Question: Case study: WNG Capital LLC*please read the case its in the attached photos it has all the information* What does WNG bring to the deal

Case study: WNG Capital LLC*please read the case its in the attached photos it has all the information*

- What does WNG bring to the deal other than money to buy the aircraft? How does the deal fit into WNG's business model?

- What are the major drivers of value for the sale and leaseback? Which assumptions are you most worried about and why? Should WNG go forward with the transaction or not?

- Now value the lease from the airline's perspective. Are the cash flows for the airline the same as for WNG? What do you get as the NPV for the lessee?

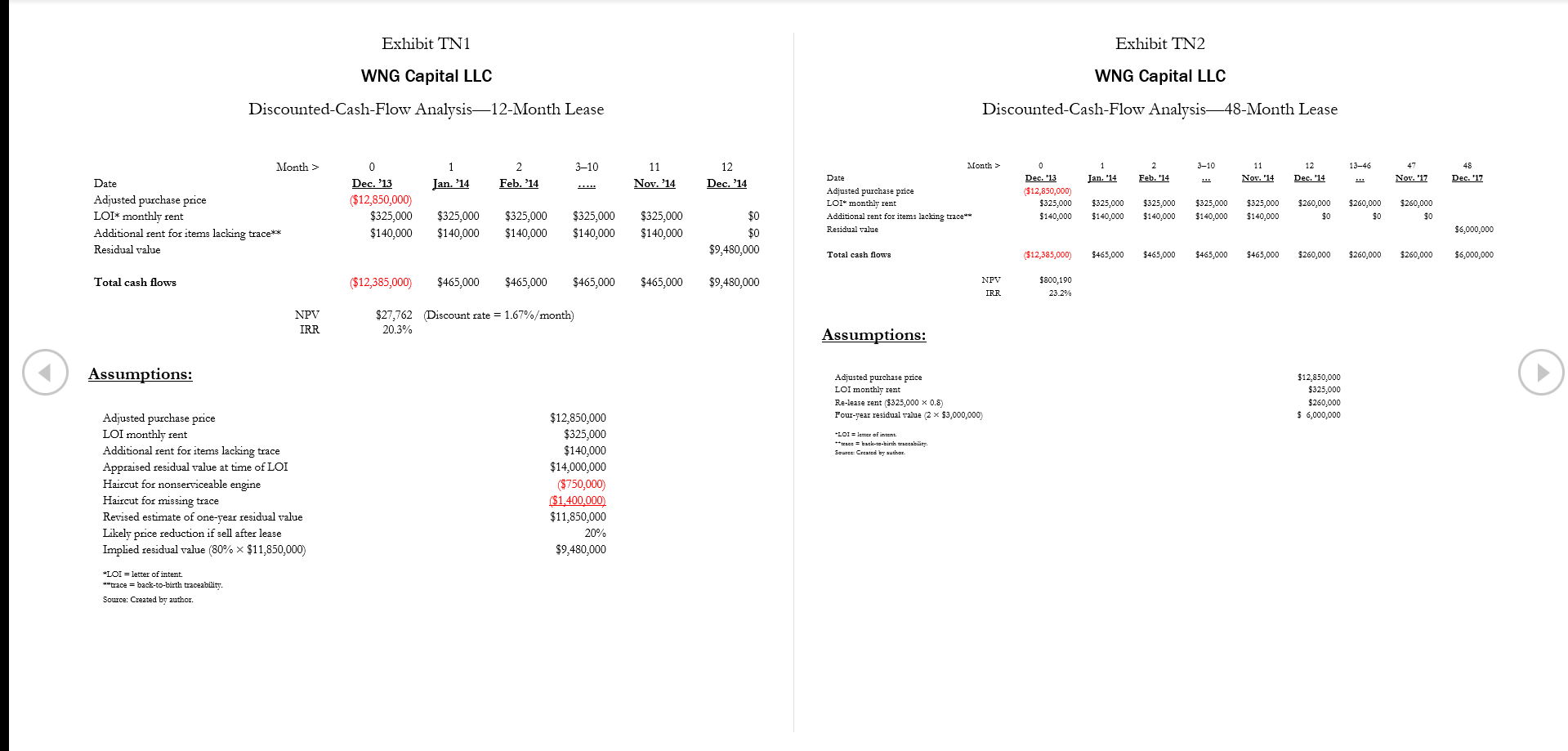

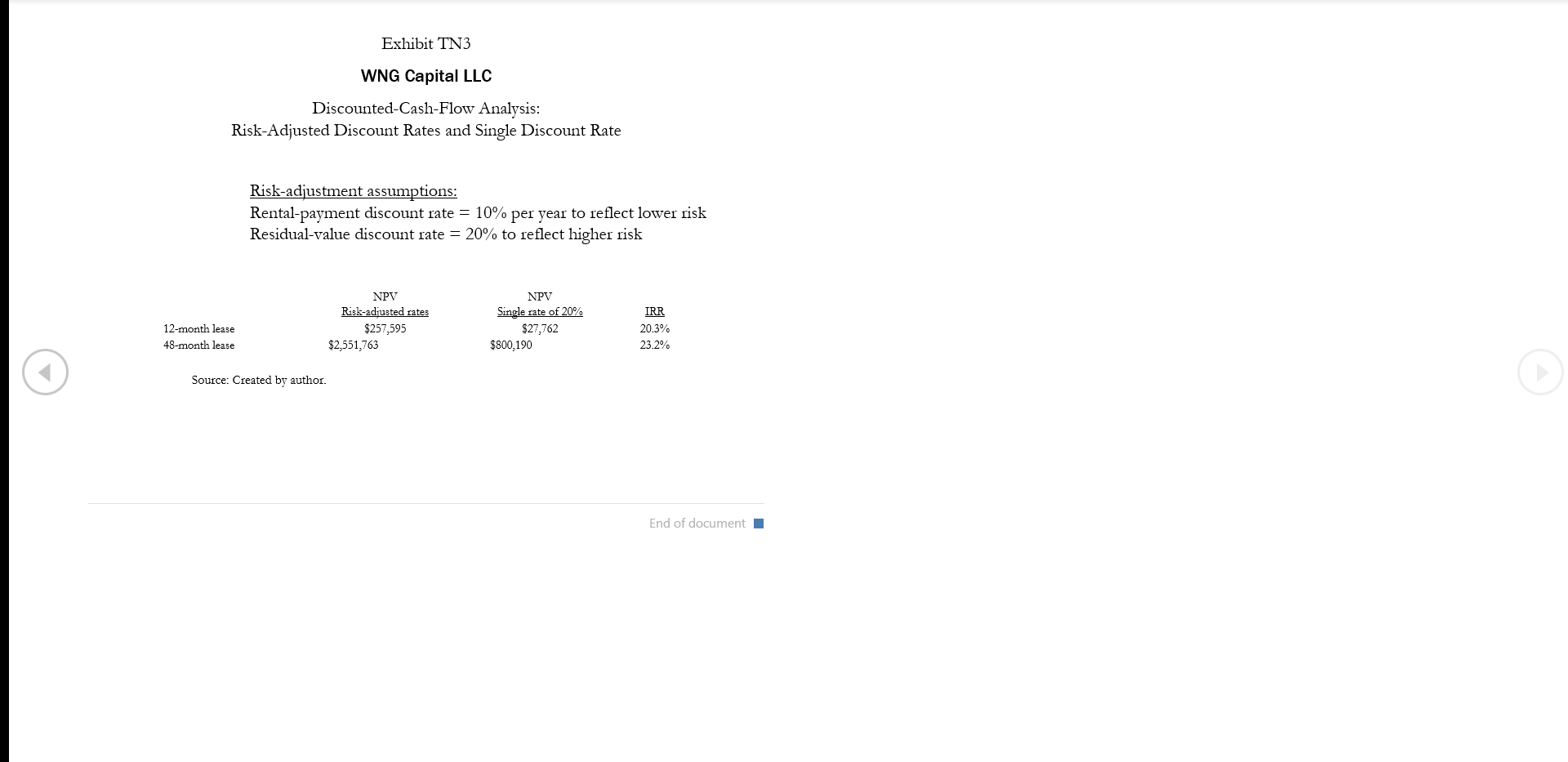

Synopsis and Objectives WNG Capital LLC Teaching Note In late 2013, Wenbo Su, an analyst at WNG Capital LLC (WNG), a U.S.-based asset manage- ment firm, was reviewing the terms of a proposed transaction for his employer. WNG specialized in aviation leases, and Su was evaluating the terms of a proposed purchase-and-leaseback deal with a small private airline based in the United Kingdom. The essence of the transaction would be to transform the airline from being the owner of three aircraft to being the lessee of the aircraft for 12 months. WNG would become the new owner of the equipment (aircraft and related parts) and would act as the lessor in the deal. The airline would have full use of the aircraft but would not own the aircraft, nor have use of the aircraft after the end of the lease. The cash flows to all parties were complicated, and Su planned to conduct a thorough analysis of the proposed lease terms before making a recommendation to WNG's CEO. The task for the student is to assume the role of Su, who needs to be sure that WNG can meet or exceed its objective of a 20% return to compensate WNG for the credit risk of the airline, plus deliver the objective of an 11% to 14% return on invested capital to its investors. Moreover, Su needs to be cognizant of the fact that a deal that is perceived as too costly for the airline could result in WNG losing business to other airlines in the future. The primary learning objective of this case is to provide students with a comprehensive exer- cise in the economics of lease financing. Students are given the primary cash flows to consider in the analysis, plus the discount rate assumed by WNG, which allows students to build a straightfor- ward cash-flow model and estimate the net present value (NPV) and IRR for the base case, plus a number of sensitivity scenarios. The discounted-cash-flow (DCF) analysis serves to illustrate the importance of the residual value to the lessor's evaluation of a lease deal. It also provides the opportunity for students to recognize that cash flows must be valued according to their respective risks that is, the residual value for a lease carries substantially more risk than a monthly lease payment. The case also illustrates how the distribution of value between lessor and lessee is largely determined by the respective bargaining positions of the two parties and the alternatives available to each side. A secondary objective is to underscore important insights about capital markets, financial in- novation, and financial contracting. Financial contracts exist to meet the needs of those providing funds and those using the funds. All contracts provide certain benefits to each party at certain costs, and for particular assets there is always the opportunity to create more-efficient contracts relative to the "plain-vanilla contracts available in the market. The leasing contract has long been available as an alternative to borrowing and buying an asset. Students can easily see that a lease contract is very similar to debt because of the similarity between a lease payment and an interest payment. The fact that both forms of financing are widely used suggests that leases exploit capital- market imperfections and fill special needs for both the user of the asset (lessee) and the owner of the asset (lessor/investor). The final objective is to provide institutional background on lease financing, which includes the dramatic increase in the volume of leasing, accounting considerations, and a general perspective from the lessor's point of view. As an introduction to the economics of equipment leasing, this case can be used for MBA or undergraduate students and could be taught in either a principles course or a corporate-finance elective. Students should be proficient in discounted-cash-flow analysis and the general principles 1 See Keith Crutcher, "A Short History of Leasing," Automotive Fleet, July 1986. The article cites the ancient Sumerian city of Ur in 2010 BC as providing the first recorded instance of equipment leasing. http://www.automotive-fleet.com/article/story/1986/07/a- short-history-of-leasing.aspx.

Step by Step Solution

There are 3 Steps involved in it

Question 1 What does WNG bring to the deal other than money to buy the aircraft How does the deal fit into WNGs business model WNGs Contributions Beyond Capital 1 Asset Management Expertise WNG acts n... View full answer

Get step-by-step solutions from verified subject matter experts