Question: CASE STUDY SCENARIO You are provided with the pre - adjustment trial balance of XYZ Limited is presented as follows: Additional information: A customer returned

CASE STUDY SCENARIO

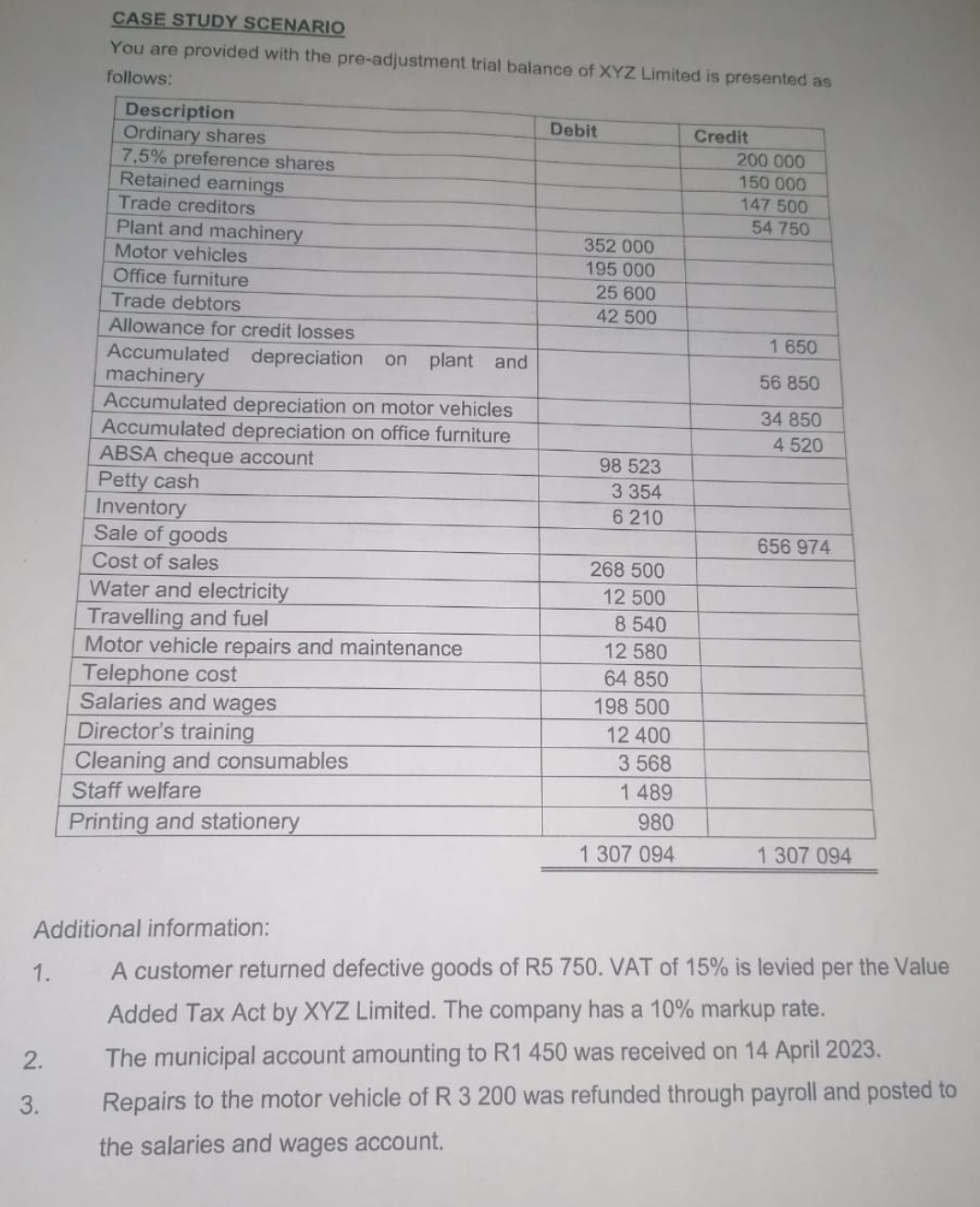

You are provided with the preadjustment trial balance of XYZ Limited is presented as

follows:

Additional information:

A customer returned defective goods of R VAT of is levied per the Value

Added Tax Act by XYZ Limited. The company has a markup rate.

The municipal account amounting to R was received on April

Repairs to the motor vehicle of was refunded through payroll and posted to

the salaries and wages account.XYZ Trading adopted the periodic inventory system to account for the consumables.

Consumables purchased during March of R was posted to the cost of

sales account by the bookkeeper. The stock count concluded on March

valued the consumable inventory on R

Ordinary shares trades at R each. At reporting date, the shareholders declared a

dividend of c A prospectus offering R ordinary shares and R

preference shares was advertised during March Mrs Flinch entered into an

underwriter's agreement with XYZ Limited for an agreed fee.

The allowance for credit losses should equal of the debtor's book at reporting

date.

Use the information provided and:

Prepare general journal entries to record the additional information as at March

Prepare:

Trial Balance

The Statement of Financial Position as at March based on the reporting

requirements of the International Financial Reporting Standards.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock