Question: CASE STUDY FINANCIAL REPORT ANALYSIS: Tom Wallis is the Chief Executive Officer ( CEO ) of EVUS Cars Pty Ltd , a publicly listed Electric

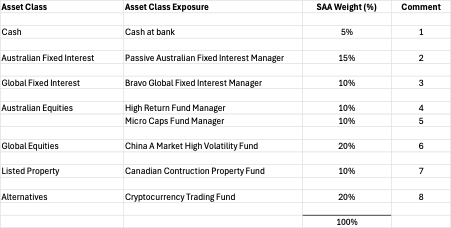

CASE STUDY FINANCIAL REPORT ANALYSIS: Tom Wallis is the Chief Executive Officer CEO of EVUS Cars Pty Ltd a publicly listed Electric Vehicle manufacturer. The share price of EVUS has fallen materially in recent months as new lower cost competitors have entered the US automotive market. To reverse this trend, Tom plans to present his latest strategy to shareholders at an upcoming market update where he will unveil EVUSs latest car, the Tron. EVUS has a manufacturing facility in California that will need to be upgraded ahead of starting production on the Tron. The expected capital outlay is US$ billion and is planned to be funded equally through debt via the issuance of corporate bonds and cash. EVUS sells of its cars into China, and Tom is worried that the Trump Administrations recently announced Tariffs will make the Tron more expensive and see EVUSs market share decline as consumers seek cheaper and locally manufactured alternatives. Tom has a friend in the US tax collections office who has suggested that EVUS could pay a $ monthly gratuity to a US Customs officer, who will then falsify trade documentation and allow EVUS to pay a lower tariff rate on exported goods. This is something Tom is considering. In terms of the debt investment of $ million, this has been arranged with a large sovereign wealth Fund based on the following terms: year term, issued October Pays a semiannual coupon of pa Regarding the cash investment, EVUS has an $ billion investment portfolio see below and plans to sell down some of these holdings and use the proceeds to fund the remaining $ million. Further detail is provided regarding these investments: At call term cash Passively managed fund benchmarked to the Bloomberg Composite Bond Index Manager subject to an inquiry by the US FSC into price manipulation Invests in stocks that pay dividends of or more High risk, concentrated small caps fund that has lost of its value the past months Invests in Chinse AShares Canadian construction company focused on building retail malls Portfolio managed by Toms son who has an interest in crypto currencies You are the Chief Investment Officer CIO of EVUS and have been asked for advice on the proposed funding arrangements and to prepare a report to the Board that addresses the following: A Appropriateness of the current Strategic Asset Allocation SAA and asset class exposures given EVUS nearterm funding needs. B What investments would you sell down to realise $ million? C What subsequent changes would you make to the SAA and asset class exposures? D How would you seek to fund the pa debt repayment on bonds and then repay the $ million debt in years? E Any other advice that you believe is necessary to provide to the board.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock