Question: Case Study Part 2 Chipotle Net Present Value analysis of proposed strategys new cash flow and EPS/EBIT analysis NOTE: To construct the first cash flow

Case Study Part 2

Chipotle

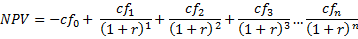

Net Present Value analysis of proposed strategys new cash flow and EPS/EBIT analysis NOTE: To construct the first cash flow (cf1) at the very minimum, the new revenue from your strategy(s) must be discounted back to the present value by calculating EBIT and that figure will be your cfn for each year. cf0 (initial cost of your strategy), cf1 (discounted cash flow first year), r (opportunity cost of capital, the rate of the next best alternative use of cash/debt/equity resources).

NPV=-cf0+ cf11+r1+cf21+r2+cf31+r3cfn1+rn

As of 12/31/18-

Total Revenue - 4,864,985

Cost of Revenue - 3,273,962

Research and Development - 0

General and Admin Expenses - 455,055

Non-Recurring - 0

Others - 568,336

Total Operating Expenses - 4,507,878

Total other income/expense net - (88,671)

Earnings Before Interest and Taxes - 357,107

Interest Expense - 0

Income Before Tax - 268,436

Income Tax Expense - 91,883

Cash and cash Equivalents - 249,953

Short term investments - 426,845

Net Receivables - 62,312

Inventory - 21,555

Long Term Investments - 0

Property - 1,379,254

Goodwill - 21,939

Other Assets 49,531

Accounts Payable - 113,071

Other Current Liabilities - 104,892

Other Liabilities - 374,189

Common Stock - 360

Retained Earning s- 2,573,617

Treasury Stock - (2,506,792)

Capital Surplus - 1,374,154

Other Stock Holder Equity - (6,236)

Total Stockholders equity - 1,441,339

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts