Question: Case You manage at Tesla. Tesla is considering the development of an entirely new electric vehicle. The engineers recommend two mutually exclusive models: The Al

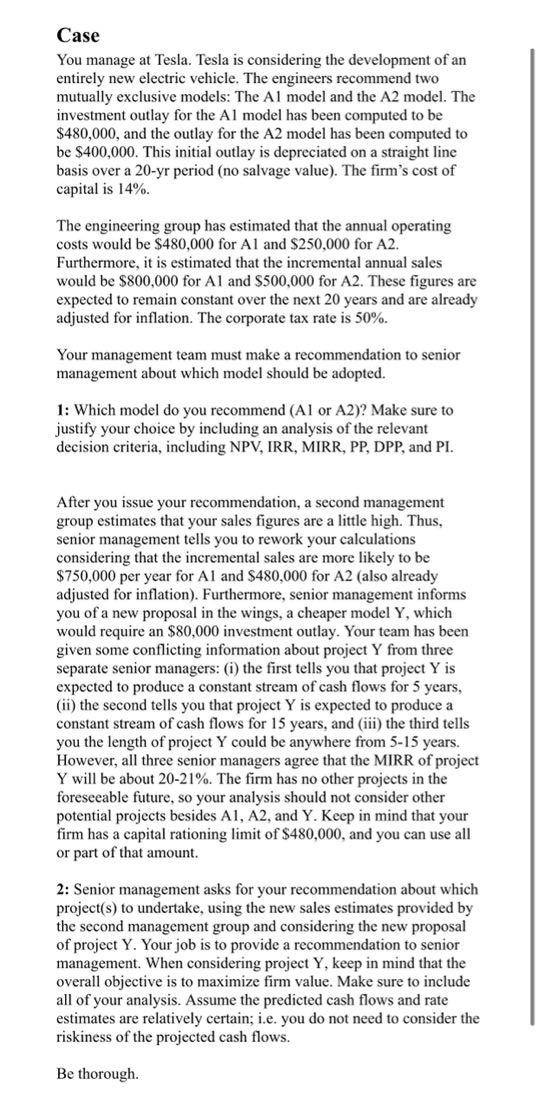

Case You manage at Tesla. Tesla is considering the development of an entirely new electric vehicle. The engineers recommend two mutually exclusive models: The Al model and the A2 model. The investment outlay for the Al model has been computed to be $480,000, and the outlay for the A2 model has been computed to be $400,000. This initial outlay is depreciated on a straight line basis over a 20-yr period (no salvage value). The firm's cost of capital is 14% The engineering group has estimated that the annual operating costs would be $480,000 for Al and $250,000 for A2. Furthermore, it is estimated that the incremental annual sales would be $800,000 for Al and $500,000 for A2. These figures are expected to remain constant over the next 20 years and are already adjusted for inflation. The corporate tax rate is 50%. Your management team must make a recommendation to senior management about which model should be adopted. 1: Which model do you recommend (Al or A2)? Make sure to justify your choice by including an analysis of the relevant decision criteria, including NPV, IRR, MIRR, PP, DPP, and PI. After you issue your recommendation, a second management group estimates that your sales figures are a little high. Thus, senior management tells you to rework your calculations considering that the incremental sales are more likely to be $750,000 per year for Al and $480,000 for A2 (also already adjusted for inflation). Furthermore, senior management informs you of a new proposal in the wings, a cheaper model Y, which would require an $80,000 investment outlay. Your team has been given some conflicting information about project Y from three separate senior managers: (i) the first tells you that project Y is expected to produce a constant stream of cash flows for 5 years, (ii) the second tells you that project Y is expected to produce a constant stream of cash flows for 15 years, and (iii) the third tells you the length of project Y could be anywhere from 5-15 years. However, all three senior managers agree that the MIRR of project Y will be about 20-21%. The firm has no other projects in the foreseeable future, so your analysis should not consider other potential projects besides A1, A2, and Y. Keep in mind that your firm has a capital rationing limit of $480,000, and you can use or part of that amount. 2: Senior management asks for your recommendation about which project(s) to undertake, using the new sales estimates provided by the second management group and considering the new proposal of project Y. Your job is to provide a recommendation to senior management. When considering project Y, keep in mind that the overall objective is to maximize firm value. Make sure to include all of your analysis. Assume the predicted cash flows and rate estimates are relatively certain; i.e. you do not need to consider the riskiness of the projected cash flows. Be thorough. Case You manage at Tesla. Tesla is considering the development of an entirely new electric vehicle. The engineers recommend two mutually exclusive models: The Al model and the A2 model. The investment outlay for the Al model has been computed to be $480,000, and the outlay for the A2 model has been computed to be $400,000. This initial outlay is depreciated on a straight line basis over a 20-yr period (no salvage value). The firm's cost of capital is 14% The engineering group has estimated that the annual operating costs would be $480,000 for Al and $250,000 for A2. Furthermore, it is estimated that the incremental annual sales would be $800,000 for Al and $500,000 for A2. These figures are expected to remain constant over the next 20 years and are already adjusted for inflation. The corporate tax rate is 50%. Your management team must make a recommendation to senior management about which model should be adopted. 1: Which model do you recommend (Al or A2)? Make sure to justify your choice by including an analysis of the relevant decision criteria, including NPV, IRR, MIRR, PP, DPP, and PI. After you issue your recommendation, a second management group estimates that your sales figures are a little high. Thus, senior management tells you to rework your calculations considering that the incremental sales are more likely to be $750,000 per year for Al and $480,000 for A2 (also already adjusted for inflation). Furthermore, senior management informs you of a new proposal in the wings, a cheaper model Y, which would require an $80,000 investment outlay. Your team has been given some conflicting information about project Y from three separate senior managers: (i) the first tells you that project Y is expected to produce a constant stream of cash flows for 5 years, (ii) the second tells you that project Y is expected to produce a constant stream of cash flows for 15 years, and (iii) the third tells you the length of project Y could be anywhere from 5-15 years. However, all three senior managers agree that the MIRR of project Y will be about 20-21%. The firm has no other projects in the foreseeable future, so your analysis should not consider other potential projects besides A1, A2, and Y. Keep in mind that your firm has a capital rationing limit of $480,000, and you can use or part of that amount. 2: Senior management asks for your recommendation about which project(s) to undertake, using the new sales estimates provided by the second management group and considering the new proposal of project Y. Your job is to provide a recommendation to senior management. When considering project Y, keep in mind that the overall objective is to maximize firm value. Make sure to include all of your analysis. Assume the predicted cash flows and rate estimates are relatively certain; i.e. you do not need to consider the riskiness of the projected cash flows. Be thorough

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts