Question: CASE STUDY Dina and Aaron have made an appointment with you to discuss their financial planning needs. Dina is concerned about her family's financial position.

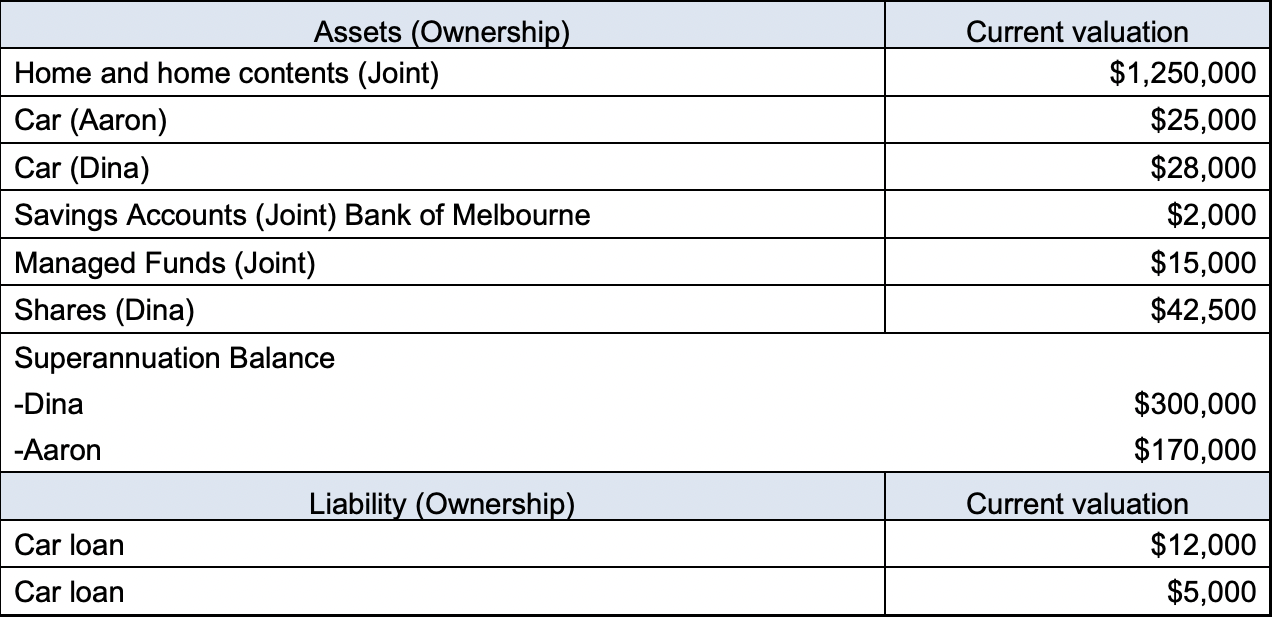

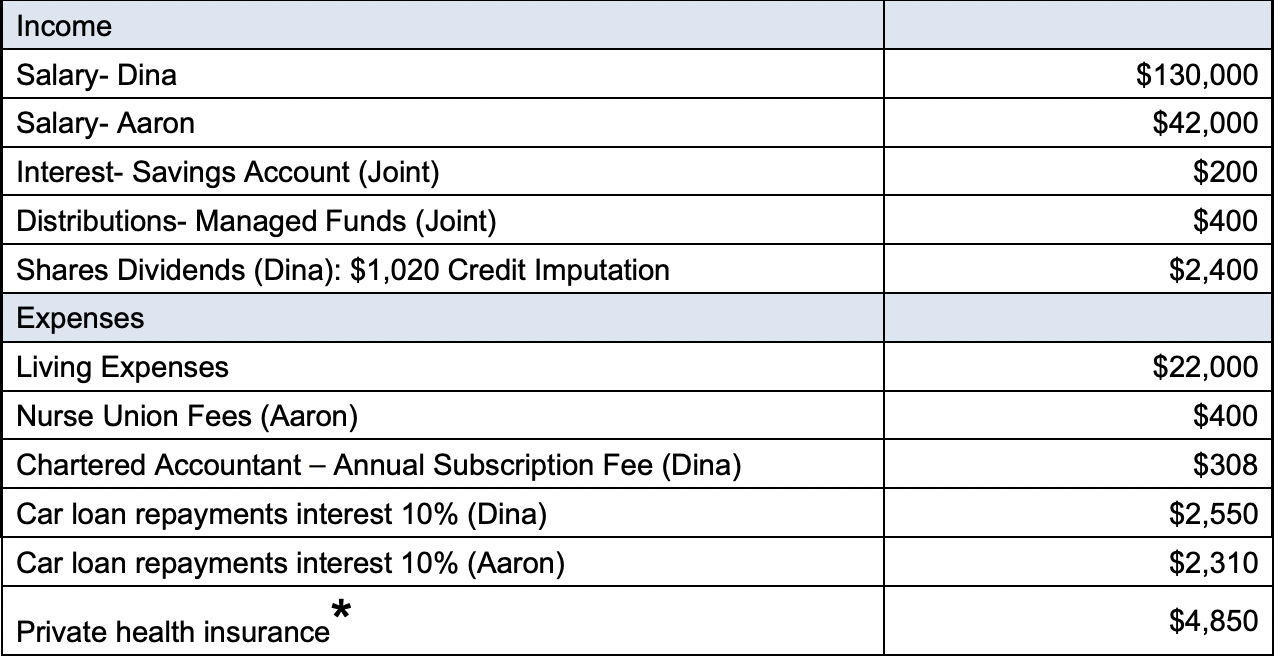

CASE STUDY Dina and Aaron have made an appointment with you to discuss their financial planning needs. Dina is concerned about her family's financial position. She is worried that their current investment allocation is unlikely to provide enough money for her family in retirement, specifically considering the Covid-19 pandemic. The COVID-19 pandemic has put a spotlight on the financial circumstances of families in Australia, and Dina's family is no exception. The couple has come to you for advice and has provided the following information. Personal details: Dina is aged 49 and Aaron is aged 47. They have been married 15 years and have two children, Himesh (age: 12 years) and Jenny (age: 10 years). Income and goals: ? Dina is a Chartered Accountant and is employed with a bank as an accountant. Aaron is a nurse in a local hospital. ? Dina and Aaron would both like to retire in 16 years' time when Dina celebrates her 65th birthday. ? Dina has decided to save into a Managed fund instead of directly investing in shares. Aaron believes direct investment in shares is better than investing in shares through managed funds. The couple have also provided you with the following information:

Assets (Ownership) Current valuation Home and home contents (Joint) $1,250,000 Car (Aaron) $25,000 Car (Dina) $28,000 Savings Accounts (Joint) Bank of Melbourne $2,000 Managed Funds (Joint) $15,000 Shares (Dina) $42,500 Superannuateon Balance -Dina $300,000 -Aaron $170,000 Liability (Ownership) Current valuation Car loan $12,000 Car loan $5,000Income Salary- Dina $130,000 Salary- Aaron $42,000 Interest- Savings Account (Joint) $200 Distributions- Managed Funds (Joint) $400 Shares Dividends (Dina): $1,020 Credit Imputation $2,400 Expenses Living Expenses $22,000 Nurse Union Fees (Aaron) $400 Chartered Accountant - Annual Subscription Fee (Dina) $308 Car loan repayments interest 10% (Dina) $2,550 Car loan repayments interest 10% (Aaron) $2,310 * Private health insurance $4,850

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts