Question: Case Study: Jacks Dog Sanctuary Jacks Dog Sanctuary performs three services: housing and finding homes for stray and unwanted dogs, providing health care and neutering

Case Study: Jacks Dog Sanctuary

Jacks Dog Sanctuary performs three services: housing and finding homes for stray and unwanted dogs, providing health care and neutering services for the dogs, and dog training services. One facility is dedicated to housing dogs waiting to be adopted. A second facility houses veterinarian services. A third facility houses the director, administration staff, and several dog trainers. This facility also has several large meeting rooms that are frequently used for classes conducted by the dog trainers. The trainers work with all the sanctuary dogs to ensure that they are relatively easy to manage. They also provide dog obedience classes for families who adopt dogs.

Estimated annual costs and services are as follows:

$

Director and administration staff salaries 60,000

Housing services employees salaries 100,000

Veterinarians and technicians salaries 150,000

Dog trainers salaries 40,000

Food and supplies 125,000

Building-related costs 200,000

On average, 75 dogs per day are housed at the facility, or about 27,375 (75 365) dog days in total. In addition, the trainers offer about 125 classes for about 30 weeks throughout the year. On average, 10 families attend each class. Last year the veterinarian clinic experienced 5,000 dog visits.

One of the administration staff, Joan, just graduated from an accounting program and would like to set up an ABC system for the sanctuary so that the director can better understand the cost for each of the sanctuarys services. She gathered the following information:

Square metres for each facility:

Housing service 5,000 m2

Director and training 3,000 m2

Veterinarian clinic 2,000 m2

Percentage of trainer time used in classes 50%

Portion of Supplies used for veterinarian services $75,000

Part A - ALREADY ANSWERED (see image) - Identify three cost pools and assign costs to them, considering the three cost objects of interest. Explain your choice for each cost pool identified and how the costs are assigned to each of the cost objects. (Hint: Take the services provided into account when identifying a cost object. Assign the costs based on its traceability to the cost object).

TO BE ANSWERED Question (i) Determine an activity driver for each cost pool your group identified in Part A. Explain your choice. (10 marks)

TO BE ANSWERED Question (ii) Using the activity drivers, you identified in part (i) calculate the direct cost per unit of activity driver for each pool and explain what the cost per unit of activity driver for each pool means. Show ALL your workings. (10 marks)

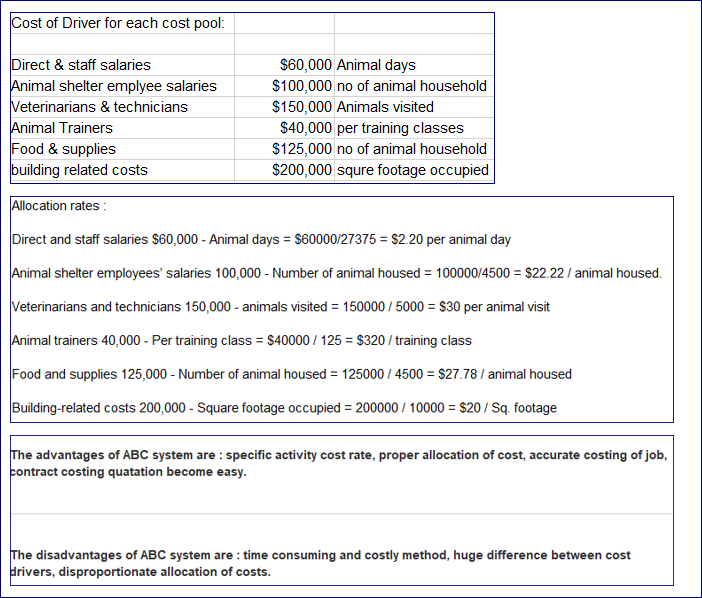

Cost of Driver for each cost pool: Direct & staff salaries Animal shelter emplyee salaries Veterinarians & technicians Animal Trainers Food & supplies building related costs $60,000 Animal days $100,000 no of animal household $150,000 Animals visited $40,000 per training classes $125,000 no of animal household $200,000 squre footage occupied Allocation rates : Direct and staff salaries $60,000 - Animal days = $60000/27375 = $2.20 per animal day Animal shelter employees' salaries 100,000 - Number of animal housed = 100000/4500 = $22.22 / animal housed. Veterinarians and technicians 150,000 - animals visited = 150000 / 5000 = $30 per animal visit Animal trainers 40,000 - Per training class = $40000 / 125 = $320 / training class Food and supplies 125,000 - Number of animal housed = 125000 / 4500 = $27.78 / animal housed Building-related costs 200,000 - Square footage occupied = 200000 / 10000 = $20 / Sq. footage The advantages of ABC system are : specific activity cost rate, proper allocation of cost, accurate costing of job, contract costing quatation become easy. The disadvantages of ABC system are : time consuming and costly method, huge difference between cost drivers, disproportionate allocation of costs. Cost of Driver for each cost pool: Direct & staff salaries Animal shelter emplyee salaries Veterinarians & technicians Animal Trainers Food & supplies building related costs $60,000 Animal days $100,000 no of animal household $150,000 Animals visited $40,000 per training classes $125,000 no of animal household $200,000 squre footage occupied Allocation rates : Direct and staff salaries $60,000 - Animal days = $60000/27375 = $2.20 per animal day Animal shelter employees' salaries 100,000 - Number of animal housed = 100000/4500 = $22.22 / animal housed. Veterinarians and technicians 150,000 - animals visited = 150000 / 5000 = $30 per animal visit Animal trainers 40,000 - Per training class = $40000 / 125 = $320 / training class Food and supplies 125,000 - Number of animal housed = 125000 / 4500 = $27.78 / animal housed Building-related costs 200,000 - Square footage occupied = 200000 / 10000 = $20 / Sq. footage The advantages of ABC system are : specific activity cost rate, proper allocation of cost, accurate costing of job, contract costing quatation become easy. The disadvantages of ABC system are : time consuming and costly method, huge difference between cost drivers, disproportionate allocation of costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts