Question: Case Study Exercises It is now 12 years since the system was publicly launched and engineers have invested most of their savings in an innova-

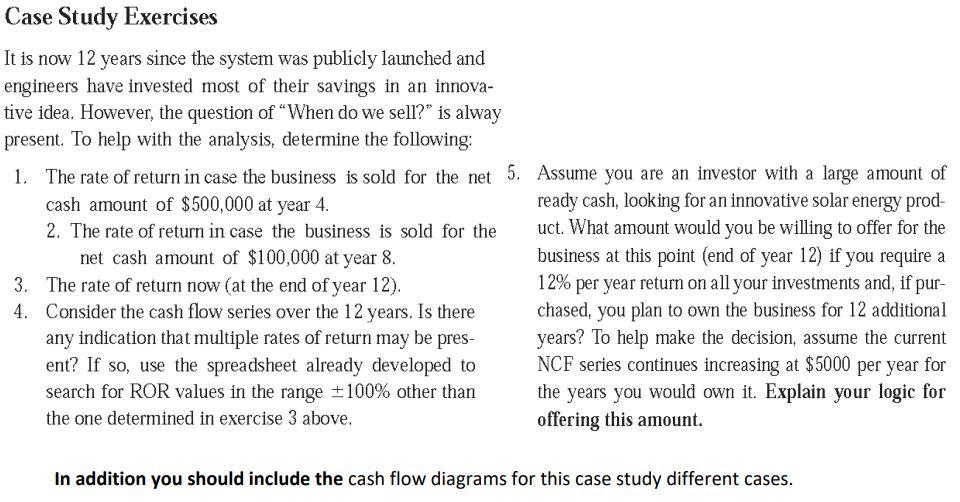

Case Study Exercises It is now 12 years since the system was publicly launched and engineers have invested most of their savings in an innova- tive idea. However, the question of When do we sell?" is alway present. To help with the analysis, determine the following: 1. The rate of return in case the business is sold for the net 5. Assume you are an investor with a large amount of cash amount of $500,000 at year 4. ready cash, looking for an innovative solar energy prod- 2. The rate of return in case the business is sold for the uct. What amount would you be willing to offer for the net cash amount of $100,000 at year 8. business at this point (end of year 12) if you require a 3. The rate of return now (at the end of year 12). 12% per year return on all your investments and, if pur- 4. Consider the cash flow series over the 12 years. Is there chased, you plan to own the business for 12 additional any indication that multiple rates of return may be pres- years? To help make the decision, assume the current ent? If so, use the spreadsheet already developed to NCF series continues increasing at $5000 per year for search for ROR values in the range +100% other than the years you would own it. Explain your logic for the one determined in exercise 3 above. offering this amount. In addition you should include the cash flow diagrams for this case study different cases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts