Question: CASE STUDY QUESTION The Financial Position: As the statement of financial position and the income statement for the years 2007 through 2016, indicated, Neha was

CASE STUDY QUESTION

The Financial Position:

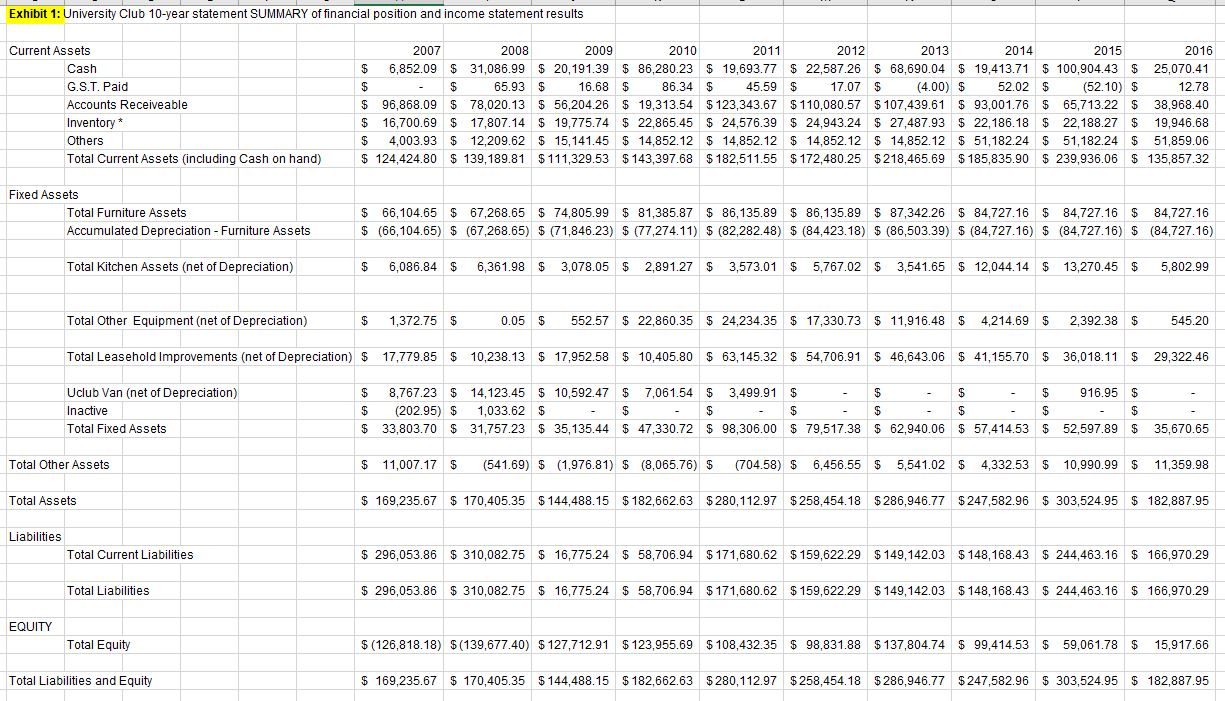

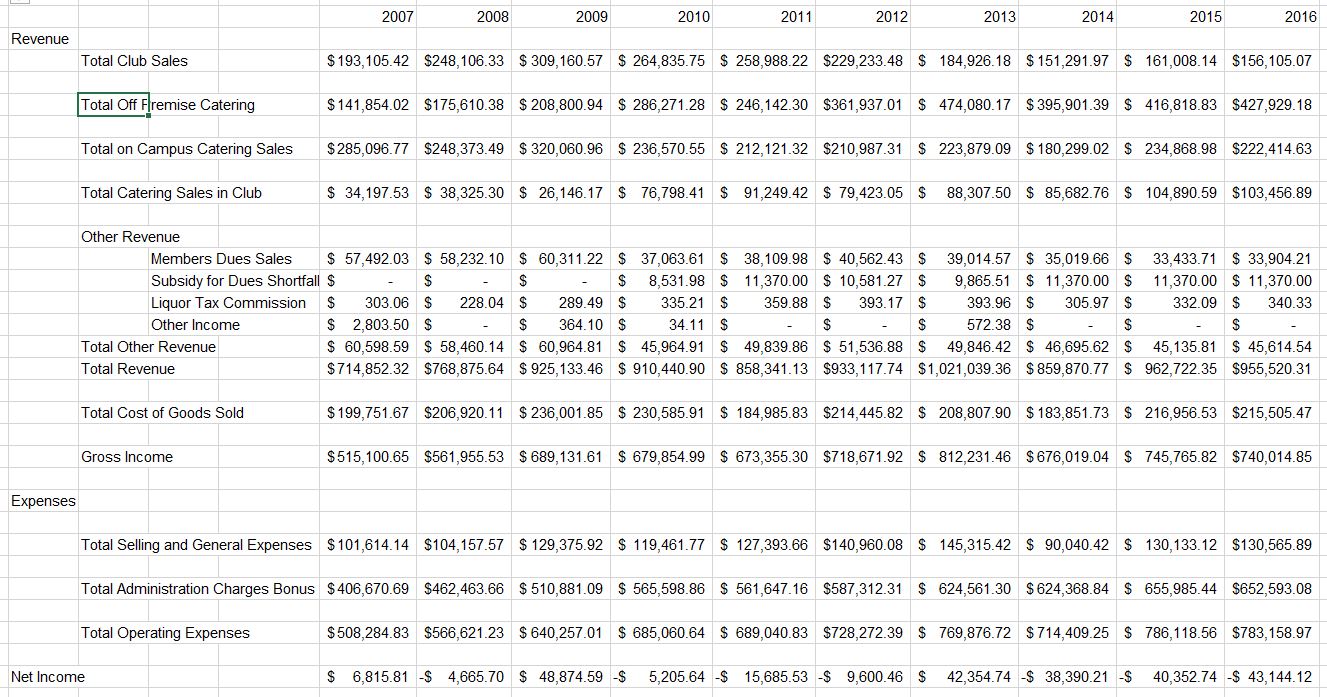

As the statement of financial position and the income statement for the years 2007 through 2016,

indicated, Neha was concerned that net income was negative in seven out of these 10 years (see Exhibit 1). The university valued the services that the club provided to its faculty, guests, and the professionals working at several private organizations housed in the research park on campus. Therefore, the university subsidized these losses by writing off the accounts payable. The most recent write-off occurred in 2009, when the university wrote off all outstanding debts owed to it by the club. However, government's budget deficit of over $1.5 billion1 reduced university funding by 3.5 per cent. With this financial crunch, the university was no longer able to subsidize the club's shortfalls. Neha noted that the gross income in these 10 years ranged from $500,000 to $700,000. This seemed to be an anomaly to Neha?negative net income despite a sizeable positive gross income. She wanted to dig deeper by performing a detailed ratio analysis.

Benchmarking:

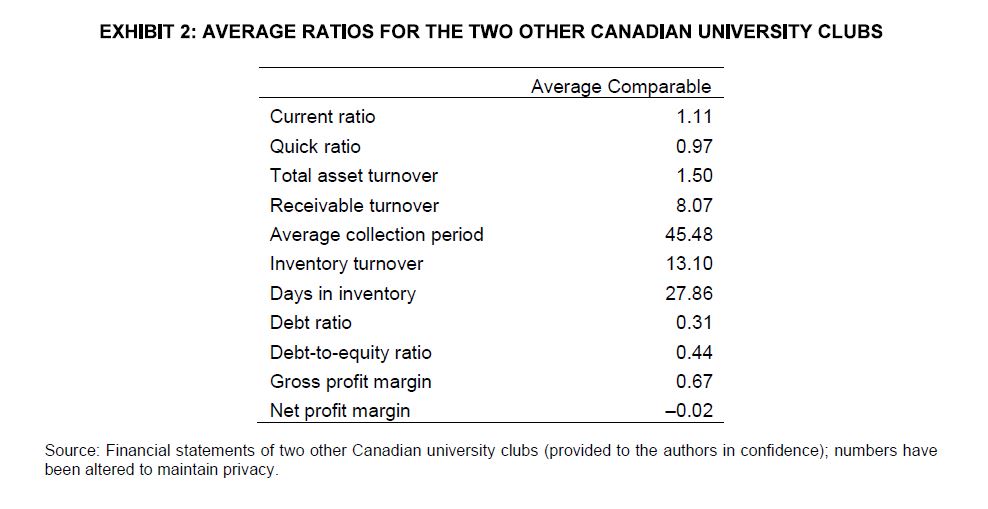

The financial ratios above provided a set of numbers that needed to be benchmarked to provide useful information for deciding the future of the faculty club. Two types of benchmarks could have been used:

cross-sectional and time series.

Cross-sectional analysis used the ratios of similar firms (firms within the same industry) as a benchmark at the same point in time. For example, a current ratio of 1.5 for the firm in question might raise a red flag

if the ratio was 2.5 on average for the other firms in the same industry. The only comparable data

available at the time were the average financial ratios of two other university clubs for the year

2015 (see Exhibit 2).

Time series analysis used the historical ratios of the same firm as the benchmark. For example, a current ratio of 1.45 could have been reason for concern if the firm's ratio had been around 2.2 over the previous five years.

Course of Action:

The deliberations on the future of the club led the board to consider one of three courses of action.

The first was to increase the membership fee. This would have been a reversal of a policy adopted a few years earlier, when the fee was reduced from a fixed percentage of salary to a fixed low monthly fee of $10. The risk of this action was that more members would drop out, and total membership revenue would decrease. If the board chose to pursue this option, careful analysis would be required to come up with a fee figure that was sufficient to cover the club's losses.

The second course of action was to increase the number of members. A few years earlier, the board had attempted and failed to boost membership when it replaced the percentage-of-salary fee. Membership numbers could be increased if membership were made mandatory for all faculty members. However, such a decision required faculty union approval, and the board was reluctant to go that route.

The third course of action was the most difficult and painful. It was to close the club. This decision would result in layoffs of long-term employees, who had over many years developed personal relationships with the faculty through excellent service. It would also be negatively received by the membership and the faculty in general, because the club provided valuable services that were not available elsewhere on campus.

Conclusion:

Neha realized that the decision was not strictly financial. However, she strongly believed that the ratio analysis would reveal whether the club was viable, or could be made viable, without university subsidy.

She was hopeful that she might identify issues hidden in the numbers, which if addressed properly, could help revitalize the club. With that conviction, she pulled all the numbers in her Microsoft Excel

spreadsheet and set out to work.

Answer should be an Executive summary and is limited to strictly one page only, with five-page limit for any appendices (including worksheets) that you believe are necessary to include to support your analysis/decision.

Concisely conveying key issues, analysis and recommendations is a highly valuable real world business skill. Think of the real-world recipient of this executive summary. Appearance matters and typos, poor formatting, etc. can diminish the impact of the most robust analysis and well-constructed argument.

The executive summary should follow the following format (headings must be included):

1. Identification of key Issue(s):

Brief description of the key problem(s)/issue(s) introduced in the case and the decision(s) that need to be made. This should be very brief, comprising one to two sentences at most.

2. Relevant fact(s)/issues that need to be considered:

Main points that need to be considered.

Given total executive summary is limited to one page, make efficient use of space. Assume the reader is familiar with the case information, so do not repeat the case, merely highlight to the reader the key facts that need to be focused on.

3. Summary of Analysis:

An analysis of each alternative/decision, with numbers/facts/analysis to support the points whenever available. Remember, space is limited, so do not describe everything you did (the appendices are where you can display your workings), rather summarize the most important findings from your analysis. The numbers/results of the analysis themselves are not sufficient without context, convey to the reader why the numbers underlying your analysis matter.

This is the bulk of the executive summary.

4. Conclusion

Your decision/recommendation and the key reasons for choosing it over any alternatives. This should be the logical conclusion that rests upon the analytical case you have been building in the prior sections. Use action words; what should be done, and why.

Questions:

1. How do you evaluate financial performance of a business using financial statements?

2. What risks and opportunities are faced by the University Club?

3. Calculate and interpret financial ratios as analytical tools for decision-making.

4. Using both quantitative and qualitative information, what should the board do?

ATTACHED:

Case1 Exhibit 1 - divided into two files

Case1 Exhibit 1A and Case1 Exhibit 1B

Case1 Exhibit 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts