Question: Case study Read the Semester Case Study and answer the question below. Julie Welk, Head of Finance calls you into her office and says: I

Case study

Read the Semester Case Study and answer the question below.

Julie Welk, Head of Finance calls you into her office and says:

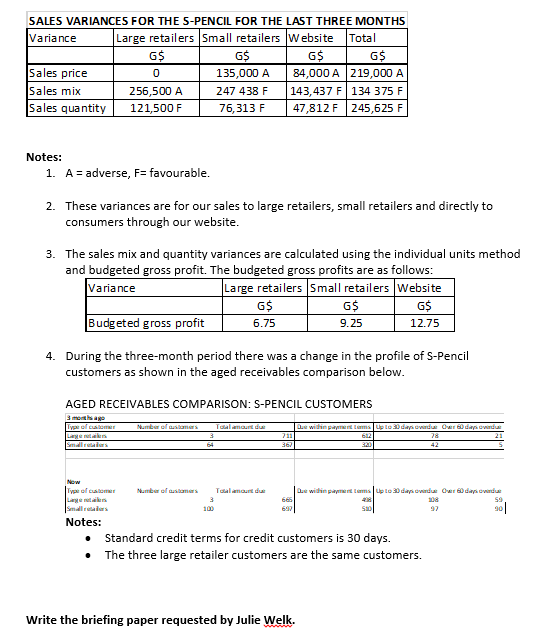

I have just been talking to Ben Thakar, Sales and Marketing Director, about the S-Pencil. In the first few months after the launch sales volumes were a little lower than budgeted. As a result of this, three months ago two things happened: firstly, Ben authorised a special promotional price for the S-Pencil on our website for sales direct to the public and secondly, he tasked his sales teams to secure new retail customers and gave them authority to offer small discounts and extended credit terms to any new retail customers.

Ben has asked me to look in detail at the impact of his actions three months ago on our actual profit compared to budget and the recoverability of our retail customer receivables. I have so far created a schedule which shows sales variances for the S-Pencil for the last three months as well as the aged receivables information for the S-Pencil customer. I would like you to prepare commentary to go with this schedule which explains:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts