Question: Case Study: Sadaras Sukuk : A Road Map to Shariah Compliant Project Financing In The Kingdom Of Saudi Arabia. 1.Elaborate on the key elements for

Case Study: Sadaras Sukuk : A Road Map to Shariah Compliant Project Financing In The Kingdom Of Saudi Arabia.

1.Elaborate on the key elements for a successful Sukuk issuance. (300 words)

2.Discuss the drivers of Sukuk supply. (450 words)

3.Outline some of the steps that might help strengthen the Sukuk market. (300 words)

4.Develop a SWOT analysis of the SADARA Sukuk. (120 words)

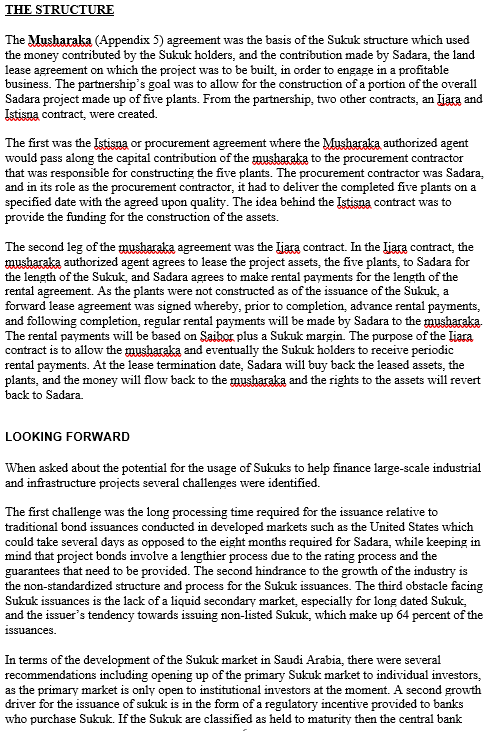

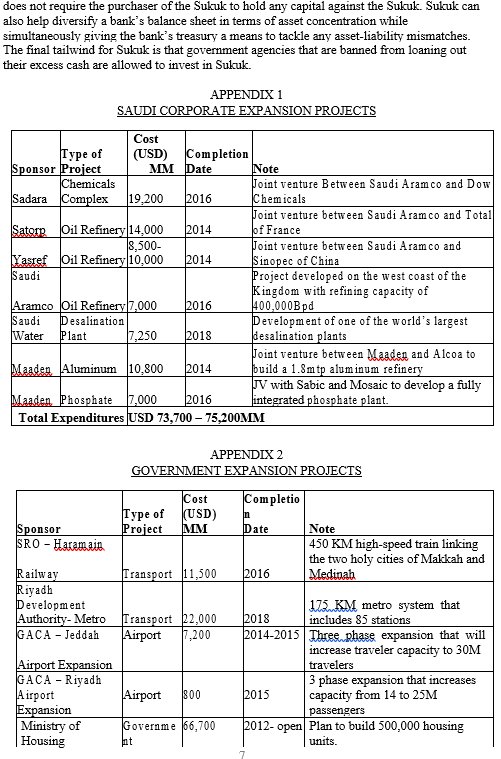

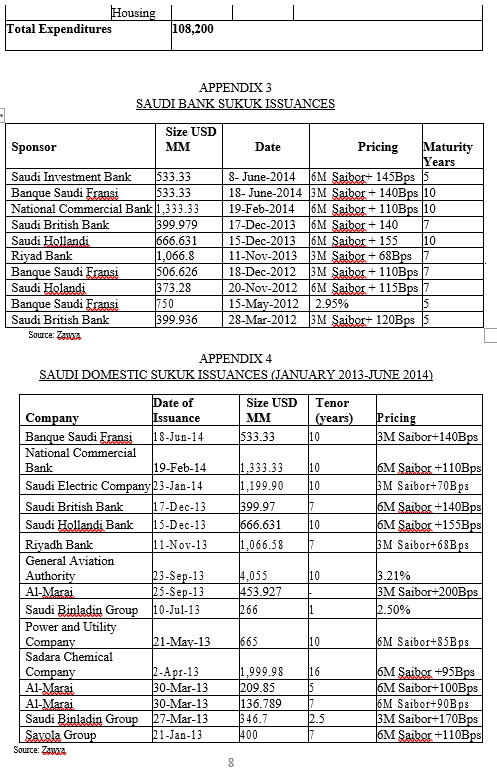

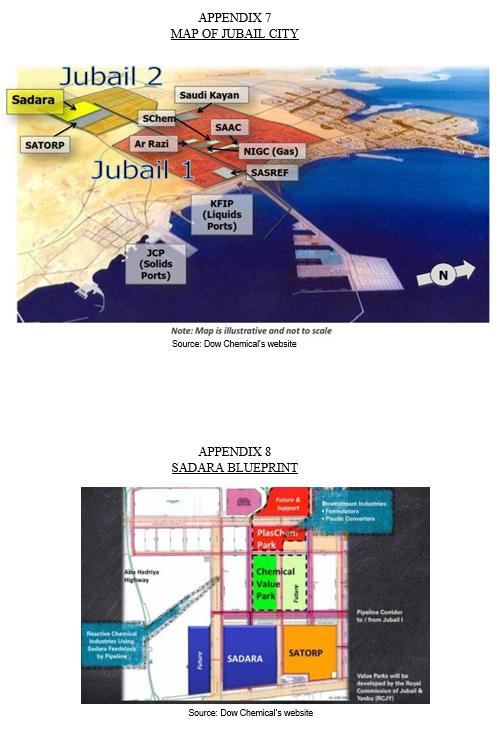

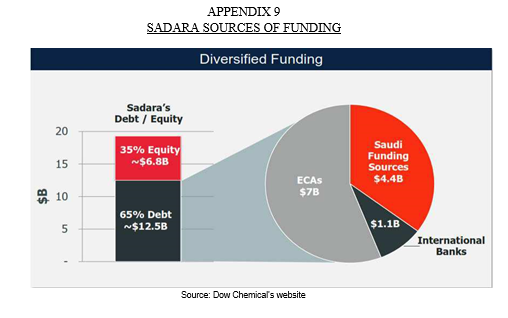

Case Study: Sadara's Sukuk: A Road Map to Shari'ah Compliant Project Financing In The Kingdom Of Saudi Arabia De Anca Ramos & Nawwab., 2018. INTRODUCTION It was April 3, 2013, and Sadara Chemical Company, a joint venture developed by Saudi Aramco and Dow Chemical in the Eastern Province of Saudi Arabia, was able to celebrate after an eight-month preparation period that involved the issuance of the second ever project finance Sukuk in Saudi Arabia. While the process was long, Sadara's issuance was considered successful by many standards including its tight pricing of Saiks: +95Bps, the oversubscription of the issuance by 2.6x, the upsizing of the issuance from SAR 5.25 billion to SAR 7.5 billion (USD 2 billion equivalent), and the long tenor of approximately 16 years. Most importantly, the issuance marked the first financial closing for the USD 20 billion petrochemical project, while the second close would involve an additional USD 10.5 billion (including significant components of SAR financing) in external financing. ISLAMIC FINANCE IN THE SAUDI ARABIAN CONTEXT Islamic finance refers to financial transactions that comply with Shari'ah, Islamic law, which is derived from the Quran, the holy book in Islam, and the Sunnah, the teaching of the prophet Muhammad (PBUH). The most common principles in Islamic finance are the bans on usury, or interest on loans, and Ghara or speculation. Interest in Islamic finance increased in the last 40 years with the establishment in 1975 of the first multilateral Islamic bank, The Islamic Development Bank based in Jeddah, Saudi Arabia, and the first ever fully Shari'ah compliant Islamic bank, Dubai Islamic Bank, in Dubai. Islamic banking rose in popularity in Saudi Arabia following the creation of Al-Rajhi Bank, currently the country's biggest bank by assets, in 1985 to be joined by three other full-fledged Islamic banks including Bank AlJazira. Al-Bilad Bank, and most recently Bank Al-Inma which was established in 2008. Islamic finance is divided into four categories: Islamic banks, Takaful, Shari'ah compliant asset management, and Sukuk. ISLAMIC BANKS The first and largest segment of Islamic finance in Saudi Arabia are the Islamic banks that as of 2013 have USD 237 billion in assets. Fully Shari'ah compliant banks make up four out of the twelve local banks operating in Saudi Arabia, with 57 percent of bank assets held at Islamic banks. Islamic banks in Saudi Arabia have achieved a compound annual growth rate of 22.3 percent relative to the 9 percent annual growth rate of conventional bank assets between 2009 and 2012. The market share of deposits held at Islamic banks has also increased from 15 to 22 percent from 2006 to 2011. Islamic banks face a conundrum as they are expanding at a rapid pace and accumulating assets, while at the same time they are forbidden from giving out interest-based loans or investing in non-Shari'ah compliant products such as conventional money-market instruments. Therefore, Islamic banks are thirsty for the development of Shari'ah compliant investment products that can help the banks achieve profits while simultaneously ensuring against an asset-liability mismatch. TAKAFUL MARKET The second segment of the Islamic finance market is the Takaful, or cooperative insurance market. Takaful differs from conventional insurance as it is a system that relies on cooperation during periods of disasters. Takaful is based on the pooling of risk, whereby periodic payments are made by a group of individuals, and when one individual or party is faced with a disaster, the Takaful vehicle makes payments towards the affected parties to help alleviate their situation during their time of need. Prior to 2003, there was no formal insurance sector in Saudi Arabia. In 2003, the Saudi Arabian Monetary Authority introduced a host of regulations under the "Law of Supervision of Cooperative Insurance Companies" which helped pave the way for the creation of a vibrant insurance industry. As of 2012, there are 35 licensed insurance companies. The insurance sector has benefited from government regulations such as the rules published in 2007 that mandate universal automobile insurance, and the introduction in May 2014 of mandatory health insurance to be provided by the private sector companies for all employees, including expats. Due to a combination of new regulations and the entrance of new insurance companies, the Takaful market has been growing at an annual rate of 20 percent. Annual premiums collected by Takaful companies have reached USD 6.5 billion by 2012; staggering growth considering the industry barely existed a decade ago. SHARI'AH COMPLIANT FUNDS/ ASSET MANAGEMENT The third leg of the Islamic finance industry is the Shari'ah compliant asset management industry. Shari'ah compliant funds must abide by strict Shari'ah requirements such as the ban on usury, speculation, and vice industries such as alcohol, gambling, and weapons manufacturing. The Shariah compliant fund industry in Saudi Arabia has USD 27.5 billion in assets under management. The industry has huge potential as there is increased demand for Shari'ah compliant investments coming from pension funds, government agencies, and the Islamic foundation, Waqf, that alone control roughly USD 257 billion. SUKUK Sukuk, or Sakk (singular for Sukuk), refers to an ownership interest in an underlying asset. While Sukuk have been referred to as "Islamic bonds," the correct reference is to compare Sukuk to trust certificates, where the owner of the Sakk has a vested interest in an investment vehicle. Sukuk are divided into two types of contracts, trade-based or profit and loss sharing contracts. The most common forms of trade-based contracts are liara. Salam, and Murabaha. The most important feature of trade-based Sukuk is that they permit the issuer to promise the repurchase of the Sukuks at par at maturity. As for the profit and loss sharing contracts, the most common are Musharaka and Mudharaba These contracts are partnership-based and therefore the promise to either guarantee capital or repurchase the Sukuk at par at maturity is forbidden. and Dow Chemical is the world's second-largest chemicals company based on revenues in 2014. Dow's contribution will mainly consist of technology and marketing expertise, while Saudi Aramco will provide their feedstock and expertise in planning and implementing megaprojects. Sadara's goal is to develop an integrated performance chemicals and plastics complex by 2016 with projected annual revenues exceeding USD 10 billion within the first 10 years of operation As of its conception date, the Sadara project will be the single largest petrochemical project ever built in a single phase with 26 world scale manufacturing units. The project will help strengthen the Saudi downstream sector, while simultaneously helping the Saudi economy diversify its industrial base and create more value-added products. The company will initially be owned 65 percent by Performance Chemicals Holding Company and 35 percent by Dow Saudi Arabia Holding B.V., until the planned IPO in which Performance Chemicals Holding Company's stake will decrease to 35 percent. The project, conceived in the midst of a global financial crisis, confronted the owners of the joint-venture with the tough task of balancing the dual goal of an optimal capital structure and simultaneously minimizing financing costs. Sadara's target capital structure includes 65 percent debt and 35 percent equity. To help achieve the USD 12.5 billion (equivalent) in debt (Appendix 9). Sadara engaged in two rounds of financing. The traditional sources of financing for similar projects usually included loans from export credit agencies, local and regional government agencies, and conventional and Islamic bank loans. As part of the first financing round, Sadara decided to tap into the Sukuk market in Saudi Arabia which had recently absorbed a large quantity of Sukuk issuances (Appendix 4). Therefore, it was decided that Sadara would include the Sukuk issuance in their first financing round. Sadara hoped that by launching the Sukuk prior to the second financial close, they would be able to take advantage of the liquidity in the Sukuk market and send a pricing signal to prospective lenders that might offer Sadara more competitive lending rates. STRUCTURING THE SUKUK To create the structure and manage the issuance, Sadara appointed an international bank, Deutsche Bank, and three local banks, Al-Inma. Riyadh Capital, and AlBilad, as joint lead managers and book runners. The offering was geared towards local institutional investors. The banks and Deutsche Bank in particular had previous experience in structuring and issuing project financing Sukuk in Saudi Arabia following their successful advisory role in the issuance of a 14-year SAR 3.75 billion project finance Sukuk for Satorr. a joint-venture between Saudi Aramco and Total, in early 2011. The structure would involve three major components: a Musharaka. Ljara, and Istisna agreements. As with any Sukuk issuance, there were several challenges involved in structuring the Sukuk. To complicate matters was the fact that Sadara was a greenfield project, where there were limited readily available assets to contribute to the Sukuk The second challenge was getting the structure approved by the Shari'ah boards that had to provide their Shari'ah- compliance seal of approval. The challenge was exacerbated by the fact that the Shari'ah advisory boards of potential investors had to certify the Sukuk as well. Therefore, it was critical to ensure that the structure was in complete compliance with Shari'ah standards in order to limit the risk of alienating possible investors and potentially increasing the financing cost for Sadara. The third and most critical challenge was the tight deadline to issue the Sukuk before the second round of financing was to close. THE STRUCTURE The Musharaka (Appendix 5) agreement was the basis of the Sukuk structure which used the money contributed by the Sukuk holders, and the contribution made by Sadara, the land lease agreement on which the project was to be built in order to engage in a profitable business. The partnership's goal was to allow for the construction of a portion of the overall Sadara project made up of five plants. From the partnership, two other contracts, an Ijara and Istisna contract, were created. The first was the Istisna or procurement agreement where the Musharaka authorized agent would pass along the capital contribution of the musharaka to the procurement contractor that was responsible for constructing the five plants. The procurement contractor was Sadara, and in its role as the procurement contractor, it had to deliver the completed five plants on a specified date with the agreed upon quality. The idea behind the Istisna contract was to provide the funding for the construction of the assets. The second leg of the musharaka agreement was the Ijara contract. In the Ijara contract, the musharaka authorized agent agrees to lease the project assets, the five plants, to Sadara for the length of the Sukuk, and Sadara agrees to make rental payments for the length of the rental agreement. As the plants were not constructed as of the issuance of the Sukuk, a forward lease agreement was signed whereby, prior to completion, advance rental payments, and following completion regular rental payments will be made by Sadara to the musharaka. The rental payments will be based on Saibor plus a Sukuk margin. The purpose of the Tiara contract is to allow the musharaka and eventually the Sukuk holders to receive periodic rental payments. At the lease termination date, Sadara will buy back the leased assets, the plants, and the money will flow back to the musharaka and the rights to the assets will revert back to Sadara. LOOKING FORWARD When asked about the potential for the usage of Sukuks to help finance large-scale industrial and infrastructure projects several challenges were identified. The first challenge was the long processing time required for the issuance relative to traditional bond issuances conducted in developed markets such as the United States which could take several days as opposed to the eight months required for Sadara, while keeping in mind that project bonds involve a lengthier process due to the rating process and the guarantees that need to be provided. The second hindrance to the growth of the industry is the non-standardized structure and process for the Sukuk issuances. The third obstacle facing Sukuk issuances is the lack of a liquid secondary market, especially for long dated Sukuk and the issuer's tendency towards issuing non-listed Sukuk, which make up 64 percent of the issuances. In terms of the development of the Sukuk market in Saudi Arabia, there were several recommendations including opening up of the primary Sukuk market to individual investors, as the primary market is only open to institutional investors at the moment. A second growth driver for the issuance of sukuk is in the form of a regulatory incentive provided to banks who purchase Sukuk. If the Sukuk are classified as held to maturity then the central bank does not require the purchaser of the Sukuk to hold any capital against the Sukuk. Sukuk can also help diversify a bank's balance sheet in terms of asset concentration while simultaneously giving the bank's treasury a means to tackle any asset-liability mismatches. The final tailwind for Sukuk is that government agencies that are banned from loaning out their excess cash are allowed to invest in Sukuk. APPENDIX 1 SAUDI CORPORATE EXPANSION PROJECTS Cost Type of (USD) Completion Sponsor Project MM Date Note Chemicals Joint venture Between Saudi Aramco and Dow Sadara Complex 19,200 2016 Chemicals Joint venture between Saudi Aramco and Total Satorr Oil Refinery 14,000 2014 of France 8,500- Joint venture between Saudi Aramco and Yasref Oil Refinery 10,000 2014 Sinopec of China Saudi Project developed on the west coast of the Kingdom with refining capacity of Aramco Oil Refinery/7,000 2016 400,000B pd Isaudi Desalination Development of one of the world's largest Water Plant 7,250 2018 desalination plants Joint venture between Maade and Alcoa to Maaden Aluminum 10,800 2014 build a 1.8mtp aluminum refinery TV with Sabic and Mosaic to develop a fully Maaden. Phosphate 7,000 2016 integrated phosphate plant. Total Expenditures USD 73,700 - 75,200MM APPENDIX 2 GOVERNMENT EXPANSION PROJECTS Type of Project Cost (USD) MM Sponsor SRO - Haramain Completio n Date Note 450 KM high-speed train linking the two holy cities of Makkah and 2016 Medinah Railway Transport 11,500 Riyadh Development Authority- Metro Transport $2,000 GACA - Jeddah Airport 7,200 175KM metro system that 2018 includes 85 stations 2014-2015 Three Phase expansion that will increase traveler capacity to 30M travelers 3 phase expansion that increases 2015 capacity from 14 to 25M passengers 2012- open Plan to build 500,000 housing units Airport Expansion GACA - Riyadh Airport Expansion Ministry of Housing Airport 800 Governme 66,700 nt Housing Total Expenditures 108,200 APPENDIX 3 SAUDI BANK SUKUK ISSUANCES Size USD Sponsor MM Date Pricing Maturity Years Saudi Investment Bank 533.33 8-June-2014 6M Saibor+ 145Bps Banque Saudi Fransi 533.33 18- June 2014 3M Saibor + 140Bps 10 National Commercial Bank 1,333.33 19-Feb-2014 6M Saibor + 110Bps 10 Saudi British Bank 399.979 17-Dec-2013 6M Saibor + 140 Saudi Hollandi 666.631 15-Dec-2013 6M Saibor + 155 10 Riyad Bank (1,066.8 11-Nov-2013 3M Saibor+68Bps 7 Banque Saudi Fransi 506.626 18-Dec-2012 |3M Saibor + 110Bps Saudi Holandi 373.28 20-Nov-2012 6M Saibor + 115Bps Banque Saudi Fransi 750 15-May-2012 2.95% 5 Saudi British Bank 399.936 28-Mar-2012 3M Saibor+ 120Bps 5 Source: Zamora APPENDIX 4 SAUDI DOMESTIC SUKUK ISSUANCES (JANUARY 2013-JUNE 2014) Size USD MM 533.33 Tenor (years) |10 Pricing 3M Saibor+140Bps 10 10 11.333.33 1,199.90 399.97 1666.631 1,066.58 7 10 6M Saibor +110Bps 3M Saibor+70Bps 6M Saibor +140Bps 6M Saibor +155Bps BM Saibor+68Bps Date of Company Issuance Banque Saudi Fransi 18-Jun-14 National Commercial Bank 19-Feb-14 Saudi Electric Company 23-Jan-14 Saudi British Bank 17-Dec-13 Saudi Hollandi Bank 15-Dec-13 Riyadh Bank 11-Nov-13 General Aviation Authority 23-Sep-13 Al-Marai 25-Sep-13 Saudi Binladin Group 10-Jul-13 Power and Utility Company 21-May-13 Sadara Chemical Company 2-Apr-13 Al-Marai 30-Mar-13 A1-Marai 30-Mar-13 Saudi Binladin Group 27-Mar-13 Saygla Group 21-Jan-13 Source: Zawara 10 14.035 453.927 266 3.21% 3M Saibor+200Bps 2.50% 11 1665 110 6M Saibor+85Bps 16 1,999.98 209.85 136.789 346.7 400 6M Saibor +95Bps 6M Saibor+100Bps 6M Saibor+90BPS 3M Saibor+170Bps 6M Saibor +110Bps 2.5 8 APPENDIX 5 SUKUK STRUCTURE Structure Diagram: SADARA Managing Partner and Partner Issuer Security Declaration of Agency Certo proceeds convited by the Chrbtion Mushara Agreement CERERE Periodic tribution And Dribution Amounts, Eary Dibution Amoures, Teinion Distribution Amounty Adorady Pay Around and Action Termin on Amour on each case as cable Completion Guarantees Completion Guarantors Agreement Forward Lease Agreement Payment and Rental Payment Drwyd Dubey Compton SADARA (as Less SADARA Procurement Contractor Sumer Tests Shorts noun guidated damage Puma Sumps any Additional Precio Source: Company documents APPENDIX 6 MAP OF SAUDI ARABIA Med 400 LEBANOND SYRIA 0 200 400 km 0 200 Sea IRAQ JORDAN IRAN Jabk KWAIN Duba Ra's al Khalil Persian Al Jubay BAHRAIN Buraydah. Ad Dammam Gull EGYPT Medina Yanbu RIYADH Babr Rabigh U.A.E. Jiddah 'Mecca Red SUDAN Sea OMAN no defined Jiza boundary ERITREA YEMEN Arabian Sewa Al Huto CATAR http://fmso.leavenworth army.mil/documents/saudi/saudi.htm APPENDIX 7 MAP OF JUBAIL CITY Jubail 2 Sadara Saudi Kayan schem SAAC SATORP Ar Razi NIGC (Gas) Jubail 1 SASREF KFIP (Liquids Ports) JCP (Solids Ports) N Note: Map is illustrative and not to scale Source: Dow Chemical's website APPENDIX 8 SADARA BLUEPRINT Bewam industries .folators Plastic Converters Plaschen Park Abu Hadirly Chemical Value Park Pipeline Condor to/from Abell Reactive Chemie Industries Using Sadar Foedelik SATORP Future SADARA Value Paris will be developed by the Royal Commission of Jubail & Yantum Source: Dow Chemical's website APPENDIX 9 SADARA SOURCES OF FUNDING Diversified Funding Sadara's Debt / Equity 20 35% Equity *$6.8B 15 Saudi Funding Sources $4.4B ECAS $7B 10 5 65% Debt $12.5B $1.1B International Banks Source: Dow Chemical's website Case Study: Sadara's Sukuk: A Road Map to Shari'ah Compliant Project Financing In The Kingdom Of Saudi Arabia De Anca Ramos & Nawwab., 2018. INTRODUCTION It was April 3, 2013, and Sadara Chemical Company, a joint venture developed by Saudi Aramco and Dow Chemical in the Eastern Province of Saudi Arabia, was able to celebrate after an eight-month preparation period that involved the issuance of the second ever project finance Sukuk in Saudi Arabia. While the process was long, Sadara's issuance was considered successful by many standards including its tight pricing of Saiks: +95Bps, the oversubscription of the issuance by 2.6x, the upsizing of the issuance from SAR 5.25 billion to SAR 7.5 billion (USD 2 billion equivalent), and the long tenor of approximately 16 years. Most importantly, the issuance marked the first financial closing for the USD 20 billion petrochemical project, while the second close would involve an additional USD 10.5 billion (including significant components of SAR financing) in external financing. ISLAMIC FINANCE IN THE SAUDI ARABIAN CONTEXT Islamic finance refers to financial transactions that comply with Shari'ah, Islamic law, which is derived from the Quran, the holy book in Islam, and the Sunnah, the teaching of the prophet Muhammad (PBUH). The most common principles in Islamic finance are the bans on usury, or interest on loans, and Ghara or speculation. Interest in Islamic finance increased in the last 40 years with the establishment in 1975 of the first multilateral Islamic bank, The Islamic Development Bank based in Jeddah, Saudi Arabia, and the first ever fully Shari'ah compliant Islamic bank, Dubai Islamic Bank, in Dubai. Islamic banking rose in popularity in Saudi Arabia following the creation of Al-Rajhi Bank, currently the country's biggest bank by assets, in 1985 to be joined by three other full-fledged Islamic banks including Bank AlJazira. Al-Bilad Bank, and most recently Bank Al-Inma which was established in 2008. Islamic finance is divided into four categories: Islamic banks, Takaful, Shari'ah compliant asset management, and Sukuk. ISLAMIC BANKS The first and largest segment of Islamic finance in Saudi Arabia are the Islamic banks that as of 2013 have USD 237 billion in assets. Fully Shari'ah compliant banks make up four out of the twelve local banks operating in Saudi Arabia, with 57 percent of bank assets held at Islamic banks. Islamic banks in Saudi Arabia have achieved a compound annual growth rate of 22.3 percent relative to the 9 percent annual growth rate of conventional bank assets between 2009 and 2012. The market share of deposits held at Islamic banks has also increased from 15 to 22 percent from 2006 to 2011. Islamic banks face a conundrum as they are expanding at a rapid pace and accumulating assets, while at the same time they are forbidden from giving out interest-based loans or investing in non-Shari'ah compliant products such as conventional money-market instruments. Therefore, Islamic banks are thirsty for the development of Shari'ah compliant investment products that can help the banks achieve profits while simultaneously ensuring against an asset-liability mismatch. TAKAFUL MARKET The second segment of the Islamic finance market is the Takaful, or cooperative insurance market. Takaful differs from conventional insurance as it is a system that relies on cooperation during periods of disasters. Takaful is based on the pooling of risk, whereby periodic payments are made by a group of individuals, and when one individual or party is faced with a disaster, the Takaful vehicle makes payments towards the affected parties to help alleviate their situation during their time of need. Prior to 2003, there was no formal insurance sector in Saudi Arabia. In 2003, the Saudi Arabian Monetary Authority introduced a host of regulations under the "Law of Supervision of Cooperative Insurance Companies" which helped pave the way for the creation of a vibrant insurance industry. As of 2012, there are 35 licensed insurance companies. The insurance sector has benefited from government regulations such as the rules published in 2007 that mandate universal automobile insurance, and the introduction in May 2014 of mandatory health insurance to be provided by the private sector companies for all employees, including expats. Due to a combination of new regulations and the entrance of new insurance companies, the Takaful market has been growing at an annual rate of 20 percent. Annual premiums collected by Takaful companies have reached USD 6.5 billion by 2012; staggering growth considering the industry barely existed a decade ago. SHARI'AH COMPLIANT FUNDS/ ASSET MANAGEMENT The third leg of the Islamic finance industry is the Shari'ah compliant asset management industry. Shari'ah compliant funds must abide by strict Shari'ah requirements such as the ban on usury, speculation, and vice industries such as alcohol, gambling, and weapons manufacturing. The Shariah compliant fund industry in Saudi Arabia has USD 27.5 billion in assets under management. The industry has huge potential as there is increased demand for Shari'ah compliant investments coming from pension funds, government agencies, and the Islamic foundation, Waqf, that alone control roughly USD 257 billion. SUKUK Sukuk, or Sakk (singular for Sukuk), refers to an ownership interest in an underlying asset. While Sukuk have been referred to as "Islamic bonds," the correct reference is to compare Sukuk to trust certificates, where the owner of the Sakk has a vested interest in an investment vehicle. Sukuk are divided into two types of contracts, trade-based or profit and loss sharing contracts. The most common forms of trade-based contracts are liara. Salam, and Murabaha. The most important feature of trade-based Sukuk is that they permit the issuer to promise the repurchase of the Sukuks at par at maturity. As for the profit and loss sharing contracts, the most common are Musharaka and Mudharaba These contracts are partnership-based and therefore the promise to either guarantee capital or repurchase the Sukuk at par at maturity is forbidden. and Dow Chemical is the world's second-largest chemicals company based on revenues in 2014. Dow's contribution will mainly consist of technology and marketing expertise, while Saudi Aramco will provide their feedstock and expertise in planning and implementing megaprojects. Sadara's goal is to develop an integrated performance chemicals and plastics complex by 2016 with projected annual revenues exceeding USD 10 billion within the first 10 years of operation As of its conception date, the Sadara project will be the single largest petrochemical project ever built in a single phase with 26 world scale manufacturing units. The project will help strengthen the Saudi downstream sector, while simultaneously helping the Saudi economy diversify its industrial base and create more value-added products. The company will initially be owned 65 percent by Performance Chemicals Holding Company and 35 percent by Dow Saudi Arabia Holding B.V., until the planned IPO in which Performance Chemicals Holding Company's stake will decrease to 35 percent. The project, conceived in the midst of a global financial crisis, confronted the owners of the joint-venture with the tough task of balancing the dual goal of an optimal capital structure and simultaneously minimizing financing costs. Sadara's target capital structure includes 65 percent debt and 35 percent equity. To help achieve the USD 12.5 billion (equivalent) in debt (Appendix 9). Sadara engaged in two rounds of financing. The traditional sources of financing for similar projects usually included loans from export credit agencies, local and regional government agencies, and conventional and Islamic bank loans. As part of the first financing round, Sadara decided to tap into the Sukuk market in Saudi Arabia which had recently absorbed a large quantity of Sukuk issuances (Appendix 4). Therefore, it was decided that Sadara would include the Sukuk issuance in their first financing round. Sadara hoped that by launching the Sukuk prior to the second financial close, they would be able to take advantage of the liquidity in the Sukuk market and send a pricing signal to prospective lenders that might offer Sadara more competitive lending rates. STRUCTURING THE SUKUK To create the structure and manage the issuance, Sadara appointed an international bank, Deutsche Bank, and three local banks, Al-Inma. Riyadh Capital, and AlBilad, as joint lead managers and book runners. The offering was geared towards local institutional investors. The banks and Deutsche Bank in particular had previous experience in structuring and issuing project financing Sukuk in Saudi Arabia following their successful advisory role in the issuance of a 14-year SAR 3.75 billion project finance Sukuk for Satorr. a joint-venture between Saudi Aramco and Total, in early 2011. The structure would involve three major components: a Musharaka. Ljara, and Istisna agreements. As with any Sukuk issuance, there were several challenges involved in structuring the Sukuk. To complicate matters was the fact that Sadara was a greenfield project, where there were limited readily available assets to contribute to the Sukuk The second challenge was getting the structure approved by the Shari'ah boards that had to provide their Shari'ah- compliance seal of approval. The challenge was exacerbated by the fact that the Shari'ah advisory boards of potential investors had to certify the Sukuk as well. Therefore, it was critical to ensure that the structure was in complete compliance with Shari'ah standards in order to limit the risk of alienating possible investors and potentially increasing the financing cost for Sadara. The third and most critical challenge was the tight deadline to issue the Sukuk before the second round of financing was to close. THE STRUCTURE The Musharaka (Appendix 5) agreement was the basis of the Sukuk structure which used the money contributed by the Sukuk holders, and the contribution made by Sadara, the land lease agreement on which the project was to be built in order to engage in a profitable business. The partnership's goal was to allow for the construction of a portion of the overall Sadara project made up of five plants. From the partnership, two other contracts, an Ijara and Istisna contract, were created. The first was the Istisna or procurement agreement where the Musharaka authorized agent would pass along the capital contribution of the musharaka to the procurement contractor that was responsible for constructing the five plants. The procurement contractor was Sadara, and in its role as the procurement contractor, it had to deliver the completed five plants on a specified date with the agreed upon quality. The idea behind the Istisna contract was to provide the funding for the construction of the assets. The second leg of the musharaka agreement was the Ijara contract. In the Ijara contract, the musharaka authorized agent agrees to lease the project assets, the five plants, to Sadara for the length of the Sukuk, and Sadara agrees to make rental payments for the length of the rental agreement. As the plants were not constructed as of the issuance of the Sukuk, a forward lease agreement was signed whereby, prior to completion, advance rental payments, and following completion regular rental payments will be made by Sadara to the musharaka. The rental payments will be based on Saibor plus a Sukuk margin. The purpose of the Tiara contract is to allow the musharaka and eventually the Sukuk holders to receive periodic rental payments. At the lease termination date, Sadara will buy back the leased assets, the plants, and the money will flow back to the musharaka and the rights to the assets will revert back to Sadara. LOOKING FORWARD When asked about the potential for the usage of Sukuks to help finance large-scale industrial and infrastructure projects several challenges were identified. The first challenge was the long processing time required for the issuance relative to traditional bond issuances conducted in developed markets such as the United States which could take several days as opposed to the eight months required for Sadara, while keeping in mind that project bonds involve a lengthier process due to the rating process and the guarantees that need to be provided. The second hindrance to the growth of the industry is the non-standardized structure and process for the Sukuk issuances. The third obstacle facing Sukuk issuances is the lack of a liquid secondary market, especially for long dated Sukuk and the issuer's tendency towards issuing non-listed Sukuk, which make up 64 percent of the issuances. In terms of the development of the Sukuk market in Saudi Arabia, there were several recommendations including opening up of the primary Sukuk market to individual investors, as the primary market is only open to institutional investors at the moment. A second growth driver for the issuance of sukuk is in the form of a regulatory incentive provided to banks who purchase Sukuk. If the Sukuk are classified as held to maturity then the central bank does not require the purchaser of the Sukuk to hold any capital against the Sukuk. Sukuk can also help diversify a bank's balance sheet in terms of asset concentration while simultaneously giving the bank's treasury a means to tackle any asset-liability mismatches. The final tailwind for Sukuk is that government agencies that are banned from loaning out their excess cash are allowed to invest in Sukuk. APPENDIX 1 SAUDI CORPORATE EXPANSION PROJECTS Cost Type of (USD) Completion Sponsor Project MM Date Note Chemicals Joint venture Between Saudi Aramco and Dow Sadara Complex 19,200 2016 Chemicals Joint venture between Saudi Aramco and Total Satorr Oil Refinery 14,000 2014 of France 8,500- Joint venture between Saudi Aramco and Yasref Oil Refinery 10,000 2014 Sinopec of China Saudi Project developed on the west coast of the Kingdom with refining capacity of Aramco Oil Refinery/7,000 2016 400,000B pd Isaudi Desalination Development of one of the world's largest Water Plant 7,250 2018 desalination plants Joint venture between Maade and Alcoa to Maaden Aluminum 10,800 2014 build a 1.8mtp aluminum refinery TV with Sabic and Mosaic to develop a fully Maaden. Phosphate 7,000 2016 integrated phosphate plant. Total Expenditures USD 73,700 - 75,200MM APPENDIX 2 GOVERNMENT EXPANSION PROJECTS Type of Project Cost (USD) MM Sponsor SRO - Haramain Completio n Date Note 450 KM high-speed train linking the two holy cities of Makkah and 2016 Medinah Railway Transport 11,500 Riyadh Development Authority- Metro Transport $2,000 GACA - Jeddah Airport 7,200 175KM metro system that 2018 includes 85 stations 2014-2015 Three Phase expansion that will increase traveler capacity to 30M travelers 3 phase expansion that increases 2015 capacity from 14 to 25M passengers 2012- open Plan to build 500,000 housing units Airport Expansion GACA - Riyadh Airport Expansion Ministry of Housing Airport 800 Governme 66,700 nt Housing Total Expenditures 108,200 APPENDIX 3 SAUDI BANK SUKUK ISSUANCES Size USD Sponsor MM Date Pricing Maturity Years Saudi Investment Bank 533.33 8-June-2014 6M Saibor+ 145Bps Banque Saudi Fransi 533.33 18- June 2014 3M Saibor + 140Bps 10 National Commercial Bank 1,333.33 19-Feb-2014 6M Saibor + 110Bps 10 Saudi British Bank 399.979 17-Dec-2013 6M Saibor + 140 Saudi Hollandi 666.631 15-Dec-2013 6M Saibor + 155 10 Riyad Bank (1,066.8 11-Nov-2013 3M Saibor+68Bps 7 Banque Saudi Fransi 506.626 18-Dec-2012 |3M Saibor + 110Bps Saudi Holandi 373.28 20-Nov-2012 6M Saibor + 115Bps Banque Saudi Fransi 750 15-May-2012 2.95% 5 Saudi British Bank 399.936 28-Mar-2012 3M Saibor+ 120Bps 5 Source: Zamora APPENDIX 4 SAUDI DOMESTIC SUKUK ISSUANCES (JANUARY 2013-JUNE 2014) Size USD MM 533.33 Tenor (years) |10 Pricing 3M Saibor+140Bps 10 10 11.333.33 1,199.90 399.97 1666.631 1,066.58 7 10 6M Saibor +110Bps 3M Saibor+70Bps 6M Saibor +140Bps 6M Saibor +155Bps BM Saibor+68Bps Date of Company Issuance Banque Saudi Fransi 18-Jun-14 National Commercial Bank 19-Feb-14 Saudi Electric Company 23-Jan-14 Saudi British Bank 17-Dec-13 Saudi Hollandi Bank 15-Dec-13 Riyadh Bank 11-Nov-13 General Aviation Authority 23-Sep-13 Al-Marai 25-Sep-13 Saudi Binladin Group 10-Jul-13 Power and Utility Company 21-May-13 Sadara Chemical Company 2-Apr-13 Al-Marai 30-Mar-13 A1-Marai 30-Mar-13 Saudi Binladin Group 27-Mar-13 Saygla Group 21-Jan-13 Source: Zawara 10 14.035 453.927 266 3.21% 3M Saibor+200Bps 2.50% 11 1665 110 6M Saibor+85Bps 16 1,999.98 209.85 136.789 346.7 400 6M Saibor +95Bps 6M Saibor+100Bps 6M Saibor+90BPS 3M Saibor+170Bps 6M Saibor +110Bps 2.5 8 APPENDIX 5 SUKUK STRUCTURE Structure Diagram: SADARA Managing Partner and Partner Issuer Security Declaration of Agency Certo proceeds convited by the Chrbtion Mushara Agreement CERERE Periodic tribution And Dribution Amounts, Eary Dibution Amoures, Teinion Distribution Amounty Adorady Pay Around and Action Termin on Amour on each case as cable Completion Guarantees Completion Guarantors Agreement Forward Lease Agreement Payment and Rental Payment Drwyd Dubey Compton SADARA (as Less SADARA Procurement Contractor Sumer Tests Shorts noun guidated damage Puma Sumps any Additional Precio Source: Company documents APPENDIX 6 MAP OF SAUDI ARABIA Med 400 LEBANOND SYRIA 0 200 400 km 0 200 Sea IRAQ JORDAN IRAN Jabk KWAIN Duba Ra's al Khalil Persian Al Jubay BAHRAIN Buraydah. Ad Dammam Gull EGYPT Medina Yanbu RIYADH Babr Rabigh U.A.E. Jiddah 'Mecca Red SUDAN Sea OMAN no defined Jiza boundary ERITREA YEMEN Arabian Sewa Al Huto CATAR http://fmso.leavenworth army.mil/documents/saudi/saudi.htm APPENDIX 7 MAP OF JUBAIL CITY Jubail 2 Sadara Saudi Kayan schem SAAC SATORP Ar Razi NIGC (Gas) Jubail 1 SASREF KFIP (Liquids Ports) JCP (Solids Ports) N Note: Map is illustrative and not to scale Source: Dow Chemical's website APPENDIX 8 SADARA BLUEPRINT Bewam industries .folators Plastic Converters Plaschen Park Abu Hadirly Chemical Value Park Pipeline Condor to/from Abell Reactive Chemie Industries Using Sadar Foedelik SATORP Future SADARA Value Paris will be developed by the Royal Commission of Jubail & Yantum Source: Dow Chemical's website APPENDIX 9 SADARA SOURCES OF FUNDING Diversified Funding Sadara's Debt / Equity 20 35% Equity *$6.8B 15 Saudi Funding Sources $4.4B ECAS $7B 10 5 65% Debt $12.5B $1.1B International Banks Source: Dow Chemical's website

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts