Question: CASE STUDY Tesco: from domestic operator to multinational giant Michelle Lowe and Neil Wrigley This case considers the emergence of Tesco plc as ane of

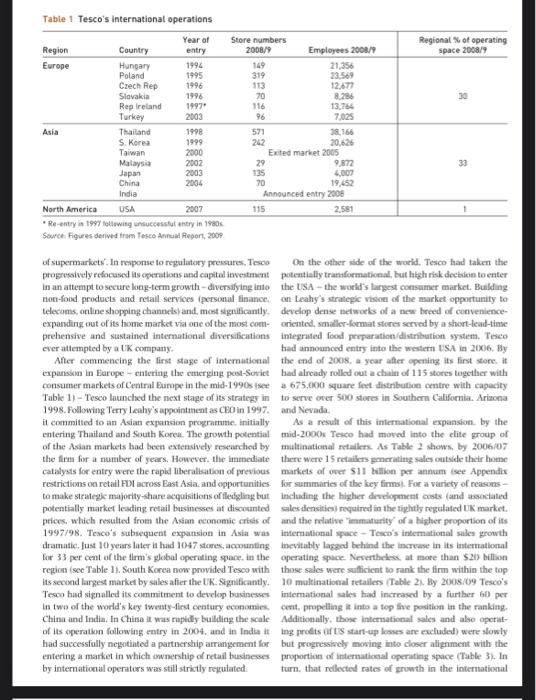

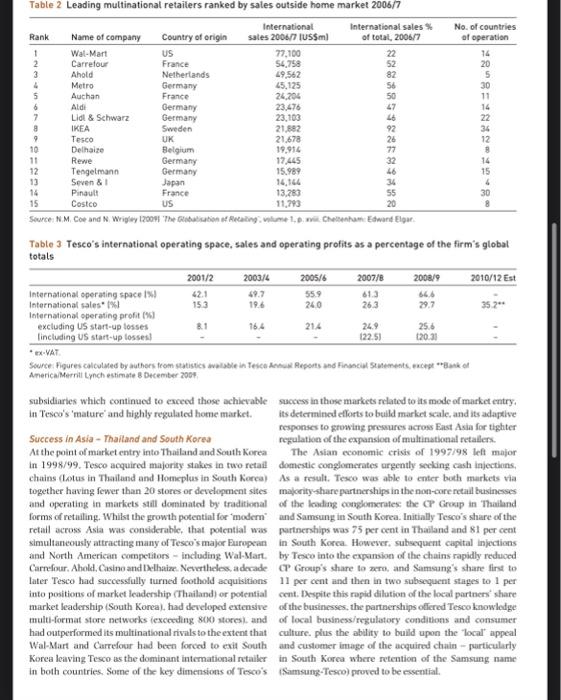

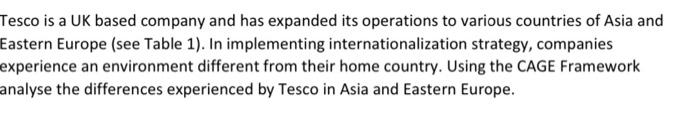

CASE STUDY Tesco: from domestic operator to multinational giant Michelle Lowe and Neil Wrigley This case considers the emergence of Tesco plc as ane of the world 's leading muttinational retailers. In a remarkable 10-year period, Tesco has transformed itself from a purely domestic operator to a multinational giant - with subsidiaries in Europe, Asia and North America - and in 2009 had 64 per cent of its operating space outside the UK. Examining market entry into Asia in more detail, the case compares 'success' in Thailand and South Korea with 'failure' in Taiwan. It atso considers 'a high risk gamble' in Tesco's entry into the US market, long considered to be a graveyard of overambitious expansion by UK retailers. Introduction terms of sales density. tumover growth In April 2009. Tesco. the UK's largest and profitability. Over the next decade it retailer and private sector employer of managed a remaricable transormation Labour. announced annual sales for repositioning itself from its discount roots 2008/09 of allmost C60 billikn ( 66bn or into a mass market customer-focused \$90, 2bn) together with protits of C3 billiks retaller serving all segments of the VK (/3.3bn of $4.5bn). After a dramatic market. By judicious acquisition of some decade-long transiormation from purely smaller rivals. and by innovative and domestic operator to multinational giant, flexible store development programmes Tesco now had a remarkable 64 per which by the mid-2000s had traniformed ceat of its operating space outside the UK. it into a genuine multi-format operator Was developing increasingly strong businesses across 11 with 72 per cent of its [K stores in smaller convenience/ Asian and European markets, had a rapidly expanding supermarket formats of less than 15,000 square feet, it first 'sart-up' subsidiary operating in the western USA, and had captured market leadership in the UK then progressively announced its entry into the Lndian market. Moreover, accelerated its lead over closest rivals Sainsbury's ind Astal as signalled in both the tate of its Annual Report (Value. Wal-Mart. By 2007, on a conservative definition of the DK Travebi) and the prominenee given in that report to its grocery market, its share was 27.6 per cent-almost twice international proflle. the firm was publicly expressing its as large as Asda/Wal-Mart and Sainsbury's with 14.1 per confidence that it had mastered the art of international cent and 13.8 per cent respectively. Simultaneously. as expansion. so long a weakness of LK retailing. Tesco's. that gap first emerged in the late 1990 and then widened. emergence as the world's third largest retailer, operating Tesco, as the increasingly dominant market leader, faced 2025 stores und employing 183,600 stalf outside the UK growing regulatory pressure relating to both marketby 2008/09, represents one of the most successful examples competition conditions and land-use planning restrictions. of strategic diversification by any UK company and offers It also experienced increasingly adverse media scrutiny insight into the role of the 'corporate strategist', the CEO. And orchestrated campaigns to 'rein in' its visibly growing power, In response to the latier it moved quickly to embrace International expansion - from the UK to agendas of community responsiveness, urban regeneratiot. Centrat Europe, Asia and North America sustainable development, and ethical/responsible souncing to address what the UK Covernment's Department for In the early 1990 s Tesco was the UK's second largest food Fnvironment, Food and Rural Afialrs described as 'rising retailer, lagging behind the market leader Sainsbury's in consumer expectations regarding the social responsibilities This case was prepared by Michelle Lowe, Professor of Retail Management. University of Survey and Lead innovation Fellew AlM and Neil Wrigley, Professor of Geography, University of Southampton and Editor of Journal of Ecanpmic Geography. It is intended as a basis for class discussion and not as an illustration of good or bad practice. O Michelle Lowe and Neil Wrigley. Not to be reproduced ar quoted without permission. Table 1 Tesco's internationat operations Source: Figuees derived tram Tesco Anruad Repert, 200%. of supermarkets. In response to regulatory pressures. Tesco On the oftser side of the world. Tesco had taken the progressively refocused is operations and capital inventment potentially tramiformational, but high risk dectoion to enter in an attempt to secure long-term growth-diversifying into. the USA - the woth's largest consumer market. Building notr-food products and retail services ipersonul finance, on Lealhy's strategic vision of the market opportunity to telecoms, onlineshopping channels) and, mont skgnificantly. develop dense netwoels of a new breed of convenienceexpanding out of its home market via one of the most coem- oriented, smaller-format stores scrved by a short-lead-time prehensive and sustained international diversifications integrated food proparation/distributhon system. Theo ever attempted by a LK company. had announced entry into the western US.A in 2006 . By After commencing the first stage of internutional the end of 2008 , a year after opening its first stoee. it expansion in Earope - entering the emerging post-Sovict had already rolled out a chin of 115 stores together with consumer markets of Central Europe in the mid-1990s isee a 675,000 square fent distribution centre with capacity Table 1) - Tesco launched the next stage of its strategy in to serve over 500 stures in Southern California. Arizona 1998. Following Terty Leahy's apointment as CEO in 1997. and Nevada. it conmitted to an Asian expansion progratune, initially As a result of this international expansion. by the entering Thailand and South Korea. The growth potential mid-2000s Tesco had moved into the elite group of of the Assan markets had been extensively rescarched by matuinational retalken. As Table 2 shows, by 2006 27 the firm for a number of years. However. the imenediate there were 15 retallers penerating sales outside their home catalysts for entry were the rapid liberalisation of previous markets of ofer 511 bilikon per annum isee Appendix restrictions on retail FDI across East Asia, and opportunities. for surmmaries of the key firmsi. For a variety of reasons to make strategie majority-share acquisitions of fledgling but. inclading the higher derelopenent costs (and assoclatied potentially market leading retail businesses at discounted sales densities) required in the tightly regulated uk market. prices, which resulted from the Asian economic criss of and the relative 'immaturity' of a higher proportion of its 1997/98. Tesce's subsequent expoinsion in Asia was internutional space - Tesco's international sales growth draduatic, Just 10 years later it had 1047 stones, acounting inevitubly lassod behind the increase in its international for 33 per cent of the flrm's global operoting pare, in the operating space. Nervertheliss, at mote than $20 billon region (see Table 1). South Korea now provided Tesco with those sales were sufficient to rank the firm within the top Its second largest market by sales after the UK. Significantly. 10 mulkinational tetailess (Table 21. By 2008 . 09 Tesco's Teseo had signalled its commitment to develop busineses international sales had increased by a further 60 per In two of the workd's key iweaty-first eentury economies. cert, propeling it into a top five position in the ranking. China and fndia, In China it was rupidly bulding the scale Additionally, those international sales and alyo operalof its operation following entry in 2004, and in India it ing prodts (if ts start-up losses are excluded) were slowly had successfully negotinted a partnerstip arrangement for but progressively mowing into closer alignment with the entering a market in which invnership of retail busineros proportion of international openuting space (Table 3 ). In by international operators was still strictly requaled. turn. that nellected rates of growth in the international Table 3 Tesco's international operating space, sales and operating profits as a percentage of the firm's global totals - ex-VAT. AnericalMerrit tynch estimate 8 December 2004. subsidiaries which continued to exced those achicrable success in those markets rilated to its mode of market entry, in Tesco's 'mature' and highly regulated home market. Its determincd eflorts to build market scale, and its adaptive responses to growing pressures across East Asla for tighter Success in Asia - Thailand and South Korea repulation of the expansion of multinational retalers. At the point of market entry into Thailand and South Korea The Asian economic crisis of 1997/98 left major in 1998/99. Tesco acquired majority stakes in two retail domestic conglomerates urgently secling cash injections, chains (Lotus in Thailand and Homeplus in South Kerea) As a result. Tesco was able to enter both markets via together having fewer than 20 stores or development sites magerity-shane partnerships in the non-core retail businesses and operating in markets saill dominated by traditional of the loading cotrelomerates: the CP Grokip in Thailand forms of retuiling. Whilst the growth potential for 'modern' and Samsung in South Korea. Initially Tesco's share of the retail across Asia was considerable, that potential was partnerships was 75 per cent in Thailand and 81 per cent simultancously attracting many of Tesco'smajor Furopean in South Korea. However, subsequent capital injections and North American competitors - including. Wal-Mart. by Testo into the expansion of the chains rapidly reduced Carrefour. Ahold, Casino and Delhaize. Nevertheles, adocade CP Group's share to acro, and Samsung's share first to later Tesco had successfully turned foothold acquisitions 11 per cent and then in two subsequent stages to 1 per into positions of market leadership (Thailand) or potential cent. Despite this rapid dilution of the local partners' share market leadership (South Konea), had developed extensive of the businesses, the partnerships offered Tesco knowledge multi-format store networks (exceeding 8(00 stores), and of local business/regulatory conditions and consamer had outperformed its multinational rivals to the extent that culture. plus the ability to build upon the "local' appeal Wal-Mart and Carrefour had been forced to exil South and customer image of the acquired chain - purticulariy Korea leaving Tesco as the dominant intemational retailer in South Korea where retention of the Samsung name in both countries. Some of the key dimensions of Tesco's (famsung-Tesco) proved to be essential. In both countries, Tesco has made substantual and con- in Thalland and South Korea were absent in Taiwan. tiruous post-entry capitial investment to build scale and In particular. Tesco entered the market in which one of accrue market leadership advantages, In Thailand the its major multinational relail competitors, Carrefour, had investment bas been pumped entirely into organic expan- been operating for more than a decude and had built a sion and has reguired store development programmes strong and, in practice, unirsailable market dominamce. of consuderable flexibility. in South Korea, 'within market' Moreover. unlike Thailand and Soath Korea and Tesco's acquisitions - 36 cx-Carrefour 'Homever' hypermarkets for subsequent Asian market eatries into Malaysia and Chima, E950 million in 2008 and 12 Aram Market hypermarkets Tesco was umable to find a suitable local partner and in 2005 - have been used to enhance its market position was therefore obliged to attempt an entry based on de nasw and tokeep pace (as the country's second ranked operator) exponsion. However, not only had many of the potentiwith the domestic market leader B-Mtart. Tesco's ability ally most attractive sites for expansion atready been to tlnance those acquisitions (outbidding its rivals when developed by Carrefour, or were held under future developnecessary) and to sustain a substantial annual cipital ment option, but abo the highly complex Chinese land expenditure programme has rested on the firm's steadily ownership system proved to be at diflicult arena in which growing profitability. That is to say, on the 'free cash flow' to transfer Tesco's skills in market'site location analysis for investment generated from both its domestic and and property acquisition/development. international operations and the ability to ratse capital at As a result, despite determined eflorts, Tesco was never advantageous rates which that prolitability ensures, able to develop the market scale nocessiry to support the Capital investment in both countries has occurred substantial infrastructure investment required for the asainst a background of presures ffel across many parts type of central distribution systems which so vitally underof Eiest Asial to tighten regulation and rein in expansion of pinned its operations in Thailand and South Koreal. With the multinational retallers. Those pressures have ranged a market share of barely 3 per cent it became iacreasfrom attempts to re-impose restrictions on ownership and ing clear both to the firm and to industry analysts that conatrol, through efforts to protect existing retail strue- there was little realistic opportunity of achieving a market tures via land-use woning, to regulation of store-opening penetration level in Taiwan where the subsidiary would hours, retail formats, and below cost' selling. In Thailand. become self-reinforcing in terms of profits. as development of large-format hypermarkets became more dificult. Tesco transferred its IK-developed small- The asset swap market exit solution store operating skills and began infilling ies hypermarket In late 2005 Tesco announced an innovative strategic framework with dense networks of small-format (Express) divestment solution to its problems in Taiwan. The solution convenience stores, first in metropolitan Bangkok, sub- involved a cross-repion swap of retail assels with its rival sequently in other leading cities. Those stores also had Carrefour, whereby each firm would simultaneously secure the additional benelit of being unrestricted by opening. scale and benefit from strengthened market positions in hours' regulation introduced to limit trading hours of different countries. It was agreed that in Talwan Tesce's Larger-format stones. Additionally. it developed a novel six stores and two develogment sites would be translow-build-cost 'Value' store format-essentially a stripped- ferred to Carrefour whilst, in exchange, in Central Europe down small hypermarket embedded within a local vendor Carrefour would transfer 11 stores in the Crech Republic market - to provide an entry vehicle for development and four stores in Slovakia to Tesca. The deal dearly in low-income rural 'up country' towns where expansion laad competition and consumer welfure implications as using conventional large-format hypermarkets was polit- it enhanced the dominance of the market leader in each ically unfeasible. Finally. it invested considerable effort country. Ultimately it wus approved in Taiwan and the in working with local communities to counter mounting. Cxech Republic but in Slovakia was blocked by the Antiregulatory pressures - explaining the value of the benefits. Monopoly OAlce. Nevertheless, the Slovakian element of (employment, supply chain modernisation, infrastructure the swap was relatively small, and Tesce was ahle to exit its investment, skills training. export gateway opportunities) only unsuccesthal Asian operation. Kearn valuable lessons It offered to the Thal economy. and stressing the potential for other Asian marlect entrics. and simultaneously to concistence of 'treditional' and 'modern' components of strengthen its market position in Central Europe, Relative the retail system. failure had been transformed into modest success by an aggile and innovative strategic divestment. Failure in Asia - Taiwan Tesco entered Taiwan in 2000. developed six stores, and A high risk gamble in the USA exiled the market in 2005. In simple terms. several of the In February 20016, after a year of intensive but dosely elements which had been key drivers of Tesco's success guarded market research by a CEO-selected team of as Angoles, and bulding on more profitably offered Tesco the opportunity to explore a IS than a decade of in-depth investigation of the potential marlet entry focused aruand 'convenience', Additionally. and characteristics of the market. Tesco annocinced its it recognised that the model of dense networks of 10.000 intention to commit Cl.25 billion over five years to enter square fect of high sisibility corner-location stores suceessthe western USA. The entry vehicle was to be a chain of fully used by lS drug retailers (chenists) such as Walerecns 'convenience' focused neighhourhood stores. later to be could be used to structure a chain of smaller format food called Fresh \& Easy Neighborhood Markets. The decision stores on a mutually reinlorcing network logic. represented a significant shift in Tesco's previous 'emerging. In terms of retail offer. Tesco recognised that opportumarket'-focused internationalisation strategy. As the CO nitics caisted to exploit the extensive experience of thk of Fresh \& Easy was to stress, the US repeesented: 'the first food retailen in chulled prepared meals development and mature, well-served market, that we have egened into, so operation of the cool-chain distribution/logistics systems actually [Fresh \& Pasy] is not filing a vacuum and has to nequired by those products. US food retailers. and in tum carn its place:' It was also, very clcarly, a high risk decision the t's food manufacturing industry. had traditionally as the US market had a long record of proving to be the offered few of these products to customers and the special'gruveyurd' of overambitioas crpansion by IK retalers. As tst distribution/logistics and quality control/traceubility a result, the entry announcement generated widespread systems necessary to support extensive retail oflers of that scepticism of Tesco's ability to succeed where so many type were underdeveloped. As a result opportunities exisied others had failed. Indeed. even sympathetie analysts to develop a chain focused on offering high quality but. questioned Tesco's ability to achicve the targats (e.g. store affordable fresh and chilled prepared meal products, productivity) implicitly set for the tS venture. The con- scrved by a short lead time responave distribution system. sensus view in Credit Subse's (2007) terms was: 'it may supplying higher levels of own label products than typical be fresh, but it won't be easy". amongit US food retailers. Tesco's decision to enter the IS alwo represented an In respoct of the threat posed by Wal-Mart. Tesco important reversal of its previous view of the likelihood of recognised that impact to have been particularly strong success in the market. Indeed. it had coesidently resisted on the weaker IS regional supermarket chains - driving many opportunities to enter the ISA via acquistion of ggnificant consolidation of those chains. Additionally. it regional food retailer chains of conventional largeformat recognised the traditional supermarket sector was essensupermarkets - not least because of their track record tially being squected between the Wal-Mart-led supercentre of low proflitablity and the threat posed to them by the operaters and a new group of discount retailers operating decade-long suproentre-driven transformation of Wal-Mart smaller format stores and achieving much higher levels from purely general merchandse to US food retail market of profitabdity than the supermarket chains, In particular leader, The change in Tesco's assessment related to its grow-. the stones of the Albrecht family - Aldi on the east coast and ing skills in small format store operation, its belief in the Trader joe's in the west - gronided Tesco with evidence competitive potential of dense networks of 'convenience'- that the threat of Wal-Mart could be accommodated. The focused neighbourhood stores prowiding an innovative innovative Trader loe's in particular offered a model of retail offer, and evidence that the Wal-Mart threat could be what was possible in the metro markets of the wetern countered in the type of urban markets Tewco had targeted ISA. ogerating with exceptionally high sules denaities and for its IS cxpansion. profitability+ Morcover, it was exactly those urban markets Tesco's small format retall skills had deceloged in the which, as a result of escalating community reskance. UK as a competitive response to tightening regulation - Wal-Mart was finding it most difficulk to enter with its both planning regulation which made large format out of-. huge supercentres. centre stores become increasingly difficult to develop and competition regulation which blocked large-scale acquisiDimensions of Tesco's market entry and expansion tions but offered an opportunity for growth by acquislition In November 2007. Tesco opened its first Fresh \& Easy in the convenienoe store market. In port. however, those stores in Southern California. They averaged 10,000. skills had been developed gravetively to gain competitive square feet and carriod a tightly edited range of 3500 sKL's advantage in a rapidly expanding 'convenience culture' with a focus on freda and chilled peepared-meal products. anarket, By the mid-20005, the fosult was that Teseo had Served by a 'short lead time' integrated lood preparation' 700 Express convenience stores in the UK. supplemented distribution system, they were based arotiad eatirely by a range of other smaller format storix.e.g. 15.000-square foet urban 'Metro' stores and. additionally. had begun to export the Express format to its international subsidiaries. "SKI = Stock Kenping Vinit, Le, a urique identifirt fir each divtinet Growing confidence in its ability to operate small formats prodost. self-scanning checkouts. Described by Fresh \& Easy's CEO have jointly invested $170 million in processing plants as 'designed to be as fresh as Whole Foods. with the value of adjacent to Tesco's DC and feed into the DC' both shelfWal-Mart, the convenience of Walqeens, and a product ready packaged produce and also 40 per cent of the range of Trader joe's'," the stores were rapidly rolled out prepared meat. poultry, frult and vegetable ingredients in Southern California, Phocnix and las Vegas, and a year used in the food preparation facility. later exactly 100 had opened. Significant features of Tesco's LS expericuce include;. 4. A sarprisingly maled initial congefitive rexponse. Entry whe of one of the world's largest retailers into the home contrast to its previous international market entries. highly contested by leading US domestic operators. Tesco has proactively adopted digital/viral marketing could be predicted to produce a flerce competitive techniques to address the challenge of defining, launch- response. Given the inability to protect the 'front region' ing and embedding the Presh \& Easy brand. Determined innovations underiying lis LS chain. Tesco essentually efforts have been made by the firm to use blog and text- had to attempt to lay down sture networks as rapilly as messaging based communication with online commun- possible before drawing that anticipated response. ities of customers and potential customers. Although Wahin a year of Fresh \& Easy's launch Wal-Mart had ocerisknally these efforts have rebounded oa the firm. begun to trial a chain of small format stores closely Tesco has continued to explore these methods and to modelled in terms of size. SKLs and nelghbourhood transfer learning into its whider international operations. orientation on the Tesco stores. However, by late 20019 those 'Marketside' stores remained confined to just four 2 Ertablishing bnand visiblity and maximisirg krvelopment locations in Phoenis. Although scaling up of the trial oportanities vit inwspnent it anderserved cammunities. was anticipated. Tesco had been riven unexpected time An important component of Tesco's entry into Los Angeles to continue developing its store network density and to has been its commitment to develop stores in low respond to "front rezion' innovations iranging. signage, incone/deprived and ethnically segregated communities store atmospherics) in the prototype Marketside stores. - visibly underserved by its major US competitors. Transferring the development-coalition and community- 5 The reputational gamble of the Caio, One of the defining specilic retail operating skillsgained since the late 1990 s characteristics of Leahy's strategic realignment of Tesco in opening 'urban regeneration partnership' stores as a multinational operator had been his ability to in deprived areas of many LK cities. Tesco quickly engineer that transformation largely under the radar developed stares in Compton, South Central and sim- of hostile public scrutiny and retain financial market ilar areas of Los Angeles. Its continuing commitment support for the strategy. That was never likely ta be pos: to investment in underserved communities has, on the sible with an entry into the USA. Despite the relatively one hand, gained strong local community support and modest scale of the f1.25 billion five-year US investment increasing national recognition. leading to a more rapid (compared to annual international capital expenditure establishment of brand identity than might otherwise in 2008/09 of E2.1 billion the lirm. and its Clo in have been expected, On the other hand it has provided a particular, was acutely aware of both the reputational rallying point for a varkety of groups inotably retail labour . risks and potentially transformational consequiences of unions strongly opposed to Tesco's decision to operate the US venture in the case of either success or fallure. its IS stores on a non-unionised basis) antingonistic to We've carefully balanced the risks, if it fails it's its market entry. embarrassing. It might show up in my career [but] 3 Integraied fool productumidistribution supportrd by_ it li cost an amount of money that is casily alfordable follower-stuphiers. To ensure reliable avallability of high by Tesco - call it 1 billion if you like. If it succeeds quality prepared food products critical to its vision of the _. then it's transormational." Fresh \& Easy brand in a context where it had concerns Leahy has, in eflect, been required to publicly place ubout prevailing qualityfrocenbility standards of locel his conshdrable 'reputational equity' on the line and third-party production. Tesco has becn obliged to take has found it necessary to repeatedly stignal strategic the unusal step of managing its own food preparation. 'commitment' to the US venture. It has developed an 80,000 square foet 'lood preparation' facility alongside its distribution centre (DC) in Riverside. Success or failure in the USA - the jury remains out and has been supported by the simultaneous move to By late 2009 Tesco had opened more than 130 stores in the California of two of its leading UK suppliers - Nature's USA. In the face of a global economic crisis with origins Way Foods and 2 Sisers Food Group. These companies in the sub-prime US housing market, the growth of some of the previously fast expanding western 18 markets future development sites with limited competition, the core targeted by Tesco had been decimated. The pace of Fresh positioning of the brand' described by US Retailing 'Today \& Basy's store openings had been slowed and the opera- (November 2007) as occupying; 'the white space wbere tions of the chain had been subject to a period of intense the combination of good food. good value. convenienoe reappraisal. Start-up losses were running af a higher and environmental sensitivity that matters to the energing kevel than planned, and the TK media was cagerly secking .American consumer converge" retained its logic, and who opportunities to announce a rare Lapee in Tesco's secm- would be prepared to bet against leahy's reputational ingly unstoppable global expansion. Long term sceptics commitment to the ventureamongst the equity analysts continued to argue that Tesco was likely to 'heial for the exit' and quit the US, writireg off Relerences: E1 billion of investment in the process. Mason. F, The Romes, 17 November 2007. On the other band, economic recovery was beginning Gedit Suisse Epury Resarch, 16 February. to emerge in the ISA. the recssion had provided oppor- Financial Temet, 1 December 2007. tunities for Tesco to build its store networis and acquire 21 Juse. farailable at www actnomist.cum.| APPENDIX Tesco's leading multinational retail rivals Wal-Mart: The worid's largest industrial corporation in terms of sales $379 bilion in 2008/09 and the teading multinational retailer. Wal-Mart operates outside its US base in 16 international markets, including Argentina, Brazil, Canada, China. Japan, Mexice, the UK, and announced entry into thdia via a joint venture in 2006. Although widely vitwed as essentially a large-format, big box' retailer, Wal-Mart has increasingly become a multi-format retailer in parts Iparticutarty Latin Americal of its international portiolio. Has enjoyed mixed fortunes internationally. Highly successfut in Mexico and Canada, it strengtbened its position elsewhere in South and Central America with acquistions from Ahold. Less successtul in parts of Asia and Europe lwith the exception of its. Asda chain in the UKI it was forced to exit Germany and South Korea having failed to achieve market scale. Carrefour: The wortd's second targest retailer lbut with annual sales in 2008/09 approximately one-third of Wal-Martl. this French firm was the pioneer retail multinational, In the late 1980s it entered emerging markets in East Asia Inotably Taiwan] and South America IBrazil and Argentinal achieving 'first-mover' advantages and substantial profits. By the late 1990 s, after its merger with French rival Promodes, it had operations in cver 30 countries across Asia. South America and etsewhere in Europe. During the 20005 it has divested operations in severat markets in which it had failed to achieve scale, but remains a widely dispersed retail multinationat operating both large-format hypermarkets, supermarkets, and also small-format 'discount' stores under the Dia fascia. Royal Ahold: Leading Dutch retailer which by the Late 1990 s/early 2000s had an extensive international presence in the USA, Latin America, East Asia, Scandinavia and Seuthern/Eastern Europe, promoting itself as a distinctive global operater. Its aggressive growth strategy and tolerance of high financial leverage lost the contidence of financial markets and in 2003 Ahold was the focus of a major corporate financial scandal. Subsequently Ahold was forced to sell many of its operations in Latin America, Asia and Europe to protect its 'core' retail chains (Stop 8 Shop. Oiant and Albert Hein) in the USA and the Nothertands. Metro: Second targest European retailer, this German firm has stores in over 30 countries across Asia Central, Eastern and Southern Europe, with foothold positions in North Alrica. Distinctively in many markets, it operates solely via a bulk purchase 'cash \& carry' format - under either the Metro or Makro fascias. The cash & carry Iself-service warehousel format, which is targeted towards registered business customers only and in which Metro is the global leader. has frequently allowed it to enter markets le.g. India in 20031 as a 'wholesaler' where regulatien restricts FDI by conventional retailers. Aldi: German retail group, privately owned by the Albrecht family and divided into two divisions, Aldi Nord and Adi Sud, together operating over BDo0 smaller format 'hard discount' stores in 20 countries across Europe, the USA and Australia. In the USA an Albrecht family trust also owns the innovative Trader Joe's chain concentrated in Southern California which provided a model of the possibilities for Tesco's US subsidiary. eesco is a UK based company and has expanded its operations to various countries of Asia and Sastern Europe (see Table 1). In implementing internationalization strategy, companies experience an environment different from their home country. Using the CAGE Framework analyse the differences experienced by Tesco in Asia and Eastern Europe