Question: Case Study: The Choice Between Long - Term Debt and Short - Term Debt for SMBs Background: Small and medium - sized businesses ( SMBs

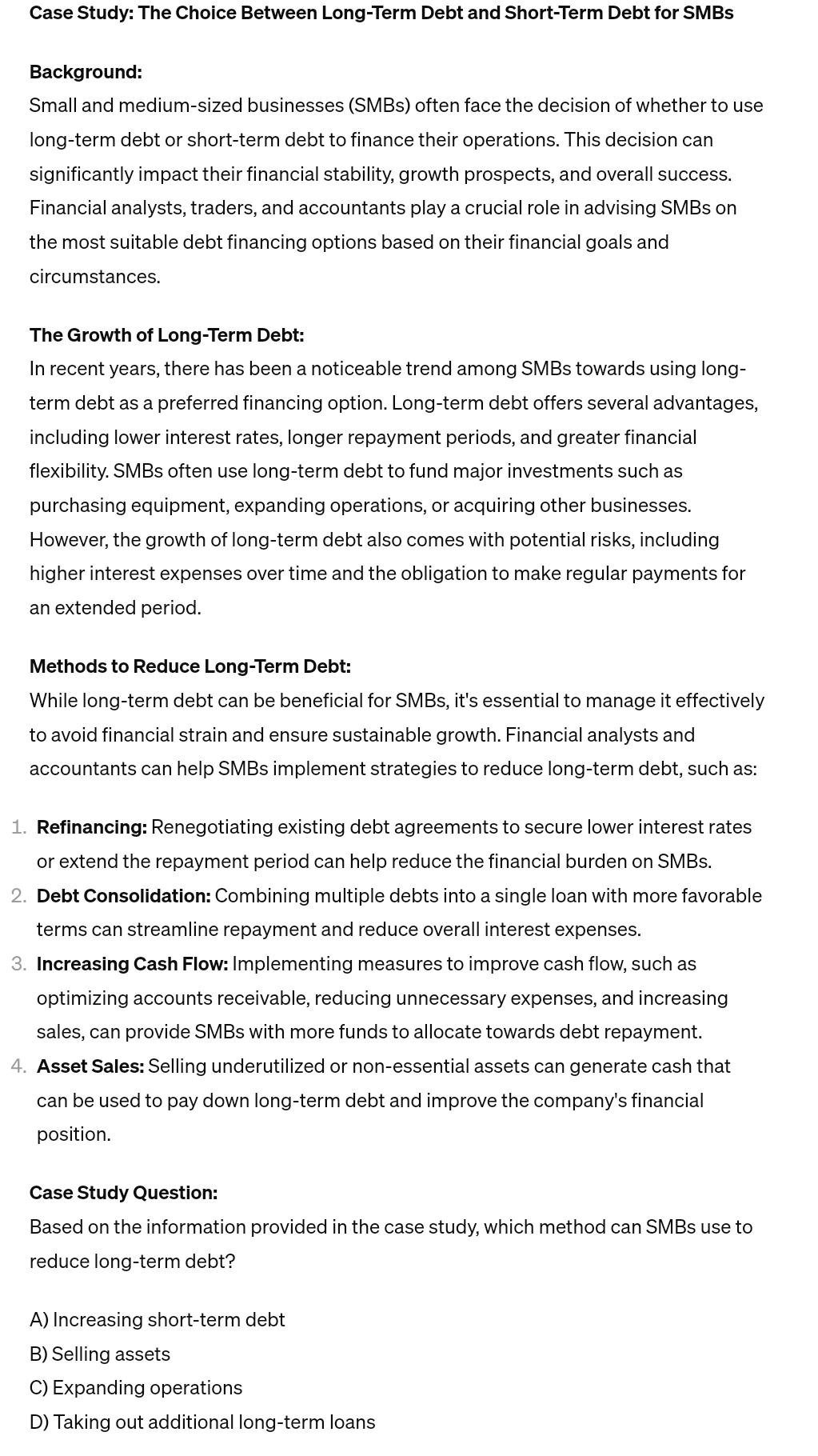

Case Study: The Choice Between LongTerm Debt and ShortTerm Debt for SMBs

Background:

Small and mediumsized businesses SMBs often face the decision of whether to use longterm debt or shortterm debt to finance their operations. This decision can significantly impact their financial stability, growth prospects, and overall success. Financial analysts, traders, and accountants play a crucial role in advising SMBs on the most suitable debt financing options based on their financial goals and circumstances.

The Growth of LongTerm Debt:

In recent years, there has been a noticeable trend among SMBs towards using longterm debt as a preferred financing option. Longterm debt offers several advantages, including lower interest rates, longer repayment periods, and greater financial flexibility. SMBs often use longterm debt to fund major investments such as purchasing equipment, expanding operations, or acquiring other businesses. However, the growth of longterm debt also comes with potential risks, including higher interest expenses over time and the obligation to make regular payments for an extended period.

Methods to Reduce LongTerm Debt:

While longterm debt can be beneficial for SMBs it's essential to manage it effectively to avoid financial strain and ensure sustainable growth. Financial analysts and accountants can help SMBs implement strategies to reduce longterm debt, such as:

Refinancing: Renegotiating existing debt agreements to secure lower interest rates or extend the repayment period can help reduce the financial burden on SMBs

Debt Consolidation: Combining multiple debts into a single loan with more favorable terms can streamline repayment and reduce overall interest expenses.

Increasing Cash Flow: Implementing measures to improve cash flow, such as optimizing accounts receivable, reducing unnecessary expenses, and increasing sales, can provide SMBs with more funds to allocate towards debt repayment.

Asset Sales: Selling underutilized or nonessential assets can generate cash that can be used to pay down longterm debt and improve the company's financial position.

Case Study Question:

Based on the information provided in the case study, which method can SMBs use to reduce longterm debt?

A Increasing shortterm debt

B Selling assets

C Expanding operations

D Taking out additional longterm loans

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock