Question: Case Study: IBM Options Problem An Option Investor talking about his investment in 2018, said: In late April, we began a case study series investigating

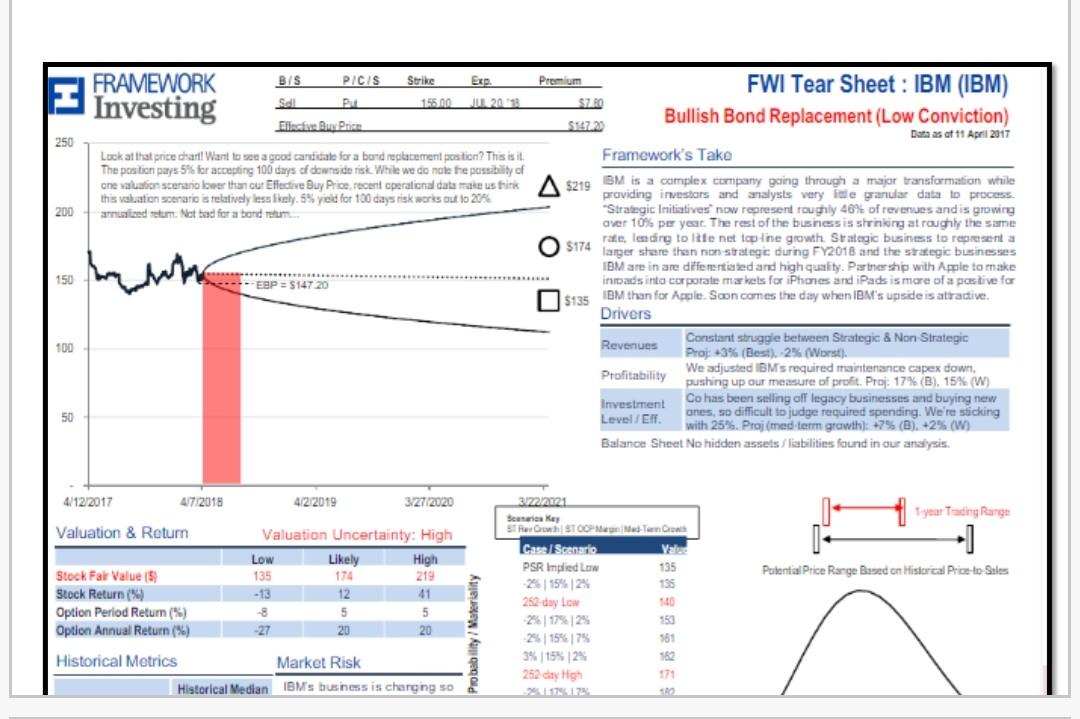

Case Study: IBM Options Problem An Option Investor talking about his investment in 2018, said: In late April, we began a case study series investigating how one might use options to express a bullish investment opinion in IBM. This case study was based on a Tear Sheet I had published to Framework Investing subscribers earlier in April. The option we highlighted in our Tear Sheet and case study series was one with an expiration date of July 20, 2018. Summary of data is shown in the graph below

From the data you found that the same option will expire on 20th of October 2018. The current strike price was $174.00 (Price of stock today is $ 147.50). Stock Volatility, per data above was calculated at 13%. As an anlyst, you were asked to value the both put and call options. Note: Risk Free rate is based on a 30 day treasury bill at 3.5%. Fill in the data sheet based on the format below;

FRAMEWORK Investing 250 200 BIS PICIS Strike Exp Premium FWI Tear Sheet : IBM (IBM) Sol 155.00 Bullish Bond Replacement (Low Conviction) Eli Buy Price $93723 Data as of 11 April 2017 Look at that price rant Want to see a good candidate for a bond replacement postion? This is it Framework's Take The position pays: 5% for accepting 100 days of downside risk. While we do nate the possibility of one valuation scenario lower than our Elective Buy Pice, recent operational data make us tink $219 IBM is a complex company going through a major transformation while this valuation scenario is relatively less likely 5 yeld for 100 days risk works out to 20% providing data to anted retum. Net bad for a bordum Strategic Initiatives now represent roughly 48% of revenues and is growing over 10% per year. The rest of the business is striking at roughly the same rate, leding to tie net top line growth Strategic business to representa $174 langer stere then non-strategie during FY2018 and the strategic businesses IBM are in are differentiated and high quality. Partnership with Apple to make EBP = 514720 inroads into corporate markets for iPhones and iPads is more of a pestive for 5135 IBM than for Apple. Son comes the day when IBM's upside is attractive. Drivers Revenues Constant struggle between Strategic & Non Strategic Proj: +3% (Best). 2% (Worst): Profitability We adjusted Ms required maintenance capex down, pushing up our measure of profit. Proj: 17% (B), 15% (W) Investment Co has been selling off legacy businesses and buying new Level/El anes, so difficult to judge required spending. We're sticking with 25%. Projmed term growth): 175(B). +2% (W) Balance Sheet No hidden assets/ liabilities found in our analysis. 150 100 50 4/12/2017 47/2018 4/2/2019 327/2020 + 1 year Trading Range Valuation & Return 372/2021 Serika Serwh STOOP Maden Case Scenario PSR Implied Low 135 135 252 day Low 10 Patental Price Range Based on Historcal Price to Sales Valuation Uncertainty: High Low Likely High 135 174 219 -13 12 41 -8 5 5 -27 20 20 Stock Fal Values Stock Return (%) Option Period Return(%) Option Annual Return (%) Probability Materialty 561 462 Historical Metrics 255156175 3% 15% 12% 252 ay High Market Risk Historical Median IBMs business is charging so FRAMEWORK Investing 250 200 BIS PICIS Strike Exp Premium FWI Tear Sheet : IBM (IBM) Sol 155.00 Bullish Bond Replacement (Low Conviction) Eli Buy Price $93723 Data as of 11 April 2017 Look at that price rant Want to see a good candidate for a bond replacement postion? This is it Framework's Take The position pays: 5% for accepting 100 days of downside risk. While we do nate the possibility of one valuation scenario lower than our Elective Buy Pice, recent operational data make us tink $219 IBM is a complex company going through a major transformation while this valuation scenario is relatively less likely 5 yeld for 100 days risk works out to 20% providing data to anted retum. Net bad for a bordum Strategic Initiatives now represent roughly 48% of revenues and is growing over 10% per year. The rest of the business is striking at roughly the same rate, leding to tie net top line growth Strategic business to representa $174 langer stere then non-strategie during FY2018 and the strategic businesses IBM are in are differentiated and high quality. Partnership with Apple to make EBP = 514720 inroads into corporate markets for iPhones and iPads is more of a pestive for 5135 IBM than for Apple. Son comes the day when IBM's upside is attractive. Drivers Revenues Constant struggle between Strategic & Non Strategic Proj: +3% (Best). 2% (Worst): Profitability We adjusted Ms required maintenance capex down, pushing up our measure of profit. Proj: 17% (B), 15% (W) Investment Co has been selling off legacy businesses and buying new Level/El anes, so difficult to judge required spending. We're sticking with 25%. Projmed term growth): 175(B). +2% (W) Balance Sheet No hidden assets/ liabilities found in our analysis. 150 100 50 4/12/2017 47/2018 4/2/2019 327/2020 + 1 year Trading Range Valuation & Return 372/2021 Serika Serwh STOOP Maden Case Scenario PSR Implied Low 135 135 252 day Low 10 Patental Price Range Based on Historcal Price to Sales Valuation Uncertainty: High Low Likely High 135 174 219 -13 12 41 -8 5 5 -27 20 20 Stock Fal Values Stock Return (%) Option Period Return(%) Option Annual Return (%) Probability Materialty 561 462 Historical Metrics 255156175 3% 15% 12% 252 ay High Market Risk Historical Median IBMs business is charging so

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts