Question: Case Study Regarding Canada Tire . Base on year 2020 Accounting 1115 The Consolidated Statement of Income 9. Using the Consolidated Statement of Income, calculate

Case Study Regarding Canada Tire . Base on year 2020

Case Study Regarding Canada Tire . Base on year 2020

Accounting 1115

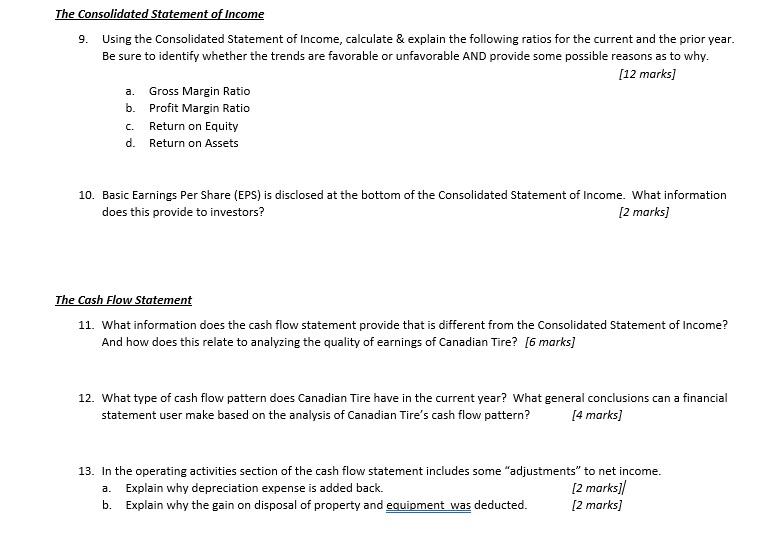

The Consolidated Statement of Income 9. Using the Consolidated Statement of Income, calculate & explain the following ratios for the current and the prior year. Be sure to identify whether the trends are favorable or unfavorable AND provide some possible reasons as to why. [12 marks] a. Gross Margin Ratio b. Profit Margin Ratio Return on Equity d. Return on Assets C. 10. Basic Earnings Per Share (EPS) is disclosed at the bottom of the Consolidated Statement of Income. What information does this provide to investors? [2 marks] The Cash Flow Statement 11. What information does the cash flow statement provide that is different from the consolidated Statement of Income? And how does this relate to analyzing the quality of earnings of Canadian Tire? [6 marks] 12. What type of cash flow pattern does Canadian Tire have in the current year? What general conclusions can a financial statement user make based on the analysis of Canadian Tire's cash flow pattern? [4 marks] 13. In the operating activities section of the cash flow statement includes some "adjustments" to net income. a. Explain why depreciation expense is added back. [2 marks]/ b. Explain why the gain on disposal of property and equipment was deducted. [2 marks] The Consolidated Statement of Income 9. Using the Consolidated Statement of Income, calculate & explain the following ratios for the current and the prior year. Be sure to identify whether the trends are favorable or unfavorable AND provide some possible reasons as to why. [12 marks] a. Gross Margin Ratio b. Profit Margin Ratio Return on Equity d. Return on Assets C. 10. Basic Earnings Per Share (EPS) is disclosed at the bottom of the Consolidated Statement of Income. What information does this provide to investors? [2 marks] The Cash Flow Statement 11. What information does the cash flow statement provide that is different from the consolidated Statement of Income? And how does this relate to analyzing the quality of earnings of Canadian Tire? [6 marks] 12. What type of cash flow pattern does Canadian Tire have in the current year? What general conclusions can a financial statement user make based on the analysis of Canadian Tire's cash flow pattern? [4 marks] 13. In the operating activities section of the cash flow statement includes some "adjustments" to net income. a. Explain why depreciation expense is added back. [2 marks]/ b. Explain why the gain on disposal of property and equipment was deducted. [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts