Question: Case study Target Corporation, the second largest retailing company in the United States, is known for its value to customers, continuous innovation and exceptional guest

Case study

Target Corporation, the second largest retailing company in the United States, is known for its value to customers, continuous innovation and exceptional guest experience. With its thirsty for international expansion, Target announced its Foreign Direct Investment (FDI) to Canada in 2011 (Megits & Schuster, 2015). Two years down the line, the attempted entry into Canadian market resulted in a loss of more than $ 5.4 billion. This necessitated the managers to revisit their decisions and make hard decisions of exiting the Canadian market. It could be noted that, Target Canada rushed into its expansion with over 124 store openings by 2013 in Canadian foreign market failing to replicate the successful United States concept in Canada for several reasons. First is wrong concepts of market entry. With the announcement market entry into Canada foreign market, Target Corporation determined to water down its competitors through buying the 220 leases of Zeller-a discount chain from Hudsons Bay thinking it will launch its entry with a bigger footprint, Target failed to determine that it was a declining chain that was struggling to survive which later on died and is now defunct. This was a big blow for Targets dream of expanding in Canada. Lack of understanding the Canadian market is another factor. International presence had been the dream for Target for long, and growth through the physical stores instead of e-commerce seemed to be Targets preference. Canada in specific was appealing due to its geographical proximity and mostly English-speaking and with little economic swings than the United States (Megits & Schuster, 2015). From experts view, Target may not have fully understood was the Canadian discount sector market. This market is ideally a tough market which is fairly saturated by competitors such as Walmart unlike the luxury segment with few competitors. This also led to its failure.

Target Corporation also faced supply-chain difficulties. The store locations were usually out of the way and not at par with Targets U.S outlook. The new stores struggled with distribution challenges and shelf replenishment leading to periodic stock-outs. More especially for Canadians familiar with Target the poorly stocked shelves, a feature that was different from the U.S stores and often higher prices than in the US all combined to discourage the potential and loyal customers making it difficult to win their trust in the brand. With these first impressions in Canadian market, customers were disappointed and it was hard to win their trust back despite mitigations that might have been taken. Failure to assess the projects complexity so as to develop a comprehensive project plan was yet another factor that led to project failure. With the high dollar-investment at stake, Target should have borrowed a French leaf from the success stories by other corporations in Canada like the J.Crew that well understood that it should differentiate its services through merchandise and customer experience and roll out stores progressively it would have saved its fortune in Canada (Mun & Yazdanifard, 2012). It can be easily summed up that Targets failure in Canada was due to culture and management issues. It could have been better for Target to take time and effort in understanding and appreciating the Canadian culture prior to opening Foreign Direct Investment instead of copy pasting US concept in Canada. Understanding customers, their needs, their wants and preferred means of doing business both personally and operationally and learning to adapt the business strategy and processes to the new culture can go a long way in assuaging any failures. Also management should consider each project as different and thus treat it with its own complexities in coming up with a comprehensive success blueprint without eating much into resources. Had Target have done that, it would be having a success story.

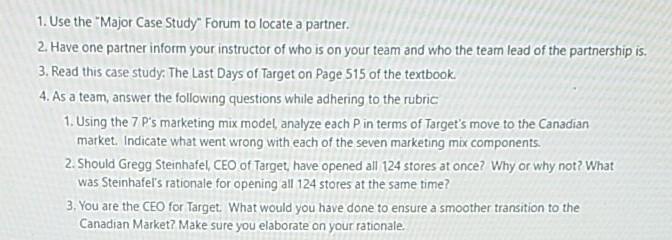

1. Use the "Major Case Study Forum to locate a partner. 2. Have one partner inform your instructor of who is on your team and who the team lead of the partnership is. 3. Read this case study. The Last Days of Target on Page 515 of the textbook. 4. As a team, answer the following questions while adhering to the rubric 1. Using the 7 P's marketing mix model, analyze each Pin terms of Target's move to the Canadian market. Indicate what went wrong with each of the seven marketing mix components. 2. Should Gregg Steinhafel, CEO of Target, have opened all 124 stores at once? Why or why not? What was Steinhafel's rationale for opening all 124 stores at the same time? 3. You are the CEO for Target. What would you have done to ensure a smoother transition to the Canadian Market? Make sure you elaborate on your rationale. 1. Use the "Major Case Study Forum to locate a partner. 2. Have one partner inform your instructor of who is on your team and who the team lead of the partnership is. 3. Read this case study. The Last Days of Target on Page 515 of the textbook. 4. As a team, answer the following questions while adhering to the rubric 1. Using the 7 P's marketing mix model, analyze each Pin terms of Target's move to the Canadian market. Indicate what went wrong with each of the seven marketing mix components. 2. Should Gregg Steinhafel, CEO of Target, have opened all 124 stores at once? Why or why not? What was Steinhafel's rationale for opening all 124 stores at the same time? 3. You are the CEO for Target. What would you have done to ensure a smoother transition to the Canadian Market? Make sure you elaborate on your rationale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts