt Other current liabilities Total current liabilities 85,0 (75.0 45.0 17.0 222.0 80.0 60.0 55.0 16.0 211.0 long-term debt Total non-current liabilities 615.0 615.0 600.0 600.0 Total liabilities 837.0 811.0 Total equity Total liabilities and equity 1,813.0 2,650.0 1,644.0 2,4750.0 Return on Equity 18.5% 18.3% Receivable days Inventory days Payables days 45.3 days 46.8 days 19.9 days 45,0 days 46.5 days 19.6 days Net operating working capital Return on assets Net margin Asset turn Gearing (total debt total assets) 425.0 12.7% 13.4% 0.94% 28.1% 400.0 12.3% 12.9% 0.95% 32.5% 641. How much did the company invest in new property, plant and equipment in the current year? weren - Lax New 1975-1940 - 135 135 +100=235 c.) 235.0 d. 275.0 135 +45 180 a. 35.0 b. 135.0 560 During the current year, how much long-term debt did the company borrow or repay? The company: borrow = CIL TO -( como a. repaid 55 and borrowed 60. 2015 -(600-45) b. repaid 55 and borrowed 135. c. repaid 60 and borrowed 60. repad LTD C15-600 IS d. Repaid 60 and borrowed 135. prop. LTD=5545 10 25 What was the company's cash conversion cycle (CCC) for last year and for the current year? CC:45 34 968-19 CU: 45-465-196 72.2 219 a. Last year's CCC was 18.1 days; the current year's CCC was 18.4 days. b. Last year's CCC was 21.1 days; the current year's CCC was 21.4 days. C. Last year's CCC was 71.9 days; the current year's CCC was 72.2 days. . Last year's CCC was 111. days; the current year's CCC was 112.0 days. 524. Which of the following is the main contributing factor to the decline in the company's EBIT in the current year? a. Falling revenues. b. Higher tax. C. Increased costs. d. Reduced depreciation. 5. The company's board has set a policy that total debt minus cash should not exceed 2.0x EBITDA. How much additional debt, based on the current year's figures, could the firm borrow before it reaches this limit? a. 415 b. 438 2 X EBITDA c. 540 d. 585 = 2xS75 - 115o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts