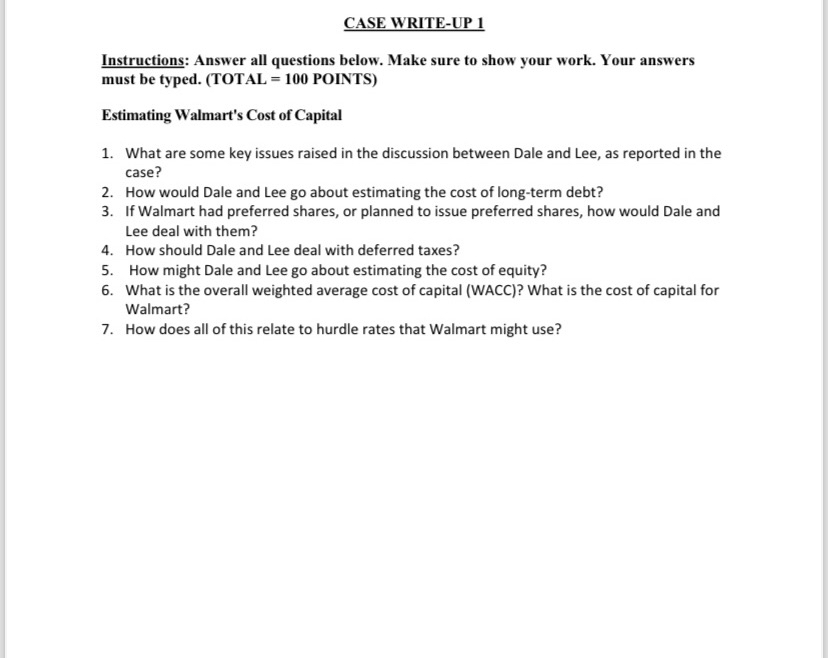

Question: CASE WRITE - UP 1 Instructions: Answer all questions below. Make sure to show your work. Your answers must be typed. ( TOTAL = 1

CASE WRITEUP

Instructions: Answer all questions below. Make sure to show your work. Your answers must be typed. TOTAL POINTS

Estimating Walmart's Cost of Capital

What are some key issues raised in the discussion between Dale and Lee, as reported in the case?

How would Dale and Lee go about estimating the cost of longterm debt?

If Walmart had preferred shares, or planned to issue preferred shares, how would Dale and Lee deal with them?

How should Dale and Lee deal with deferred taxes?

How might Dale and Lee go about estimating the cost of equity?

What is the overall weighted average cost of capital WACC What is the cost of capital for Walmart?

How does all of this relate to hurdle rates that Walmart might use?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock