Question: Case Study Vision Express (VX Co. hereafter) is a well-known and specialized company in manufacturing sunglasses. The VX Co. uses a standard costing system to

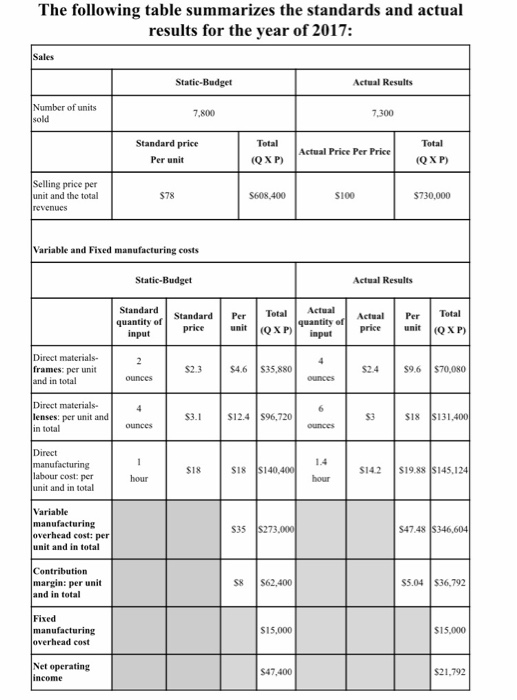

The following table summarizes the standards and actual results for the year of 2017: Sales Actual Results umber of units 7,800 7,300 Total Total Standard price Per unit Actual Price Per Price QXP) QxP) g price per t and the total $78 S608.400 S100 $730,000 Variable and Fixed manufacturing costs Actual Results StandardP TActual price it xP)input Actual Per Total quantity ef input quantity cunit(QxP) Direct materials- $4.6 S35,880 S24 S frames: per unit in total S2.3 9.6 $70,080 S3.1 lenses: per unit and in total $12.4 S96,720 S3 1.4 S18 $14.2 $19.88 $145,1 labour cost: per it and in total Variable manufacturing S35 $47.48 cost: per unit and in total S8 S62,400 S5.04 S36,792 margin: per unit in total Fixed $15,000 15,000 cost Net operating $47,400 $21,792

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts