Question: Case Study: Financial Analysis and Decision Making at Orange Manufacturing Background: Orange Manufacturing is a mid - sized company that produces X products. The company

Case Study: Financial Analysis and Decision Making at Orange Manufacturing

Background: Orange Manufacturing is a midsized company that produces X products. The

company has been growing steadily over the past five years, but recently management has

noticed a decline in profitability. They are considering making strategic changes, including

launching a new product line and cutting costs in underperforming areas.

The CEO has asked the finance team to analyse the company's financial position and provide

recommendations. The finance team has provided the following financial statements from the

last fiscal year:

Income Statement in thousands

Amount

Revenue $

Cost of Goods Sold $

Gross Profit $

Operating Expenses $

Operating Income $

Interest Expense $

Net Income $

Balance Sheet in thousands

Amount

Assets

Current Assets $

Property, Plant, and Equipment PPE $

Total Assets $

Liabilities

Current Liabilities $

Longterm Debt $

Total Liabilities $

Equity

Shareholder's Equity $

Total Liabilities and Equity $

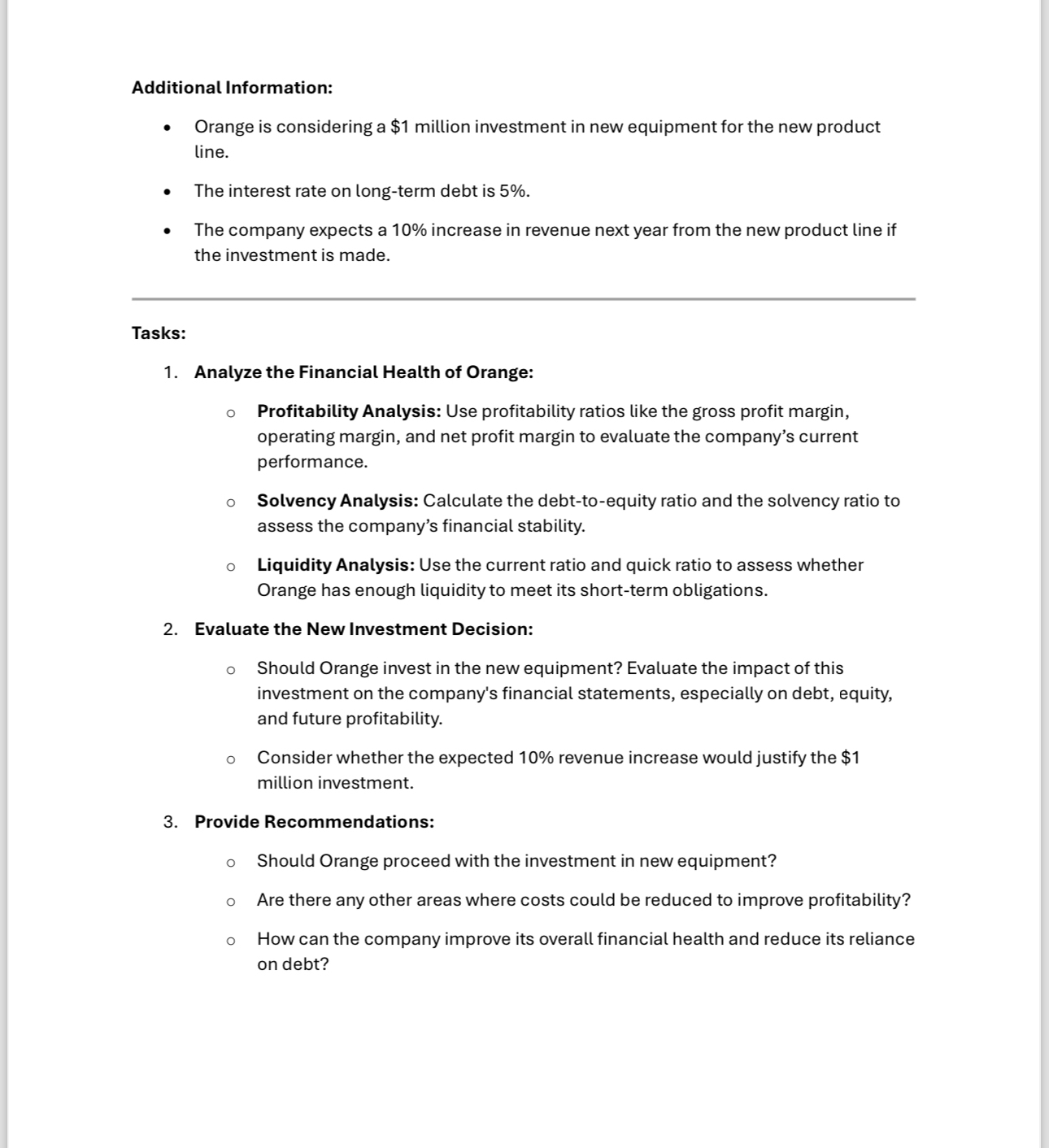

Additional Information:

Orange is considering a $ million investment in new equipment for the new product

line.

The interest rate on longterm debt is

The company expects a increase in revenue next year from the new product line if

the investment is made.

Tasks:

Analyze the Financial Health of Orange:

Profitability Analysis: Use profitability ratios like the gross profit margin,

operating margin, and net profit margin to evaluate the company's current

performance.

Solvency Analysis: Calculate the debttoequity ratio and the solvency ratio to

assess the company's financial stability.

Liquidity Analysis: Use the current ratio and quick ratio to assess whether

Orange has enough liquidity to meet its shortterm obligations.

Evaluate the New Investment Decision:

Should Orange invest in the new equipment? Evaluate the impact of this

investment on the company's financial statements, especially on debt, equity,

and future profitability.

Consider whether the expected revenue increase would justify the $

million investment.

Provide Recommendations:

Should Orange proceed with the investment in new equipment?

Are there any other areas where costs could be reduced to improve profitability?

How can the company improve its overall financial health and reduce its reliance

on debt?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock