Question: Case study: On 1 July 2018, Joel Ltd acquired all the shares of Billy Ltd for $425 000 on an ex-div . basis. On this

Case study:

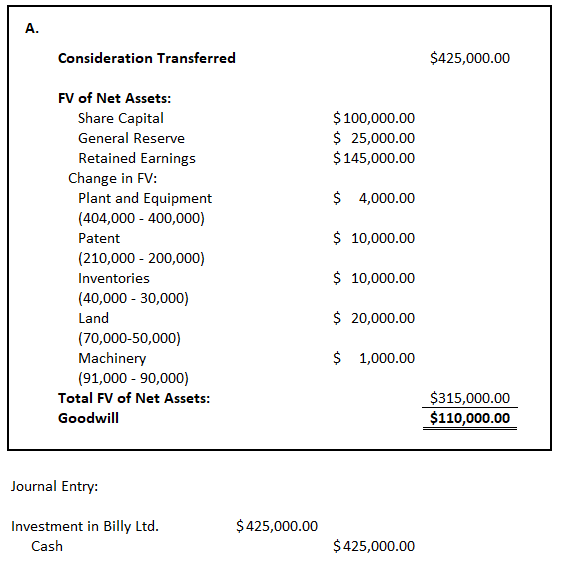

On 1 July 2018, Joel Ltd acquired all the shares of Billy Ltd for $425 000 on an ex-div. basis. On this date, the equity and liabilities of Billy Ltd included the following balances:

Share capital | $100,000 |

General reserve | 25,000 |

Retained earnings | 145,000 |

Dividend Payable | 8,000 |

At acquisition date, all the identifiable assets and liabilities of Billy Ltd were recorded at

amounts equal to fair value except for:

Carrying amount | Fair value | |

Plant and equipment (cost $500,000) | $400,000 | $404,000 |

Patent | 200,000 | 210,000 |

Inventories | 30,000 | 40,000 |

Land | 50,000 | 70,000 |

Machinery (cost $120,000) | 90,000 | 91,000 |

The plant and equipment had a useful life of 5 years at acquisition date and was expected to be used evenly over that time. The patent was considered to have an indefinite life. The machinery had a further 4-year useful life at acquisition date. Any adjustments for differences between carrying amounts at acquisition date and fair values are made on consolidation.

During the year ended 30 June 2019, all inventories on hand at acquisition date were sold, and the land was sold on 1 June 2020. Any valuation reserves created are transferred on consolidation to retained earnings when assets are sold or fully consumed.

(Continued on next page)

Additional information

- On 1 July 2019, Billy Ltd has on hand inventory worth $24 000, being transferred from Joel Ltd in June 2019. The inventory had previously cost Joel Ltd $20 000.

- On 30 April 2020, Billy Ltd transferred an item of plant with a carrying amount of $65 000 to Joel Ltd for $85 000. Joel Ltd treated this item as inventory. The item was still on hand at the end of the year. Billy Ltd applied a 20% depreciation rate to this plant.

- On 1 March 2020, Billy Ltd acquired $9 000 inventory from Joel Ltd. This inventory originally cost Joel Ltd $5000. 75% of this inventory has been sold to external parties for $15,000.

- On 1 January 2019, Joel Ltd sold furniture to Billy Ltd for $18,000. This furniture had originally cost Joel Ltd $22 000 and had a carrying amount at the time of sale of $17,000. Both entities charge depreciation at a rate of 20% p.a.

- Joel Ltd sold some land to Billy Ltd in 31 December 2019. The land had originally cost Joel Ltd $85 000, but was sold to Billy Ltd for only $80 000. To help Billy Ltd pay for the land, Joel Ltd gave Billy Ltd a loan of $326 000. Billy Ltd has not made any repayments on the loan. Interest is charged at 15% on the loan and the last interest payment was made on 31 March 2020.

The corporate tax rate is 30%.

Required:

- Prepare the acquisition analysis as at 1 July 2018 for Joel Ltd. (8 marks)

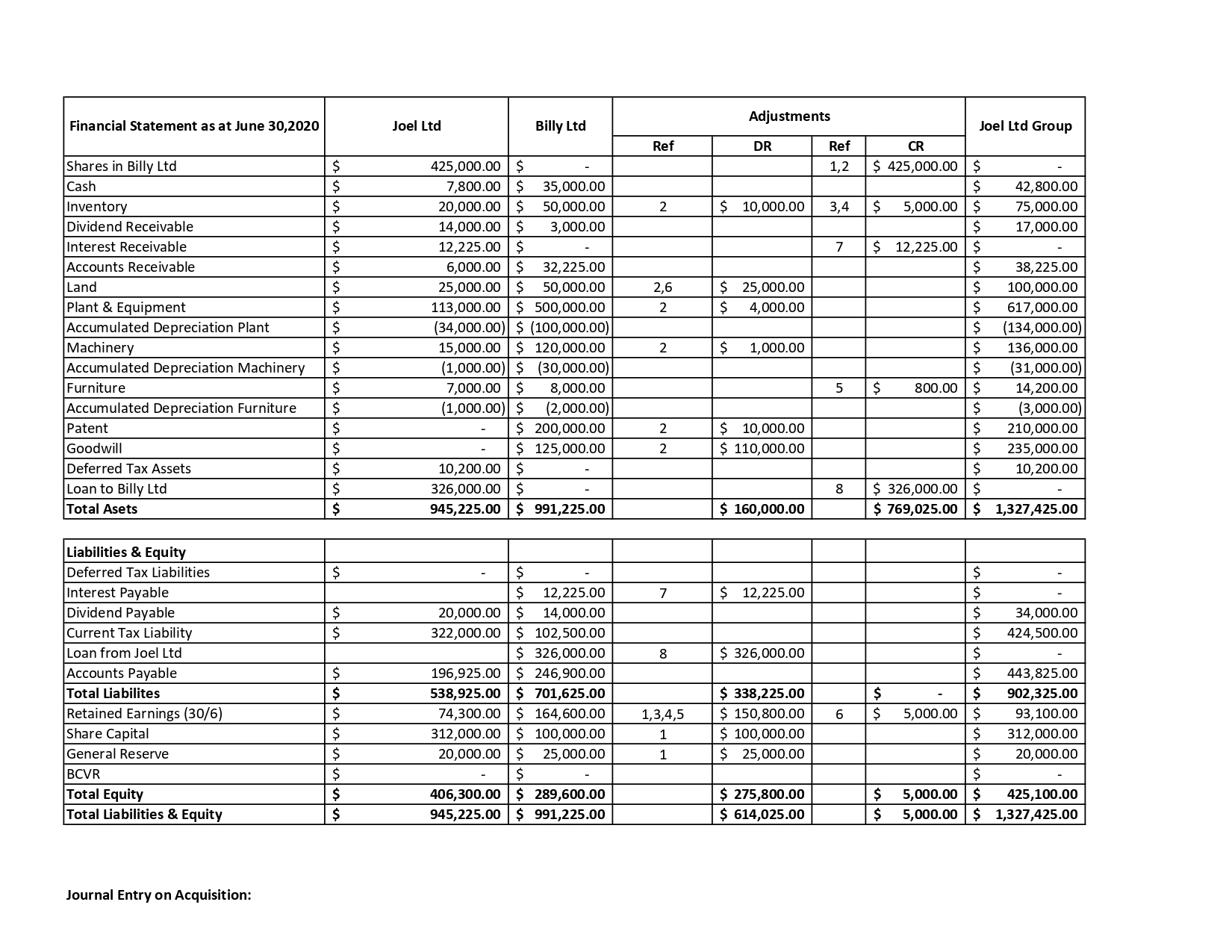

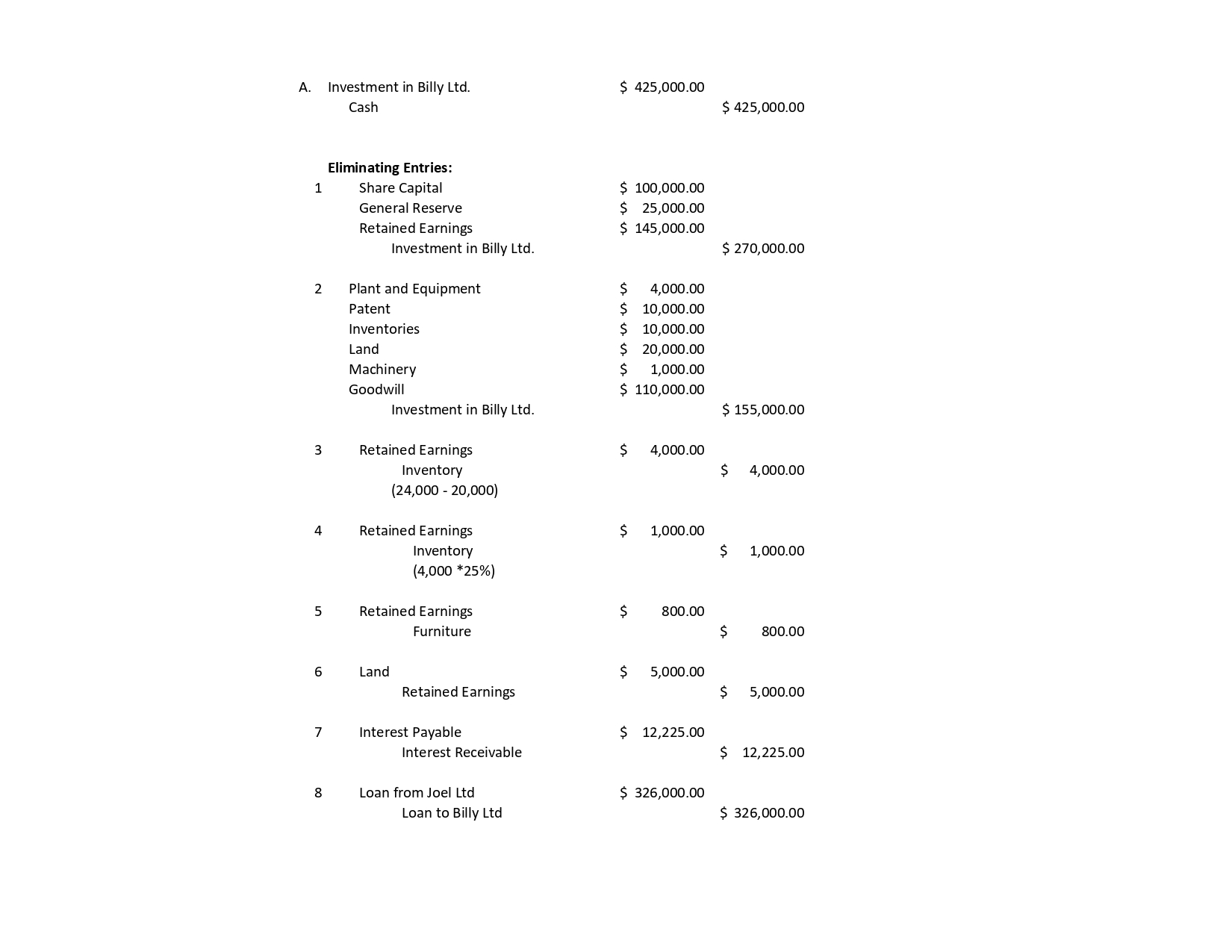

- Prepare the consolidation worksheet for Joel Ltd as at 30 June 2020, using the attached template. (81 marks)

- Prepare a consolidated statement of financial position using account format, for Joel Ltd as at 30 June 2020. (11 marks)

THIS IS THE ANSWER FOR CASE STUDY:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts