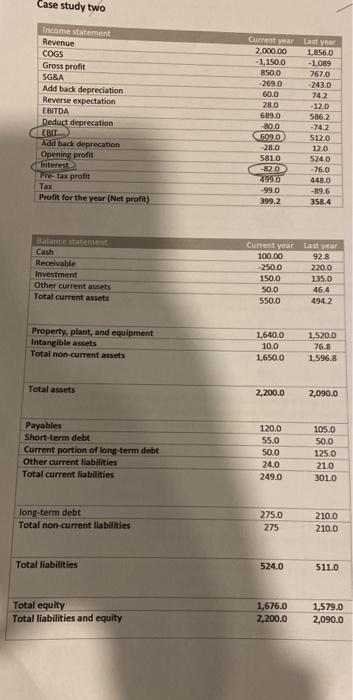

Question: case study. can you check please!!! Case study two Income statement Revenue COGS Gross profit SGSA Add back depreciation Reverse expectation EBITDA Deduct deprecation EBIT

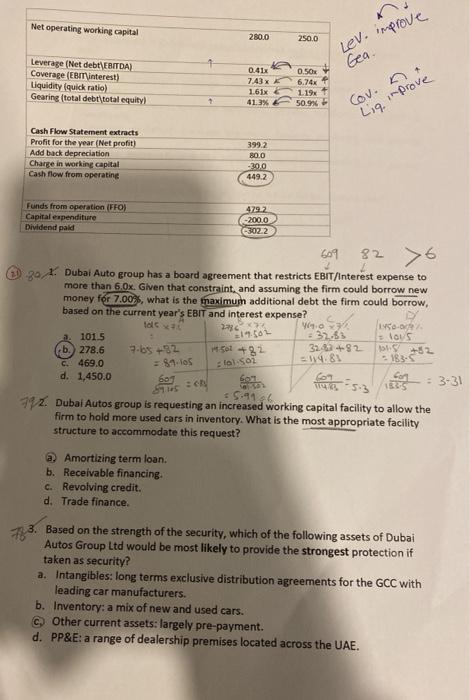

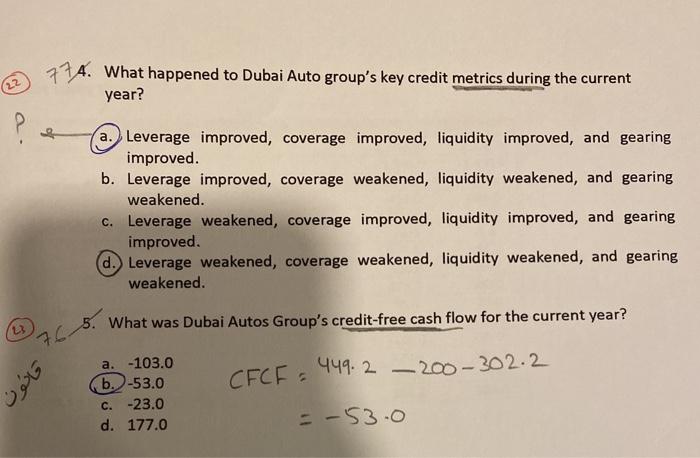

Case study two Income statement Revenue COGS Gross profit SGSA Add back depreciation Reverse expectation EBITDA Deduct deprecation EBIT Add back deprecation Opening profit Interest Pretax profit Tax Profit for the year (Net profit) Current year Last year 2,000.00 1,8560 -1,150.0 -1,089 850,0 767.0 -269.0 -243.0 60.0 742 28.0 -12.0 689.0 586.2 80.0 -74.2 5090 5120 280 120 5810 524.0 -820 -760 499.0 448.0 99.0 -89.6 399.2 358.4 LE Balance statement Cash Receivable Investment Other current assets Total current assets Current year Last year 100.00 92.8 -250.0 220.0 150.0 135.0 50.0 46.4 550.0 494.2 Property, plant, and equipment Intangible assets Total non current assets 1.640.0 10.0 1.650.0 1.520.0 76.8 1.596.8 Total assets 2,200.0 2,090.0 Payables Short-term debt Current portion of long-term debt Other current liabilities Total current liabilities 120.0 55.0 50.0 24.0 249.0 105.0 50.0 125.0 21.0 3010 long-term debt Total non-current liabilities 275.0 275 210.0 210.0 Total liabilities 524.0 511.0 Total equity Total liabilities and equity 1,676.0 2,200.0 1.579.0 2,090.0 Net operating working capital 2800 250.0 Lev. improve Gea. Leverage (Net debt\EBITDA) Coverage (EBIT interest) Liquidity (quick ratio) Gearing (total debt total equity 0.41% 7.43x 1.61x & 41.3% 0.50 6.74% 119x + 50.9 7 Covni Lig improve Cash Flow Statement extracts Profit for the year (Net profit) Add back depreciation Charge in working capital Cash flow from operating 399.2 80.0 -300 449.2 to 23 We 152 Funds from operation (FFO) 479 2 Capital expenditure 6-200.0 Dividend paid 3022 669 82 76 30 1. Dubai Auto group has a board agreement that restricts EBIT/Interest expense to more than 6.0x. Given that constraint, and assuming the firm could borrow new money for 7.00%, what is the maximum additional debt the firm could borrow, based on the current year's EBIT and interest expense? 14500 101.5 = 37.83 lous b. 278.6 7.b3 +82 4501 +82 323482 = 81.105 14.81 469.0 -183-5 d. 1,450.0 6011 con Cory = 3-31 = 5.99.6 792. Dubai Autos group is requesting an increased working capital facility to allow the firm to hold more used cars in inventory. What is the most appropriate facility structure to accommodate this request? @ Amortizing term loan. b. Receivable financing. 6. Revolving credit d. Trade finance. stol so : 3. Based on the strength of the security, which of the following assets of Dubai Autos Group Ltd would be most likely to provide the strongest protection if taken as security? a. Intangibles: long terms exclusive distribution agreements for the GCC with leading car manufacturers. b. Inventory: a mix of new and used cars. Other current assets: largely pre-payment. d. PP&E: a range of dealership premises located across the UAE. 774. What happened to Dubai Auto group's key credit metrics during the current year? a. Leverage improved, coverage improved, liquidity improved, and gearing improved. b. Leverage improved, coverage weakened, liquidity weakened, and gearing weakened. c. Leverage weakened, coverage improved, liquidity improved, and gearing improved d. Leverage weakened, coverage weakened, liquidity weakened, and gearing weakened. . What was Dubai Autos Group's credit-free cash flow for the current year? CFCF = 449.2 - 200-302.2 ver a. -103.0 (b.-53.0 C.-23.0 d. 177.0 = -53.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts