Question: CASE STUDY QUESTION 3 Expenses (Fixed and Variable) Charlene Ripper and Tonya Upper own and run the Ripper-Upper Carpet Cleaning Company. They charge $100 for

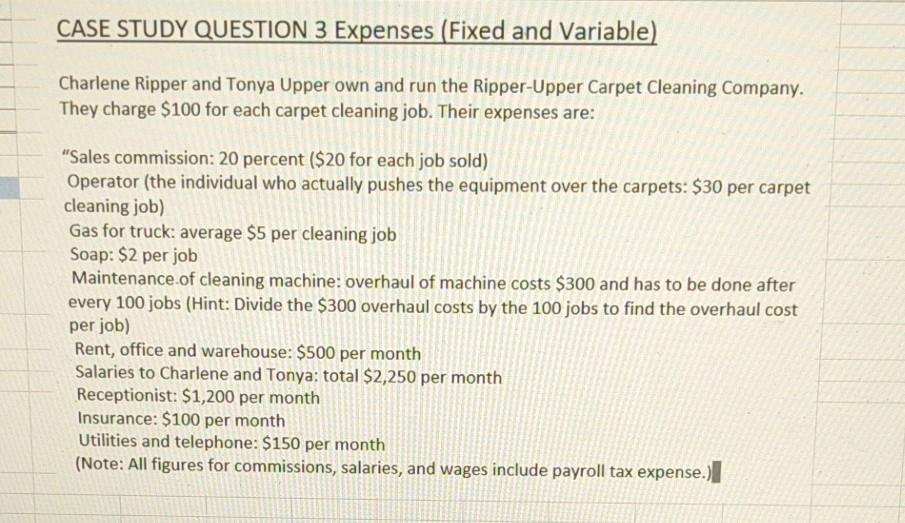

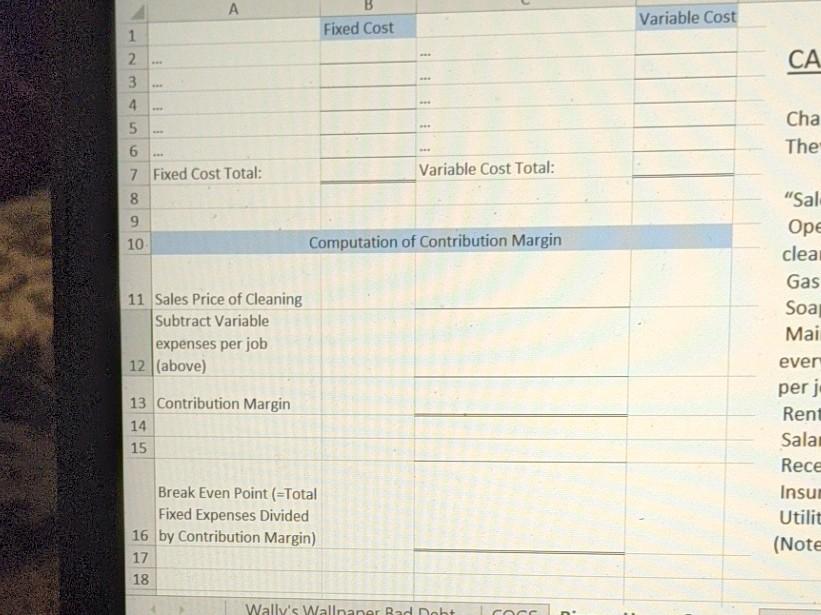

CASE STUDY QUESTION 3 Expenses (Fixed and Variable) Charlene Ripper and Tonya Upper own and run the Ripper-Upper Carpet Cleaning Company. They charge $100 for each carpet cleaning job. Their expenses are: "Sales commission: 20 percent ($20 for each job sold) Operator (the individual who actually pushes the equipment over the carpets: $30 per carpet cleaning job) Gas for truck: average $5 per cleaning job Soap: $2 per job Maintenance of cleaning machine: overhaul of machine costs $300 and has to be done after every 100 jobs (Hint: Divide the $300 overhaul costs by the 100 jobs to find the overhaul cost per job) Rent, office and warehouse: $500 per month Salaries to Charlene and Tonya: total $2,250 per month Receptionist: $1,200 per month Insurance: $100 per month Utilities and telephone: $150 per month (Note: All figures for commissions, salaries, and wages include payroll tax expense.) A B Variable Cost Fixed Cost CA 1 2 3 4 5 6 7 Fixed Cost Total: 8 9 10 Cha The Variable Cost Total: Computation of Contribution Margin 11 Sales Price of Cleaning Subtract Variable expenses per job 12 (above) "Sal Ope clea Gas Soa Mai ever per i Rent Sala Rece Insur Utilit (Note 13 Contribution Margin 14 15 un Break Even Point (=Total Fixed Expenses Divided 16 by Contribution Margin) 17 18 Wally's Wallpaner Bad Doht COCO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts