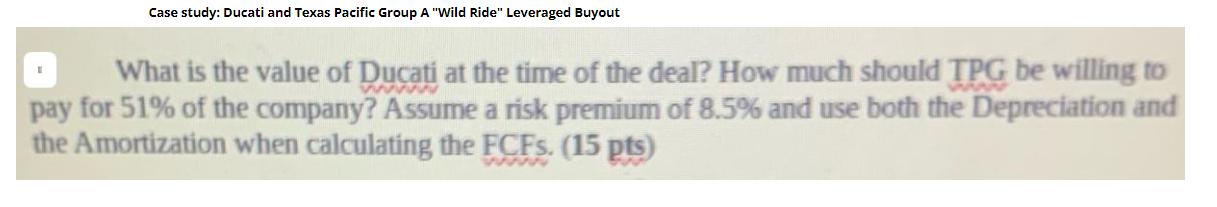

Question: Case study: Ducati and Texas Pacific Group A Wild Ride Leveraged Buyout What is the value of Ducati at the time of the deal?

Case study: Ducati and Texas Pacific Group A "Wild Ride" Leveraged Buyout What is the value of Ducati at the time of the deal? How much should TPG be willing to pay for 51% of the company? Assume a risk premium of 8.5% and use both the Depreciation and the Amortization when calculating the FCFs. (15 pts)

Step by Step Solution

There are 3 Steps involved in it

Here are the steps I would take to value Ducati and determine an acquisition price for 51 ownership ... View full answer

Get step-by-step solutions from verified subject matter experts