Question: Case Two Complete the following purchase in the General Journal: Purchase Invoice #DE - 6 7 1 1 3 Dated May 1 , 2

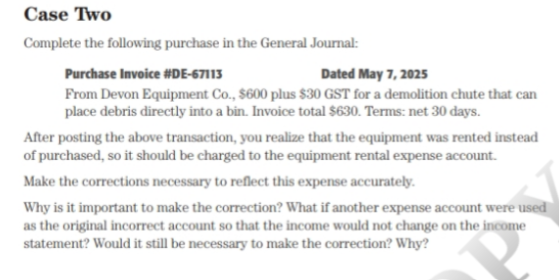

Case Two

Complete the following purchase in the General Journal:

Purchase Invoice #DE

Dated May

From Devon Equipment Co$ plus $ GST for a demolition chute that can place debris directly into a bin. Invoice total $ Terms: net days.

After posting the above transaction, you realize that the equipment was rented instead of purchased, so it should be charged to the equipment rental expense account.

Make the corrections necessary to reflect this expense accurately.

Why is it important to make the correction? What if another expense account were used as the original incorrect account so that the income would not change on the income statement? Would it still be necessary to make the correction? Why?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock