Question: Case Study: Financial Models for Dynastatics Corp. The following tables contain financial statements for Dynastatics Corpora - tion. Although the company has not been growing,

Case Study: Financial Models for Dynastatics Corp.

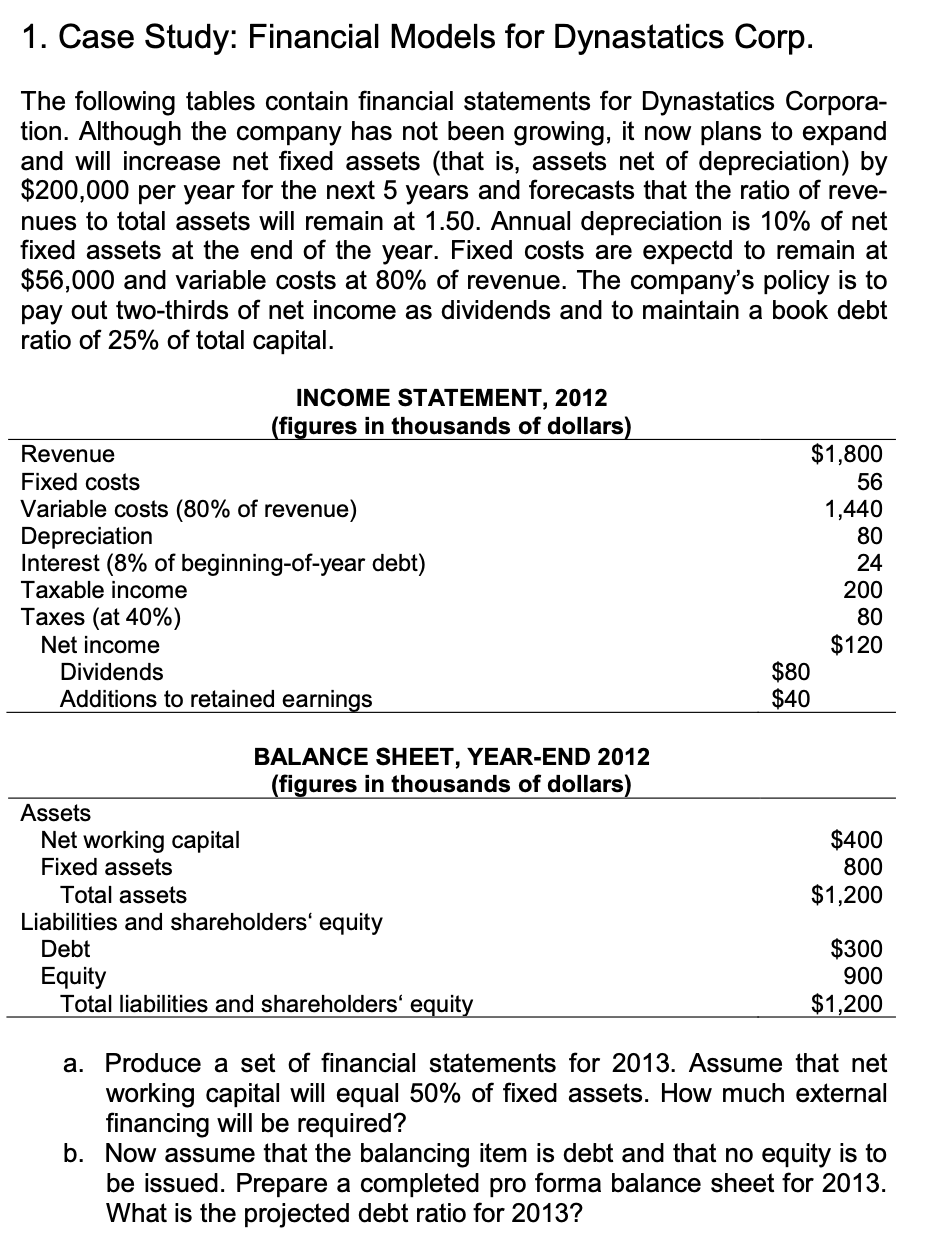

The following tables contain financial statements for Dynastatics Corpora

tion. Although the company has not been growing, it now plans to expand

and will increase net fixed assets that is assets net of depreciation by

$ per year for the next years and forecasts that the ratio of reve

nues to total assets will remain at Annual depreciation is of net

fixed assets at the end of the year. Fixed costs are expectd to remain at

$ and variable costs at of revenue. The company's policy is to

pay out twothirds of net income as dividends and to maintain a book debt

ratio of of total capital.

INCOME STATEMENT,

figures in thousands of dollars

BALANCE SHEET, YEAREND

figures in thousands of dollars

a Produce a set of financial statements for Assume that net

working capital will equal of fixed assets. How much external

financing will be required?

b Now assume that the balancing item is debt and that no equity is to

be issued. Prepare a completed pro forma balance sheet for

What is the projected debt ratio for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock