Question: Casey is in the 1 2 % marginal tax bracket, and Mei is in the 3 5 % marginal tax bracket. Their employer is experiencing

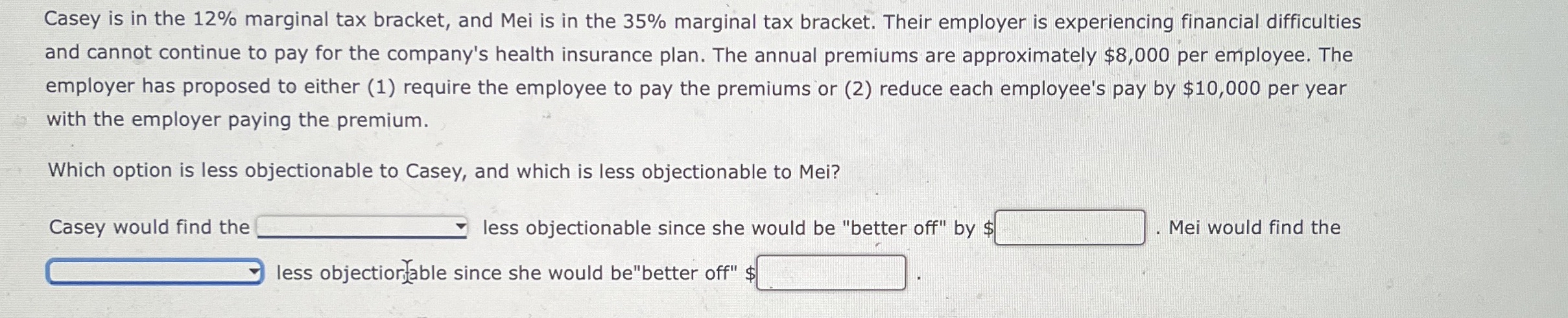

Casey is in the marginal tax bracket, and Mei is in the marginal tax bracket. Their employer is experiencing financial difficulties and cannot continue to pay for the company's health insurance plan. The annual premiums are approximately $ per employee. The employer has proposed to either require the employee to pay the premiums or reduce each employee's pay by $ per year with the employer paying the premium.

Which option is less objectionable to Casey, and which is less objectionable to Mei?

Casey would find the less objectionable since she would be "better off" by $ Mei would find the less objectiorfable since she would bebetter off" $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock