Question: Case Study: INTRODUCTION Balancing quantitative and qualitative factors can be quite a challenge, Charles Riley thought to himself. Riley is the CFO of Fashion Designs

Case Study:

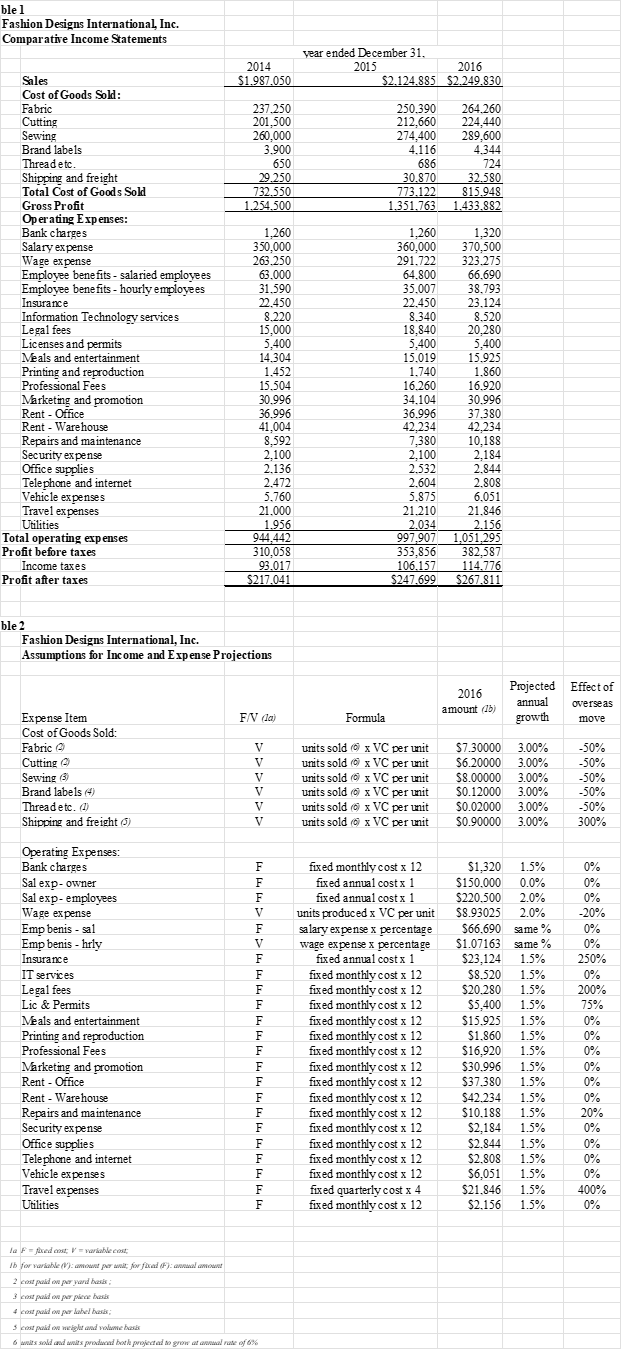

INTRODUCTION "Balancing quantitative and qualitative factors can be quite a challenge," Charles Riley thought to himself. Riley is the CFO of Fashion Designs International, Inc. (FDI), a small women's apparel business. The CEO and sole shareholder of FDI, Alina Rossi, had asked Riley for suggestions about how to increase the company's profits to the level that matched her financial goals. Riley knew, however, that there were qualitative factors of importance to Rossi that posed challenges. FDI, based in Greensboro, North Carolina, manufactures and distributes women's apparel to retailers worldwide under the brand name RossiDesigns. Headed by Rossi, an Italian-educated, award-winning fashion designer with a high work ethic and a perfectionist streak, the company's products are considered of excellent quality by consumers and retailers. The designs, fabric, and processes used in production all contribute to this high level of quality. Since its inception in 2001, the company has grown steadily to annual sales of US$2.25 million in 2016 (see Table 1). ALINA ROSSI, FASHION DESIGNER Alina Rossi studied fashion design in Italy and, upon completing her studies, moved back to the United States where her family had emigrated when she was 10 years old. Rossi was a highly creative designer who almost certainly could have done well by selling her designs to large international fashion companies but chose instead to start her own company. Rossi started her fashion business in 2001 by selling women's apparel to small U.S.-based boutique shops. Her designs?particularly popular with women in their 20s, 30s, and 40s?sold quickly, and her business grew accordingly. After several years, her market expanded to include Canada, Mexico, and a few countries in Europe. Rossi tends to be a perfectionist both with her designs and in her insistence on high production quality. This manifests itself in her close supervision of production processes, to a point of near-obsession with ensuring the high apparel standards that she demands. APPAREL PRODUCTION The production of FDI's products is composed of three major phases: (1) manufacturing the fabric to be used for apparel pieces, (2) cutting the fabric according to the particular apparel piece's design, and (3) sewing the cut fabric into apparel wear. FDI's women's outfits are made from high-quality fabric, which Rossi specifies to the fabric manufacturer, a company based in Toronto, Ontario, Canada. Large rolls of fabric manufactured for FDI are shipped to FDI's warehouse in Greensboro, where they are stored until ready to be used in production runs. At such time, fabric is sent to the cutting shop where the fabric is cut into large pieces of specific size and shape, as specified by Rossi's design. Finished cut pieces are then delivered to the sewing shop. In the sewing process, cut pieces are sewn as prescribed by Rossi into final products, which is then transported to FDI's warehouse until ready for shipment to retailers (for instance, FDI's main customers). The cutting and sewing shops, independent from each other, are both located within a 50-mile radius of FDI's main offices in Greensboro.

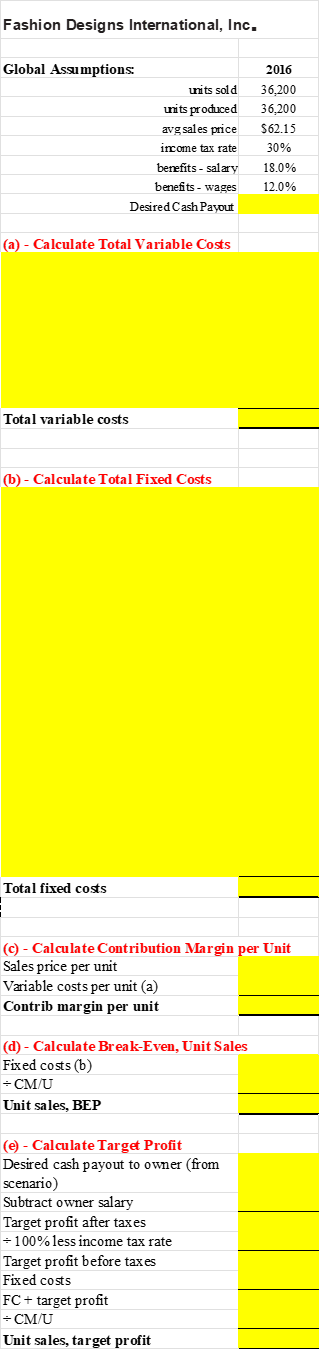

A separate company, RossiDesigns LLC, owns the RossiDesigns brand name and trademarks. Rossi assigns all of her designs to RossiDesigns LLC. As apparel pieces are distributed to retailers, FDI pays a royalty to RossiDesigns LLC for the right to use the designs and the RossiDesigns brand name.1 The RossiDesigns label is sewn into each piece that FDI produces. FDI PROFITABILITY FDI's profitability is attributable to a lean company structure and Rossi's talents and work ethic. The company, however, has not achieved the level of profitability that Rossi desires. While her goal is an annual net cash payout from the company of US$600,000, currently the net cash paid or available to her (for instance, combined salary and net profit) is only about two-thirds that amount.2 RILEY'S RESEARCH AND PREPARATION As mentioned previously, all of FDI's production activities are in North America: The fabric is produced in Canada, and the cutting and sewing are done in the United States. Riley believes that the quickest and surest way for FDI to increase its profitability is by moving manufacturing activities overseas to a low-cost country where labor and other production costs would be significantly reduced.3 Based on his prior research, Riley has estimated how the company's costs would change if all manufacturing was moved overseas (see Table 2). He has prepared a schedule of revenue and expense growth rates that allow him to project future net profits under either scenario?for instance, keeping manufacturing in North America or moving it overseas (see Table 2, "Projected Annual Growth" column). Riley determined the cost behavior of each item of expense based on cost drivers and used this information to arrive at formulas for projecting each expense item (see Table 2, "Formula" column). Riley believes that it is in the company's best interest to move production overseas and that this course of action is the best way to reach Rossi's goals for the company. He recognizes, however, that a big challenge in convincing Rossi of this is her strong desire for close supervision of all production processes. Riley knows that Rossi is a perfectionist, and he believes that other related aspects of Rossi's personality represent potential hurdles to an overseas move. Fashion design is, at its essence, an artistic skill. As with many artists, Rossi probably views her company's final product as an extension of herself. Riley imagines that Rossi's pride and ego are significant factors in her strong need for oversight and her obsession with production quality. Riley knows that he will have to keep Rossi's personality factors in mind if he is to have a good chance of convincing her to move the company's production overseas. When he meets with Rossi, Riley's challenges include helping her focus on her financial goal, convincing her that achieving those goals will require tradeoffs in production supervision, and convincing her that the tradeoffs will be well worth it.

Data:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts