Question: CASE STUDY GILBERT ENTERPRISES Valuation Gilbert Enterprises had the most advanced just-in-time (JIT) inventory management system in the industry. For that reason, Albert Roth believed

CASE STUDY GILBERT ENTERPRISES

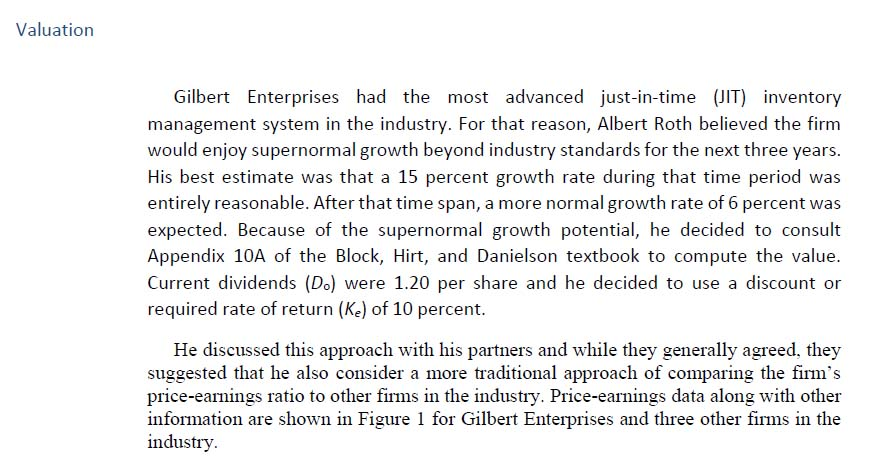

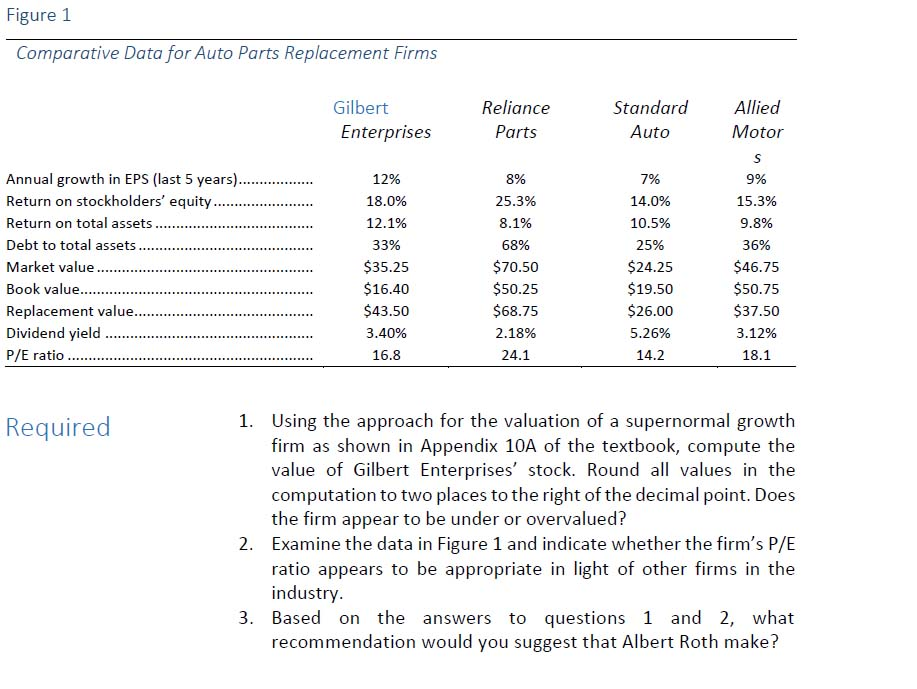

Valuation Gilbert Enterprises had the most advanced just-in-time (JIT) inventory management system in the industry. For that reason, Albert Roth believed the firm would enjoy supernormal growth beyond industry standards for the next three years His best estimate was that a 15 percent growth rate during that time period was entirely reasonable. After that time span, a more normal growth rate of 6 percent was expected. Because of the supernormal growth potential, he decided to consult Appendix 10A of the Block, Hirt, and Danielson textbook to compute the value. Current dividends (Do) were 1.20 per share and he decided to use a discount or required rate of return (Ke) of 10 percent. He discnsed thi approach with his partners and while hey generally agreed, they He discussed this approach with his partners and while they generally agreed, they suggested that he also consider a more traditional approach of comparing the firm's price-earnings ratio to other firms in the industry. Price-earnings data along with other information are shown in Figure 1 for Gilbert Enterprises and three other firms in the industry Valuation Gilbert Enterprises had the most advanced just-in-time (JIT) inventory management system in the industry. For that reason, Albert Roth believed the firm would enjoy supernormal growth beyond industry standards for the next three years His best estimate was that a 15 percent growth rate during that time period was entirely reasonable. After that time span, a more normal growth rate of 6 percent was expected. Because of the supernormal growth potential, he decided to consult Appendix 10A of the Block, Hirt, and Danielson textbook to compute the value. Current dividends (Do) were 1.20 per share and he decided to use a discount or required rate of return (Ke) of 10 percent. He discnsed thi approach with his partners and while hey generally agreed, they He discussed this approach with his partners and while they generally agreed, they suggested that he also consider a more traditional approach of comparing the firm's price-earnings ratio to other firms in the industry. Price-earnings data along with other information are shown in Figure 1 for Gilbert Enterprises and three other firms in the industry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts