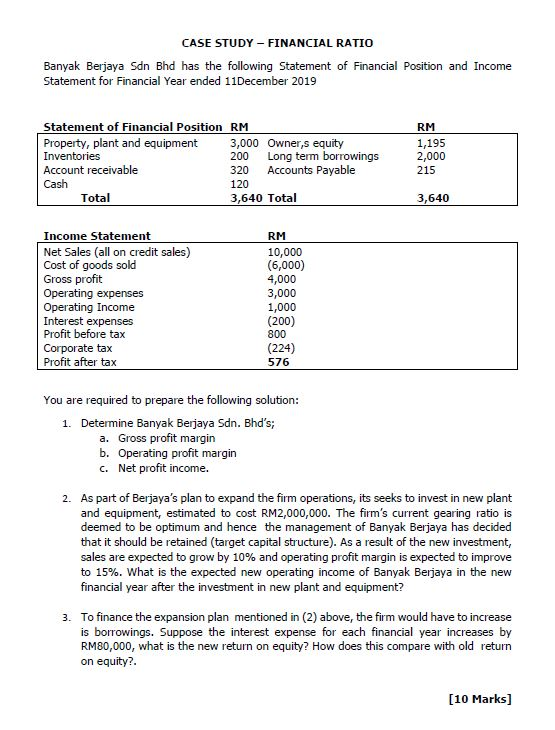

Question: CASE STUDY - FINANCIAL RATIO Banyak Berjaya Sdn Bhd has the following Statement of Financial Position and Income Statement for Financial Year ended 11 December

CASE STUDY - FINANCIAL RATIO Banyak Berjaya Sdn Bhd has the following Statement of Financial Position and Income Statement for Financial Year ended 11 December 2019 Statement of Financial Position RM Property, plant and equipment 3,000 Owner,s equity Inventories 200 Long term borrowings Account receivable 320 Accounts Payable Cash 120 Total 3,640 Total RM 1,195 2,000 215 3,640 Income Statement Net Sales (all on credit sales) Cost of goods sold Gross profit Operating expenses Operating Income Interest expenses Profit before tax Corporate tax Profit after tax RM 10,000 (6,000) 4,000 3,000 1,000 (200) 800 (224) 576 You are required to prepare the following solution: 1. Determine Banyak Berjaya Sdn. Bhd's; a. Gross profit margin b. Operating profit margin C. Net profit income. 2. As part of Berjaya's plan to expand the firm operations, its seeks to invest in new plant and equipment, estimated to cost RM2,000,000. The firm's current gearing ratio is deemed to be optimum and hence the management of Banyak Berjaya has decided that it should be retained (target capital structure). As a result of the new investment, sales are expected to grow by 10% and operating profit margin is expected to improve to 15%. What is the expected new operating income of Banyak Berjaya in the new financial year after the investment in new plant and equipment? 3. To finance the expansion plan mentioned in (2) above, the firm would have to increase is borrowings. Suppose the interest expense for each financial year increases by RM80,000, what is the new return on equity? How does this compare with old return on equity?. [10 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts