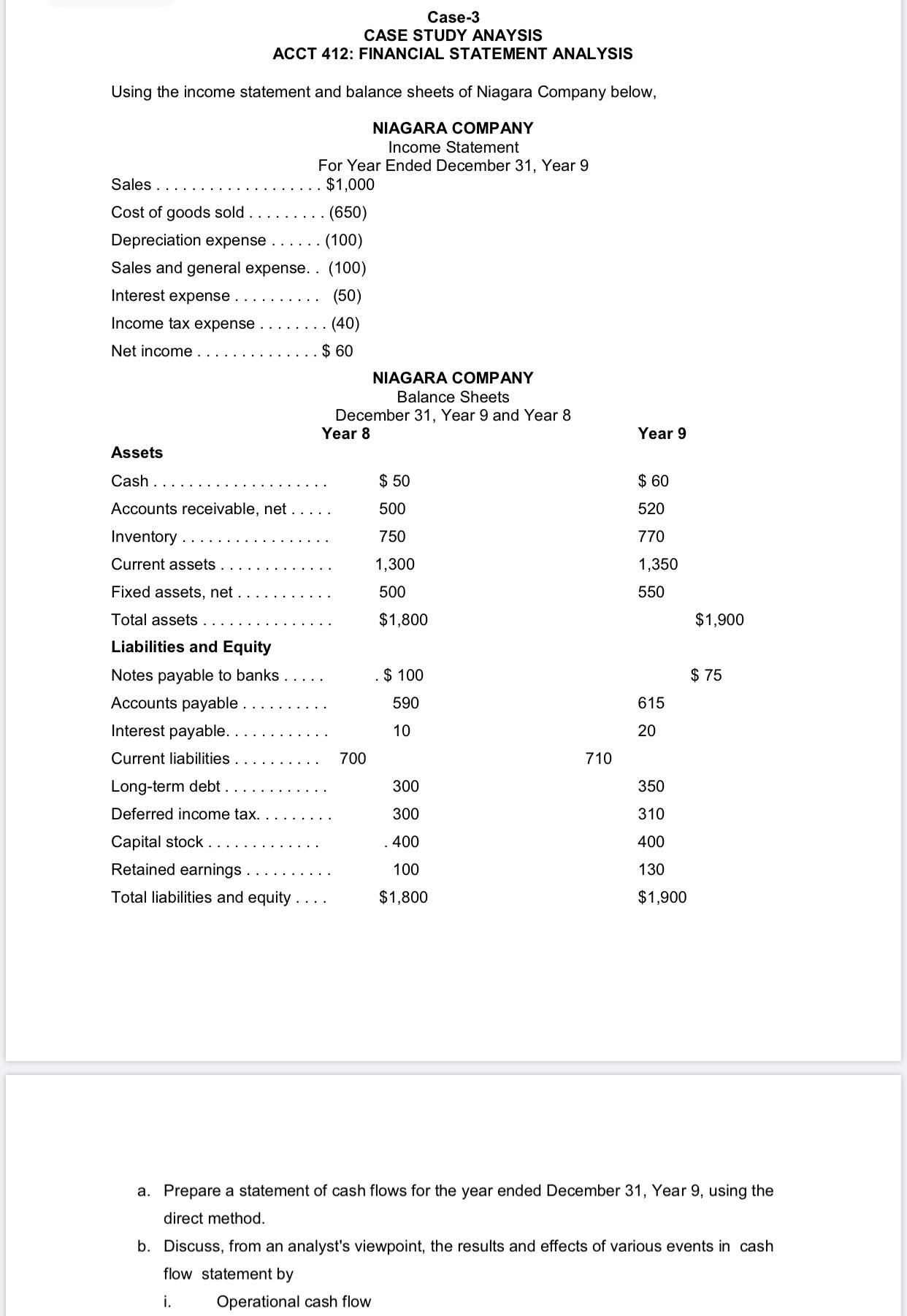

Question: Case-3 CASE STUDY ANAYSIS ACCT 412: FINANCIAL STATEMENT ANALYSIS Using the income statement and balance sheets of Niagara Company below, NIAGARA COMPANY Income Statement For

Case-3 CASE STUDY ANAYSIS ACCT 412: FINANCIAL STATEMENT ANALYSIS Using the income statement and balance sheets of Niagara Company below, NIAGARA COMPANY Income Statement For Year Ended December 31, Year 9 $1,000 Sales Cost of goods sold (650) Depreciation expense. . (100) Sales and general expense. . (100) Interest expense. (50) Income tax expense. . (40) Net income $ 60 NIAGARA COMPANY Balance Sheets December 31, Year 9 and Year 8 Year 8 Assets Year 9 Cash $ 50 $ 60 500 520 Accounts receivable, net. Inventory Current assets 750 770 1,300 1,350 Fixed assets, net 500 550 Total assets $1,800 $1,900 $ 100 $ 75 Liabilities and Equity Notes payable to banks. Accounts payable. Interest payable.. Current liabilities 590 615 10 20 700 710 Long-term debt. 300 350 Deferred income tax. 300 310 .400 400 Capital stock.. Retained earnings Total liabilities and equity 100 130 $1,800 $1,900 a. Prepare a statement of cash flows for the year ended December 31, Year 9, using the direct method. b. Discuss, from an analyst's viewpoint, the results and effects of various events in cash flow statement by i. Operational cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts