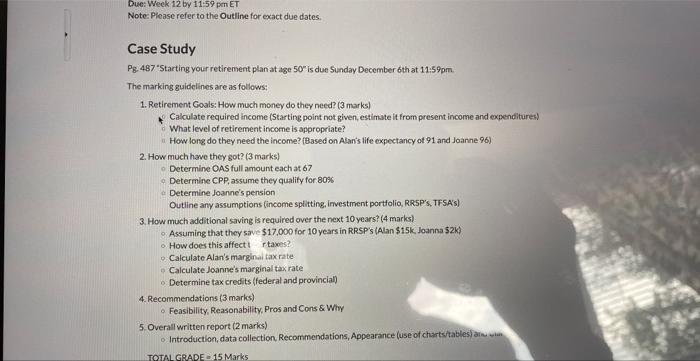

Question: Case Study Pg. 487 Starting your retirement plan at age 50 is due 5 unday December 6 th at 11:59pm. The marking guidelines are as

Case Study Pg. 487 "Starting your retirement plan at age 50 is due 5 unday December 6 th at 11:59pm. The marking guidelines are as follows: 1. Retirement Goals: How much money do they need? ( 3 marks) - Calculate required income (Starting point not given, estimate it from present income and expenditures) What level of retirement income is appropriate? How long do they need the income? fBased on Alan's life expectancy of 91 and Joanne 96) 2. How much have they got? (3 marks) Determine OAS full amount each at 67 Determine CPP, assume they qualify for 80% Determine Joanne's pension Outilne any assumptions (income spitting, investment portfolio, RRSP's, TFSA's) 3. How much additional saving is required over the next 10 years? (4 marks) Assuming that they save $17,000 for 10 years in RRSP's (Alan $15k Joanna $2k ) Howdoes this affect t r tawes? Calculate Alan's marginai taxrate Calculate Joanne's marginal tax rate Determine tax credits (federal and provincial) 4. Recommendations (3 marks) - Feasibility, Reasonability, Pros and Cons & Why 5. Overall written report (2 marks) Introduction, data collection, Recommendations, Appearance (use of chartsitables) ais wia Case Study Pg. 487 "Starting your retirement plan at age 50 is due 5 unday December 6 th at 11:59pm. The marking guidelines are as follows: 1. Retirement Goals: How much money do they need? ( 3 marks) - Calculate required income (Starting point not given, estimate it from present income and expenditures) What level of retirement income is appropriate? How long do they need the income? fBased on Alan's life expectancy of 91 and Joanne 96) 2. How much have they got? (3 marks) Determine OAS full amount each at 67 Determine CPP, assume they qualify for 80% Determine Joanne's pension Outilne any assumptions (income spitting, investment portfolio, RRSP's, TFSA's) 3. How much additional saving is required over the next 10 years? (4 marks) Assuming that they save $17,000 for 10 years in RRSP's (Alan $15k Joanna $2k ) Howdoes this affect t r tawes? Calculate Alan's marginai taxrate Calculate Joanne's marginal tax rate Determine tax credits (federal and provincial) 4. Recommendations (3 marks) - Feasibility, Reasonability, Pros and Cons & Why 5. Overall written report (2 marks) Introduction, data collection, Recommendations, Appearance (use of chartsitables) ais wia

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts