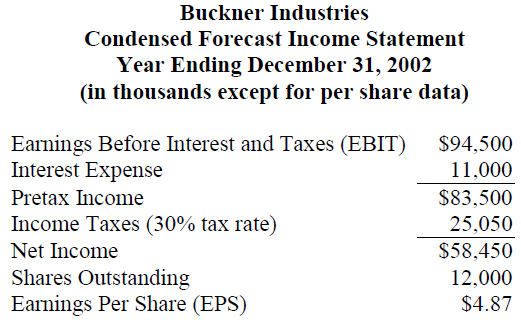

Question: Case Study V Financial Projections (15 points) Buckner Industries has prepared the condensed forecast income statement for the year ending December 31, 2002. After creating

Case Study V Financial Projections (15 points) Buckner Industries has prepared the condensed forecast income statement for the year ending December 31, 2002. After creating the forecast, Buckner develops a new product, which will require $100 million in additional capital expenditures at the beginning of 2002. With the new product, EBIT in 2002 is expected to be 15 percent higher than the amount forecast in Exhibit above. To finance the increase in the capital budget, Buckner is considering a plan using 50 percent equity and 50 percent long-term debt. New equity would be issued at $25.00 net proceeds per share and the interest rate on the new long-term debt would be 8.50 percent. Buckner is reviewing how this financing, if completed on December 31, 2001, would affect the companys EPS.

Construct a pro forma income statement for 2002, assuming the financing plan is adopted.

Buckner Industries Condensed Forecast Income Statement Year Ending December 31, 2002 (in thousands except for per share data)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts