Question: Case-Based Critical Thinking Questions Case 6-1 Phil has put together the worksheet above with a 5-year cash flow estimate for his shoe company. He needs

Case-Based Critical Thinking Questions

Case 6-1

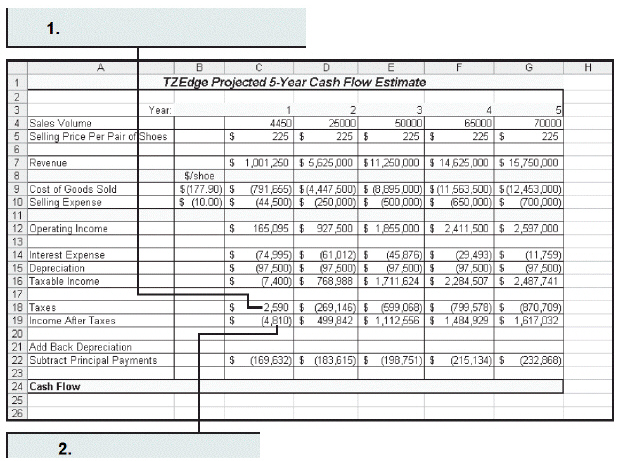

Phil has put together the worksheet above with a 5-year cash flow estimate for his shoe company. He needs to explain the chart to his investors. Please answer the questions below using this figure as a reference.

Phil must now total the following: taxable income, depreciation added back to the cash flow, and principal payments deducted from the cash flow (already a negative value) to determine the projected cash flow. Phil enters the following formula in cell C24 and copies it across the row: ____.

=SUM(C19,C21,C22)

=C19-C21+C22

=C19+C21-C22

=C19-C21-C22

1. H A B F G 1 TZEdge Projoctod 5-Year Cash Flow Estimate 2 3 Year 1 2 3 4 4 Sales Volume 4450 25000 50000 65000 70000 5 Selling Price Per Pair of Shoes $ 2256 2255 225$ 2256 225 6 7 Revenue $ 1,001,250 $ 5,625,000 $11,250 000 $ 14,625,000 $ 15,750,000 8 $/shoe 9 Cost of Goods Sold $(177.90) 5 (791,565) $(4.447,500) 58,895.000) 5 (11,563,500) $(12,453.000) 10 Selling Expense S (10.00 $ (44,500 $ 250,000 $ 500 000 3 (650,000 $ (700,000) 11 12 Operating Income $ 165,095 $ 927,500 $ 1,855 000 $ 2,411,500 $ 2,597 000 13 14 Interest Expense 5 (74,995) 5 (61,012) 5 (45 876) 5 (29,493) $ (11,759) 15 Depreciation S (97,500 $ 97,500 5 197 500) 5 (97,500 $ 97,500) 16 Taxable income S 7,400) $ 768,988 $ 1.711 624 3 2,284,507 $ 2,487,741 17 18 Taxes $ 2,590 $ 269,146) 6 599068) S (799,578) $ (070,709) 19 Income After Taxes 5 4,810) $ 499,842 $ 1,112 556 $ 14B4,929 $ 1,617 032 20 21 Add Back Depreciation 22 Subtract Principal Payments S (169,632) $ (183,615) 5 (198,751) 3 (215,134) $ (232.868) 23 24 Cash Flow 25 26 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts