Question: Case Study - Part B FIN7230 010 At the last board of directors meeting, her advisory group informed Ms. Tyrell that they believe the company

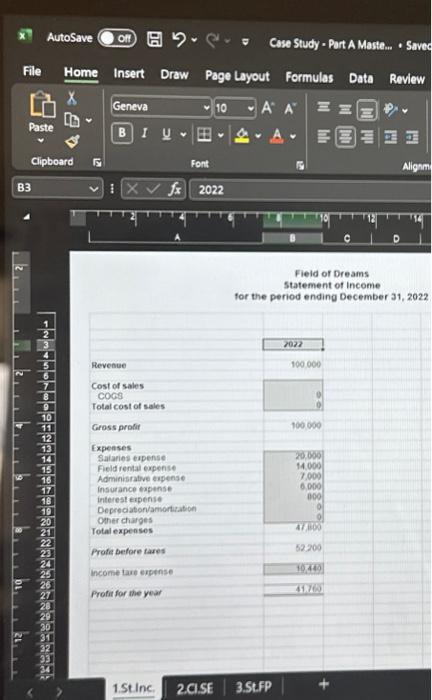

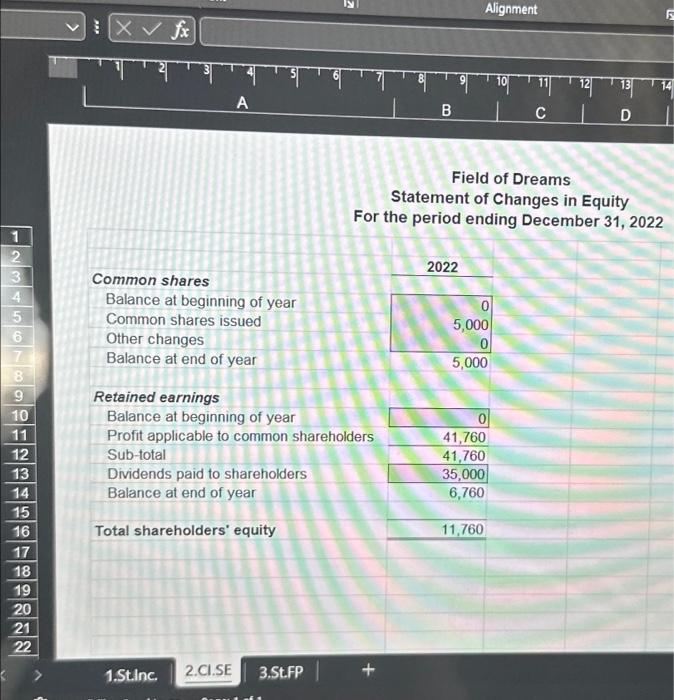

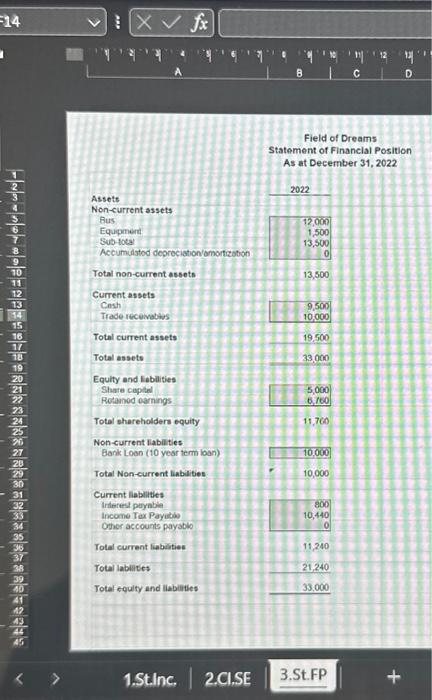

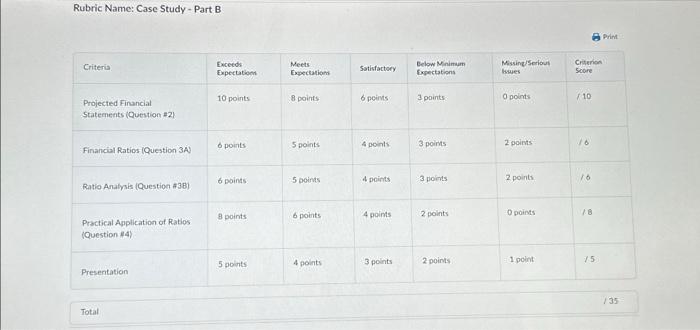

Case Study - Part B FIN7230 010 At the last board of directors meeting, her advisory group informed Ms. Tyrell that they believe the company can grow substantially. However, there is also a rival company starting up operations in 2023. Because of this threat to their market share, the board of directors wants to watch Field of Dream Ltd.'s financial ratios more closely. They also want a clearer picture of how the company can fund the new equipment purchases that the owner wishes to make to accommodate the growth of the business. Instructions: 1. Before beginning Part B of the term project, ensure that any corrections to your financial statements from Part A have been made. Refer to the posted "Case Study - Part A Master" located under the "Helpful Resources" tab on Brightspace. 2. Based on the financial statements that you prepared for Field of Dreams for the 2022 fiscal year, prepare a set of projected financial statements for the year ending December 31, 2023. HINT: Set up your financial statements from Part A so that they show both 2023 and 2022 financial data (comparative financial statements). Use the following conditions to support the creation of your projected financial statements: 1. 22% increase in revenue. ii. All accounts receivables from 2022 will be collected as cash in 2023; 15% of the 2023 revenue will be outstanding as a receivable at the end of the 2023 year. iii. 15% increase in salaries. iv. 1.3% increase in rental cost for fields. v. 5% increase in administrative expenses. vi. New advertising expense of $3000. vii. Interest expense for 2023 will be $720, which will still be owed at the end of 2023 viii. Comprate tax rate will be at 20%; This amount will still be owing at the end of 2023. ix. CCA allowance for combined total non-current assets is 20%. x.$1000 of the term loan will be paid off during the 2023 year. xi. Income tax payable from 2022 will be paid in cash during the 2023 year. xii. Jasmine Tyrell's dividend payout for 2023 will increase by 5%. Note: For the projected Statement of Income, Statement of Changes in Equity, and Statement of Financial Position, ensure that the 2023 financial statement cells include formulas... do not simply type in your numbers!!!! 3. Based on Field of Dreams financial statements for 2022&2023, calculate and comment on the following financial ratios by comparing both years to each other as well as to the industry standards (provided on last page). i. Current ratio ii. Debt-to-total assets ratio iii. Times - interest earned (note: interest expense = financing costs) iv. Average collection period v. Return on total assets. vi. Return on revenue (return on sales) 4. Jasmine Tyrell wants to invest in $50,000 worth of new equipment for the camps in 2023. She believes it would be possible to improve the average collection period to 30 days. Based on the 2023 projected financial statements, would there be enough cash to internally finance the purchase of this new equipment? HINT: Make sure to show your work (calculations) that you used to reach your decision. 5. Prepare a professional financial package in Excel that includes the company's comparative financial statements (for 2022 \& 2023), the ratio analysis, and your internal financing review for submission to the board of directors. 6. Submit on Brightspace an electronic copy of your financial statements in Excel. You should have 1 Excel file with 5 worksheet tabs representing each financial statement, your ratio analysis, and your analysis of the internal financing. 7. You must include your first and last name in cell A1 on each of your Excel worksheet tabs. Assessment Marks will be awarded for accuracy and presentation based on the following rubric: Field of Dreams statement of income for the period ending December 31, 2022 Field of Dreams Statement of Changes in Equity For the period ending December 31, 2022 Field of Drearns Statement of Financlal Position As at December 31,2022 Rubric Name: Case Study - Part B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts