Question: case study -please answer all Case 1: The Farm Purchase Jan Schmidt is 45 years old and has the option of buying a farm for

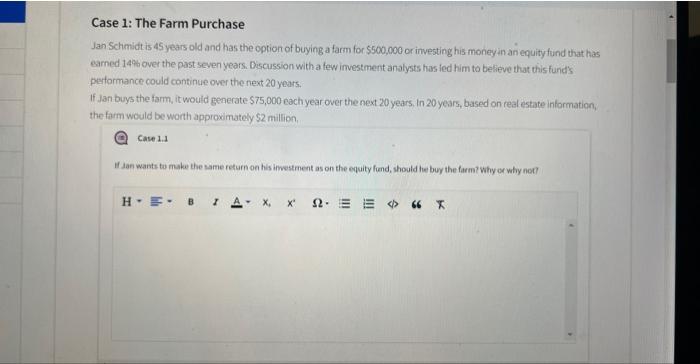

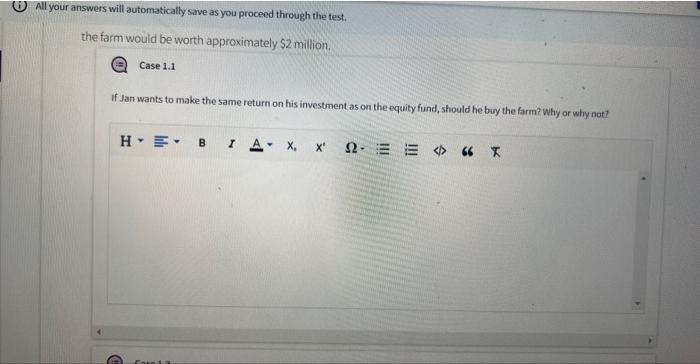

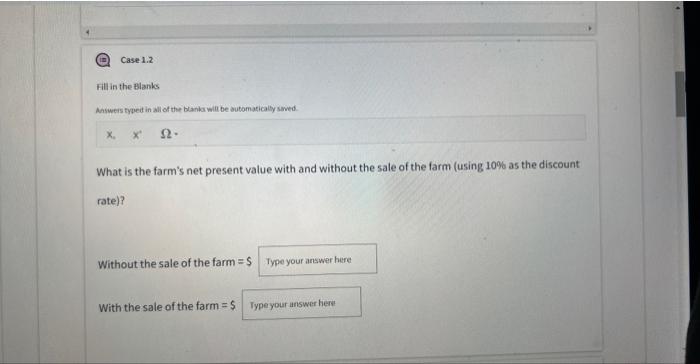

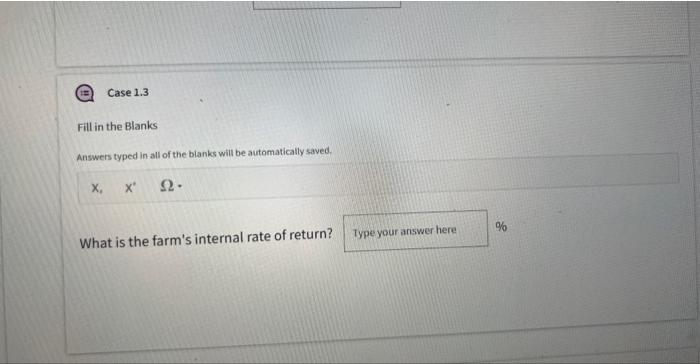

Case 1: The Farm Purchase Jan Schmidt is 45 years old and has the option of buying a farm for $500,000 or investing his money in an equity fund that has earned 14\% over the past seven years. Discussion witha few imestment analysts has fed him to believe that this fund's pertormance could continue over the next 20 years. If Jan buys the farm, it would geaerate $75,000 each year over the next 20 years, In 20 years, based on real estate information, the farm would be worth approximately $2 million. All your answers will automatically save as you proceed through the test. the farm would be worth approximately $2 million. Case 1.1 If Jan wants to make the same return on his investment as on the equity fund, should he buy the farm? Why or why not? Fill in the Blanks AAswers fyqued in all of the banka wifl be butomacicaty awed. x0x. What is the farm's net present value with and without the sale of the farm (using 10% as the discount rate)? Without the sale of the farm =$ With the sale of the farm =$ Fill in the Blanks Answers typed in all of the blanks will be automatically saved

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts