Question: Case study: please base your answers on the below case study Kindly assist with the following question, all answers should come from case study. Carry

Case study: please base your answers on the below case study

Kindly assist with the following question, all answers should come from case study.

Carry out an industry analysis (using Porters Forces formart below) of the healthcare industry in Sub-Saharan Africa, narrowing your emphasis on the medical, hygiene and healthcare products sub-sector. How attractive or unattractive is this industry sub-sector at the time of the case? Support your answers with appropriate commentary

Please use the below template for your answers, All answers to come from case study

Columns

Porters Forces....Industry Analysis....Rivalry Strength high or low....Overall Strength High or low

Competitive Rivalry

Competitor concentration and balance:

Industry growth rate:

fixed costs:

exit barriers:

Threat to Entry

Scale and experience:

Access to supply or distribution channels:

Capital requirements:

Legislation or government action.:

Expected retaliation:

Threat of substitutes

Extra-industry effects:

The price/performance:

Power of buyers

Concentrated buyers.:

switching costs:

Buyer competition threat:

Power of Suppliers

Concentrated suppliers:

High switching costs:

Supplier competition threat:

Differentiated products:

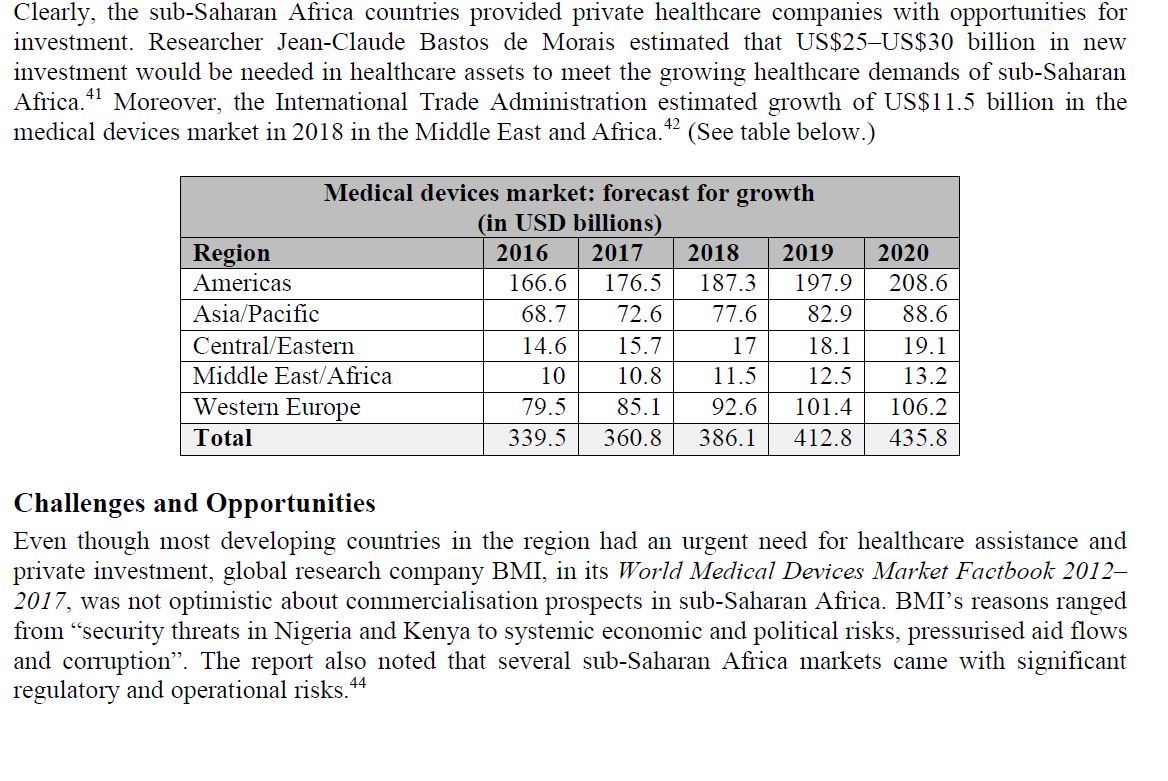

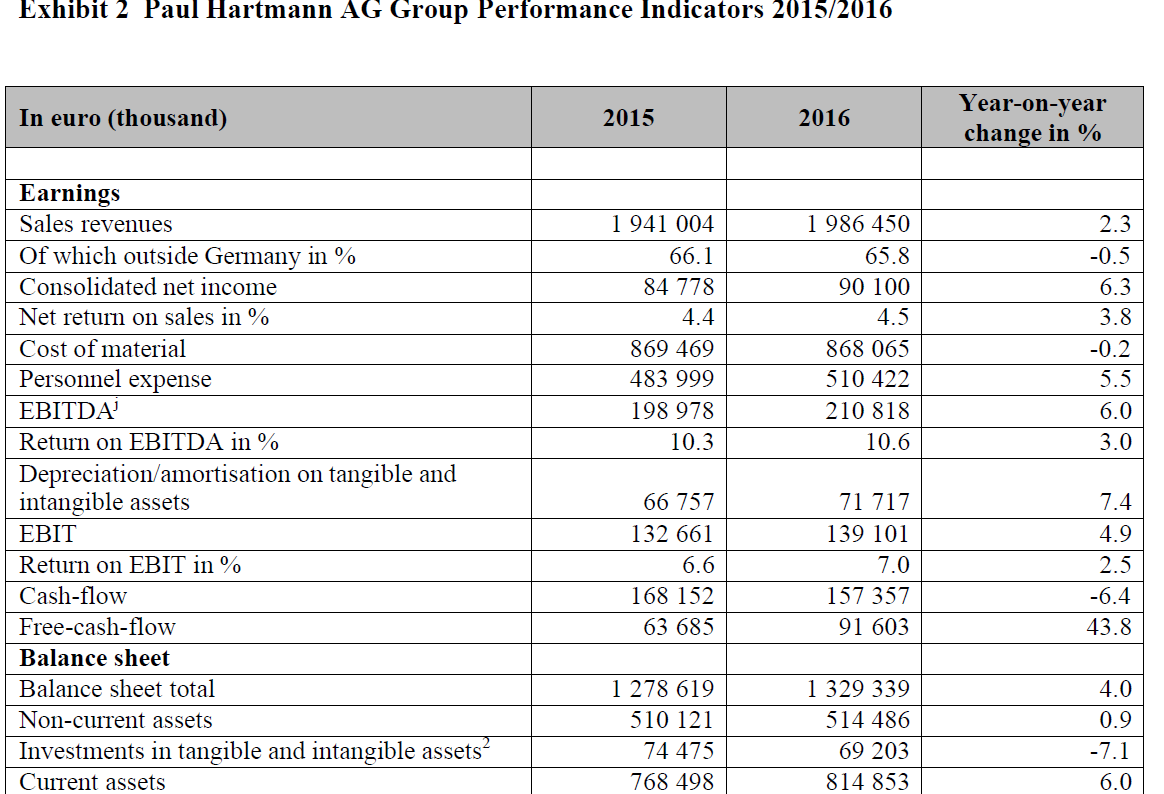

Hartmann Southern Africa: Keeping Healthcare Moving Forward German company Paul Hartmann AG" (Hartmann) (see Exhibit 1 for logo) was established in 1818 and formed the core of the Hartmann Group. Hartmann had its headquarters in Heidenheim, Germany. By 2017, the company employed 10 519 staff members and had a presence in 33 countries worldwide, three of which were in Africa: Algeria, Morocco and South Africa.? Known for its mission to constantly look for ways to improve treatments, outcomes and healthcare experiences in both the professional sector and at home, Hartmann had operated according to three core values over the years: a passion for what it did, building sustainable partnerships, and operating in the highest professional manner. When Joehle was appointed CEO of the international Hartmann Group in July 2013, he not only brought with him vast experience in the healthcare industry, but even more importantly, his passion for innovatio and diversity. He explained: We need diversity to innovate, to change and to improve. Diversity comes in many different forms, but for innovation to take place, you need diversity of ideas and a diversity of experiences. You need a multicultural environment where people see things from different perspectives and can challenge each other. The obvious solution to a challenge may be staring you in the face, but sometimes you need someone with a different view to point it out. If we surround ourselves with people exactly like ourselves, we stay biased and become blind to new and different solutions." 6 Hartmann's strategy and goal were embedded in its brand promise of Going further for health for everyone, everywhere, at all times. One way of reaching that goal, according to Joehle, was by being inventive and acting cost-effectively in all of its sales regions. Hartmann's Spanish production facility in Matar, Catalonia, was an example of adopting the Hartmann lean thinking philosophy to transform the plant. It applied the L.A.C.E. (Leadership-Accountability-Commitment-Execution) framework, as explained by Jonathan Escobar, Hartmann's global head of lean management: The basic mindset defining our approach to our lean transformation was expressed in the L.A.C.E, whose principles have guided us, putting the customer is boss', respect for people' and `improve or nothing core beliefs at the centre of our every decision.7 Despite the slow growth of the global economy, the group had consolidated sales of 1 986.5 million in 2016 (a rise of 3.2% from 2015) and consolidated earnings after tax of 90.1 million for the 2016 year. (See Exhibit 2 for group performance indicators.) Hartmann South Africa The Johannesburg-based medical supplier Vitamed Pty (Ltd) had represented Hartmann in sub-Saharan Africa since 1996 as a distributor of its products. In 2001, Hartmann obtained a 70% share in Vitamed and it became Hartmann-Vitamed until 2003, when it became Hartmann South Africa, a wholly-owned Hartmann subsidiary. The business comprised four departments: pharmacy, hospital, aged care and export. Aside from distributing Hartmann products, the company also manufactured Hartmann facemasks, shoe covers, headwear and incontinence underpads (mattress protector) for the local market. Also in 2003, Hartmann South Africa and specialty medical products company, Hollister South Africa, formed a strategic alliance to combine their respective healthcare products and services. In line with South African regulations, Hartmann SA was a member of the South African Medical Device Industry Association (SAMED). Accordingly, it was required to adhere to the association's marketing and business codes of practice, and to renew its SAMED licences to manufacture and distribute medical devices at the beginning of each year. In addition, all medical device importers had to obtain a South African Medicines Control Council (MCC) licence. 10 The South African medical devices industry was import-driven, with total imports of medical devices valued at R11.619 billion in 2013 (latest figure available).11 The United States (US) dominated the medical device import market in South Africa, with US importation valued at R3 billion (2013) in all categories, but particularly in orthopaedics, prosthetics, patient aids and other consumables. Imports from Germany followed in second place, valued at R1.8 billion (2013), with China in third place at R1.1 billion (2013), followed by Switzerland, the UK and Japan." Regarding products, consumables such as antibacterial wipes, bandages, hand sanitiser and patient care gloves made up the largest share of South Africa's sales of medical devices, estimated to reach 19% in 2020.13 Expertise Although Hartmann was typically considered to be an expert in wound management, the company also specialised in infection management, incontinence management, personal healthcare and risk prevention. The Hartmann products consisted of simple and effective solutions a trademark of the company and, for the most part, disposable products. Joehle explained why Hartmann produced simple products: Rather than being enticed by whatever new technology becomes available in wound care, which might only have 2 specific uses, at Hartmann we focus on two wound dressings in our Hydrotherapy range, for example. Together, these products are able to treat up to 80 percent of chronic wounds. For us, a proof point that simple can be much more useful than sexy." 9914 The product range included hydro-active wound dressings; compression bandages; incontinence pads; the MoliCare skin care range for dry, ageing skin; and stomad care products, and devices such as blood pressure monitors and thermometers; first aid kits; examination gloves and surgical products.ls (See Exhibits 3a to 3g for product range.) - In 2016, incontinence product sales performed best, making up 32.5% of total sales, followed by infection management products (24.1%), wound management products (21.8%) and other products such as cosmetic cotton wool products, first aid, Kneipp product lines - and retail business comprising 21.6% of total sales. 16 With regard to sales per region, Hartmann's Africa, Asia and Oceania region performed third best out of its four regions (Germany, Europe excluding Germany, and America being the other three) with a percentage share of 7.9%. (See Exhibit 4a and 4b for share of total sales by business segment and region.) Collaborations Over the years, Hartmann had acquired companies as subsidiaries, such as BODE Chemie (Hamburg), Karl Otto Braun (Wolfstein), Sanimed (Ibbenbren) and Kneipp (Wrzburg), to expand its expertise and products. This was in line with the company's outlook that collaboration is in our DNA.!" It's most recent acquisition in 2017 had been Procter & Gamble's (P&G) Lindor, a Spanish manufacturer and distributor of adult incontinence products. 18 Collaborations Over the years, Hartmann had acquired companies as subsidiaries, such as BODE Chemie (Hamburg), Karl Otto Braun (Wolfstein), Sanimed (Ibbenbren) and Kneipp (Wrzburg), to expand its expertise and products. This was in line with the company's outlook that collaboration is in our DNA. 17 It's most recent acquisition in 2017 had been Procter & Gamble's (P&G) Lindor, a Spanish manufacturer and distributor of adult incontinence products. 18 Hartmann's products were distributed to around 100 countries through a network of distributors on a business-to-business basis. Partnerships also included healthcare professionals, where Hartmann cooperated with local healthcare companies in various countries to sell and distribute its products to public and private pharmacists at clinics and hospitals. Hartmann considered pharmacists and healthcare personnel highly. Marc Prez Pey, managing director of Hartmann Spain and regional vice chairman, elaborated: Hartmann doesn't just make products. We support pharmacists and healthcare professionals. We regard them as key agents in managing healthcare in the community. That is why we offer them training and management resources, so they can establish themselves as the focal point for providing care to the public." 9919 A three-year partnership, signed in 2016 between Hartmann and international humanitarian aid organisation CARE, paved the way for Hartmann to expand in emerging markets in sub-Saharan Africa, as CARE was active in 11 countries throughout East Africa and Central Africa in line with Hartmann's goal of taking healthcare further. 20 (See Excel spreadsheet for specific countries.) Although Hartmann's social impact project started in Bolivia, the company intended to be involved in emerging markets on a far greater scale: Over the next three years, we will select 18 employees to go to countries in the developing world to support CARE Germany's local healthcare infrastructure efforts, Stephan Schulz, Hartmann's chief financial officer and labour director, noted.21 To this end, Hartmann planned to expand its involvement with CARE to Kenya and Nepal in 2018.22 Hartmann would support CARE by providing hygiene education through teaching the local healthcare workers best practices on hygiene and sanitation, emphasising the importance of hand and surface disinfection, as well as teaching the residents the basics of wound management.23 Supply Chain Management 3 Curbing supply chain costs featured high on Hartmann's priority list. For this purpose, the Hartmann Group acquired Wolters Kluwer Transport Services' transport management software (TMS) solution, called Transwide Software-as-a-Service. As a first step, the group focused on inbound distribution, and then looked at improving delivery operations. The software enabled the group to optimise and automate all its inbound transportation from factories, suppliers and dealers to more than 40 European logistics sites. The logistics platform allowed everyone in the transport chain to check the status of a consignment, while the business intelligence (BI) module provided analysis, statistics and illustrations to optimise transport management Innovation at Hartmann Committed to creating innovative healthcare solutions, Joehle 5 established two centres of excellence to support this objective: the Hartmann BODE Science Center and the Medical Innovation Center. Hartmann BODE Science Center In 2009, BODE Chemie, a manufacturer and supplier of cleaning, disinfecting and skincare products for 26 the medical industry,20 became a wholly-owned subsidiary of Hartmann. The acquisition enabled the two companies to combine and expand their expertise in infection protection one of the most important challenges the healthcare industry faced globally.?? By 2011, the merger had culminated in Hartmann's BODE Science Center, a scientific centre in Heidenheim for excellence in hygiene and infection protection, focusing on infection management. 27 28 Apart from research and product development, the BODE Science Center provided what it called systematic professional advice. Its contact centre offered a number of services to users hygiene experts and healthcare professionals interested in hygiene and infection protection. For example, employees were qualified to answer questions from the public and medical professionals on hygiene management, infection risks various products available and their proper application 29 Medical Innovation Center In 2012, Hartmann launched its state-of-the-art training and production facility, the Medical Innovation Center, also in Heidenheim. The centre included a fully equipped operating room for interactive training sessions and workshops on the proper use of surgical procedure sets, where customers could watch the interaction of clean room logistics.30 Hartmann manufactured nearly 100 million wound dressings and 700 000 customised surgical procedure sets per year at the centre. Only five machines produced 280 versions of 11 wound care products." A tugger train an innovative logistics train ensured a continuous flow of material, by transporting raw materials and semi-finished products to manufacturing facilities and picking up the finished goods. 32 Product Innovation Hartmann, through its continuous research, regularly added to its product range. But it was the company's hydro-responsive wound dressing, HydroCleanplus, which attracted the most attention. The product won the top award in the "Most Innovative New Dressing" category at the Journal of Wound Care Awards in 2017 (see Exhibit 3a). Hartmann described its product as a simple, effective, economical wound care solution that improves patient outcomes33 The dressing changed the way wounds were treated by keeping the wound moist for longer, as moist wounds healed faster. 34 Another example of product innovation was the Tensoval Blood Pressure Monitor - a fully automatic blood pressure monitor for self-measurement that included Tensoval duos control. (See Exhibit 3c.) Calling it a world novelty, Hartmann claimed that this was the first monitor with duo sensor technology a that provided ultimate accuracy and was manufactured as either a wrist device or a free-standing device. This new technology was particularly suitable for people with high blood pressure, plus various types of heart rhythm disorders. 35 Researchers at Hartmann's Spanish production facility also developed the adhesive technology currently used to coat Hartmann products." The Healthcare Industry in Sub-Saharan Africa The sub-Saharan Africa region had 48 countries and an estimated population size of just over one billion, - 11% of the world's population. The region experienced 24% of global diseases, but had only 3% of the world's doctors. 38 37 Although the quality of healthcare in sub-Saharan Africa had improved over the past five years, progress was still slow in most countries. This had resulted in citizens travelling to other countries, such as South Africa, for better quality healthcare and so becoming so-called medical tourists. Still, healthcare investment was regarded as one of the fastest-growing sectors in Africa, supported by drivers such as a fast-growing middle class, who demanded better healthcare, had a growing knowledge of healthcare needs, and required better healthcare governance. According to Fredr Meiring, debt and capital advisory partner at professional services firm Deloitte, apart from South Africa, countries such as Botswana, Kenya, Nigeria and Tanzania showed signs of an advancing healthcare system. 40 39 Clearly, the sub-Saharan Africa countries provided private healthcare companies with opportunities for investment. Researcher Jean-Claude Bastos de Morais estimated that US$25US$30 billion in new investment would be needed in healthcare assets to meet the growing healthcare demands of sub-Saharan Africa.41 Moreover, the International Trade Administration estimated growth of US$11.5 billion in the medical devices market in 2018 in the Middle East and Africa. 42 (See table below.) Medical devices market: forecast for growth (in USD billions) Region 2016 2017 2018 2019 Americas 166.6 176.5 187.3 197.9 Asia/Pacific 68.7 72.6 77.6 Central/Eastern 14.6 15.7 17 18.1 Middle East Africa 10 10.8 11.5 12.5 Western Europe 79.5 85.1 92.6 101.4 Total 339.5 360.8 386.1 412.8 82.9 2020 208.6 88.6 19.1 13.2 106.2 435.8 Challenges and Opportunities Even though most developing countries in the region had an urgent need for healthcare assistance and private investment, global research company BMI, in its World Medical Devices Market Factbook 2012 2017, was not optimistic about commercialisation prospects in sub-Saharan Africa. BMI's reasons ranged from security threats in Nigeria and Kenya to systemic economic and political risks, pressurised aid flows and corruption. The report also noted that several sub-Saharan Africa markets came with significant regulatory and operational risks. 44 However, because medical equipment (also for conditions other than cancer) was expensive, companies that manufactured low-cost alternatives were in demand in sub-Saharan Africa. Companies operating in this space included GE Healthcare's Sustainable Healthcare Solutions (SHS) business', which aimed to provide high-value, low-cost technologies and healthcare delivery solutions to underdeveloped countries. The company had developed low-cost devices in the fields of cardiology, radiology and surgery." An example of a low-cost product was the Philips VISIQ portable ultrasound system with high-resolution imaging in a small, lightweight package with a two-and-a-half-hour battery life. 54 This portable system, the size of a tablet, was used in remote areas in Kenya to detect critical conditions in pregnancy.55 53 The importance of wound debridement (the medical removal of dead, damaged or infected tissue to improve healing) and management of traumatic wounds in sub-Saharan Africa countries had been highlighted by the Lancet Commission on Global Surgery' . Yet, the commission made no mention of chronic wounds, nor of training health workers in managing these wounds. Chronic wounds, according to Dr Terry Treadwell, who had experience in Africa of treating such wounds, were a major problem in sub-Saharan Africa countries. Because the most common types of chronic wounds were leg ulcers, pressure ulcers and diabetic foot ulcers, the WHO suggested horizontal systems of primary healthcare in Africa. Such an approach encouraged different disciplines to work together as a cross-functional team - for example, diabetic experts and leprosy experts could both attend to chronic wounds." 56 57 A common ailment in sub-Saharan Africa was obstetric fistulas a form of urinary incontinence that can arise during childbirth, especially when a trained birth professional or a doctor is not present. An estimated 2 million women suffered from the condition in sub-Saharan Africa countries, according to researcher Nicole Telfer. (See also Exhibits 5a for a map showing sub-Saharan Africa countries, and 5b for country-specific information, and the Excel spreadsheet for further information.) 58 Competitive Environment Some of Hartmann's direct and indirect international competitors were already active in Africa. A main rival of Hartmann, the Swedish company Mlnlycke Health Care also known for its breakthrough innovation strategy distributed wound care management and surgical products, among others, to the sub- Saharan Africa market through its distributor Gentry Health in South Africa. - The American multinational conglomerate corporation, 3M, divided its African operations into two regions: 3M South Africa (comprising Botswana, Mozambique, Namibia and Zimbabwe) and 3M Africa. The latter comprised North, East, Central and West Africa, including Algeria, Egypt, Libya, Morocco, Tunisia, Angola, the Democratic Republic of the Congo (DRC), Ethiopia, Ghana, Kenya, Nigeria, Tanzania, Uganda and Zambia. The company distributed a host of products more than 65 000 across various industries. Some of its healthcare products included wound care products, sterilisation and monitoring products, surgical products, critical and chronic care products, and casting and splinting products. 6 Smith & Nephew, which offered products for reconstructive orthopaedics; advanced wound management; sports medicine; trauma; and ear, nose and throat (ENT) products, had representation in many sub-Saharan Africa countries. Among these were Botswana, Kenya, Mauritius, Namibia, Nigeria, Rwanda, South Africa, Sudan, Swaziland, Tanzania, Uganda, Zambia and Zimbabwe. 61 TENA, another global healthcare organisation, manufactured incontinence devices and distributed its products to South Africa and Tunisia. 62 Likewise, direct competitor Coloplast distributed its bladder and bowel products, wound care products, stoma bags and surgical urology products in South Africa, Algeria and Egypt.3 Reddy believed that there was a possibility that both of these organisations would want to expand their reach in sub-Saharan Africa. 63 She also believed that indirect competition could be turned into opportunity through innovative partnerships with companies in unrelated fields. For example, biotechnology company Genzyme Sanofi, which focused on rare diseases, multiple sclerosis, immunology and oncology, was also active in sub- Saharan Africa countries. 64 She wondered whether there might be an opportunity for Hartmann to partner with Genzyme, and on what basis. Glocalisation International companies that had been successfully operating in sub-Saharan Africa countries had managed to find the right mix of global and local practices, which led to the usage of the term "glocalisation. Joehle was acutely aware of the importance of glocalisation, as he had repeatedly declared that it is important to always maintain a balance between centralisation and close contact with the customer65 66 Analysts warned foreign investors never to assume that any country or sector in Africa operated in the same way, as each country had different dynamics. Michael Duys, CEO of Duys Engineering, which had expanded from South Africa into Mozambique 15 years ago, agreed and offered some additional advice: To succeed in any country, one needs to have a local presence and local knowledge, so larger organisations should consider partnering with smaller local companies to leverage each other's knowledge, experience and other resources. Even more importantly, he added that any form of arrogance would not be tolerated in any African country. 68 Meiring, too, echoed his advice: You need people on the ground in the country to really understand it and live the life of those people to find out all the nitty-gritty issues before even approaching the matter of investing in healthcare in that country. 69 1967 Exhibit 2 Paul Hartmann AG Group Performance Indicators 2015/2016 In euro (thousand) 2015 2016 Year-on-year change in % 1 941 004 66.1 84 778 4.4 869 469 483 999 198 978 10.3 1 986 450 65.8 90 100 4.5 868 065 510 422 210 818 10.6 2.3 -0.5 6.3 3.8 -0.2 5.5 6.0 3.0 Earnings Sales revenues Of which outside Germany in % Consolidated net income Net return on sales in % Cost of material Personnel expense EBITDA Return on EBITDA in % Depreciation/amortisation on tangible and intangible assets EBIT Return on EBIT in % Cash-flow Free-cash-flow Balance sheet Balance sheet total Non-current assets Investments in tangible and intangible assets- Current assets 66 757 132 661 6.6 168 152 63 685 71 717 139 101 7.0 157 357 91 603 7.4 4.9 2.5 -6.4 43.8 1 278 619 510 121 74 475 768 498 1 329 339 514 486 69 203 814 853 4.0 0.9 -7.1 6.0Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts