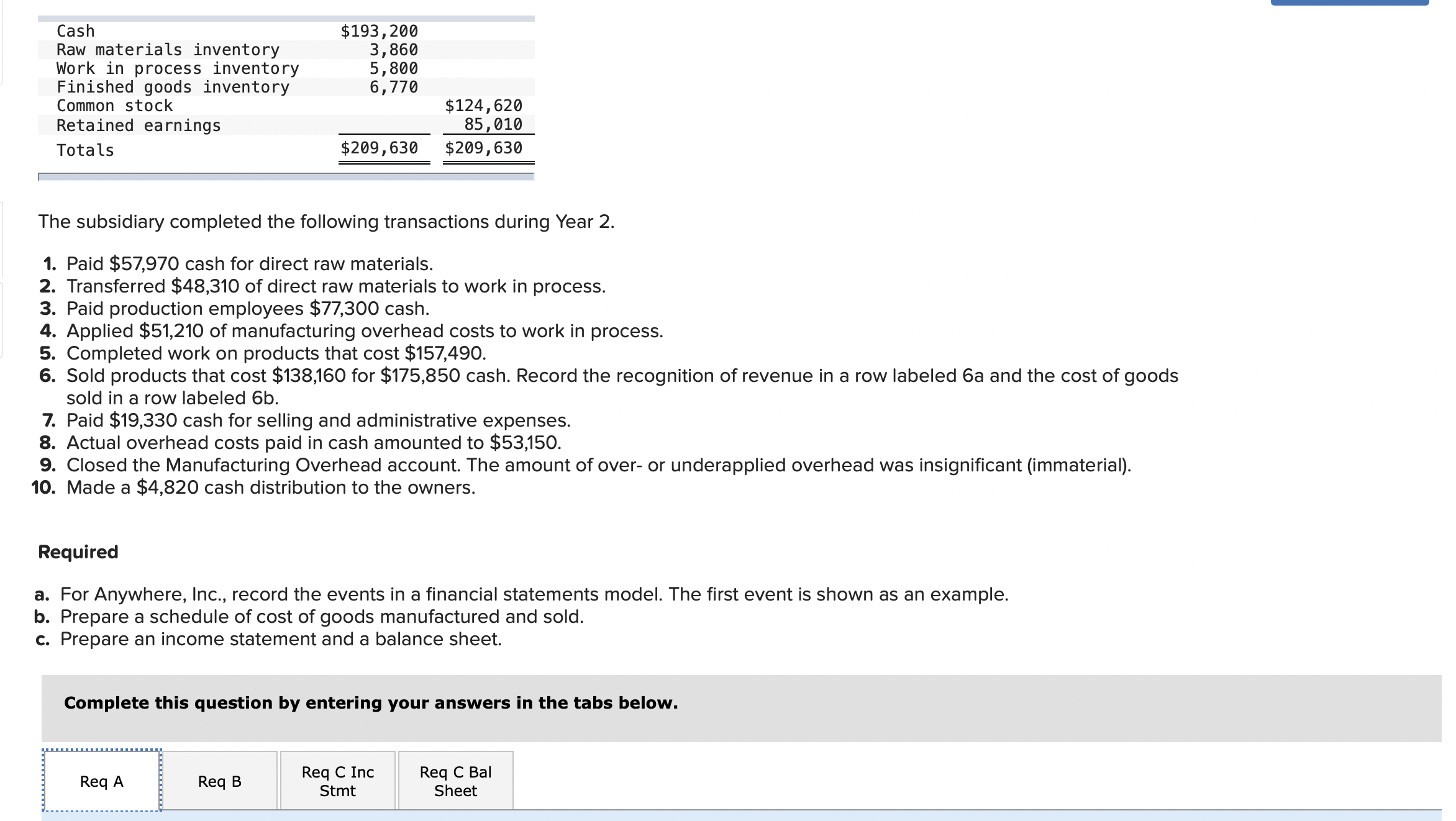

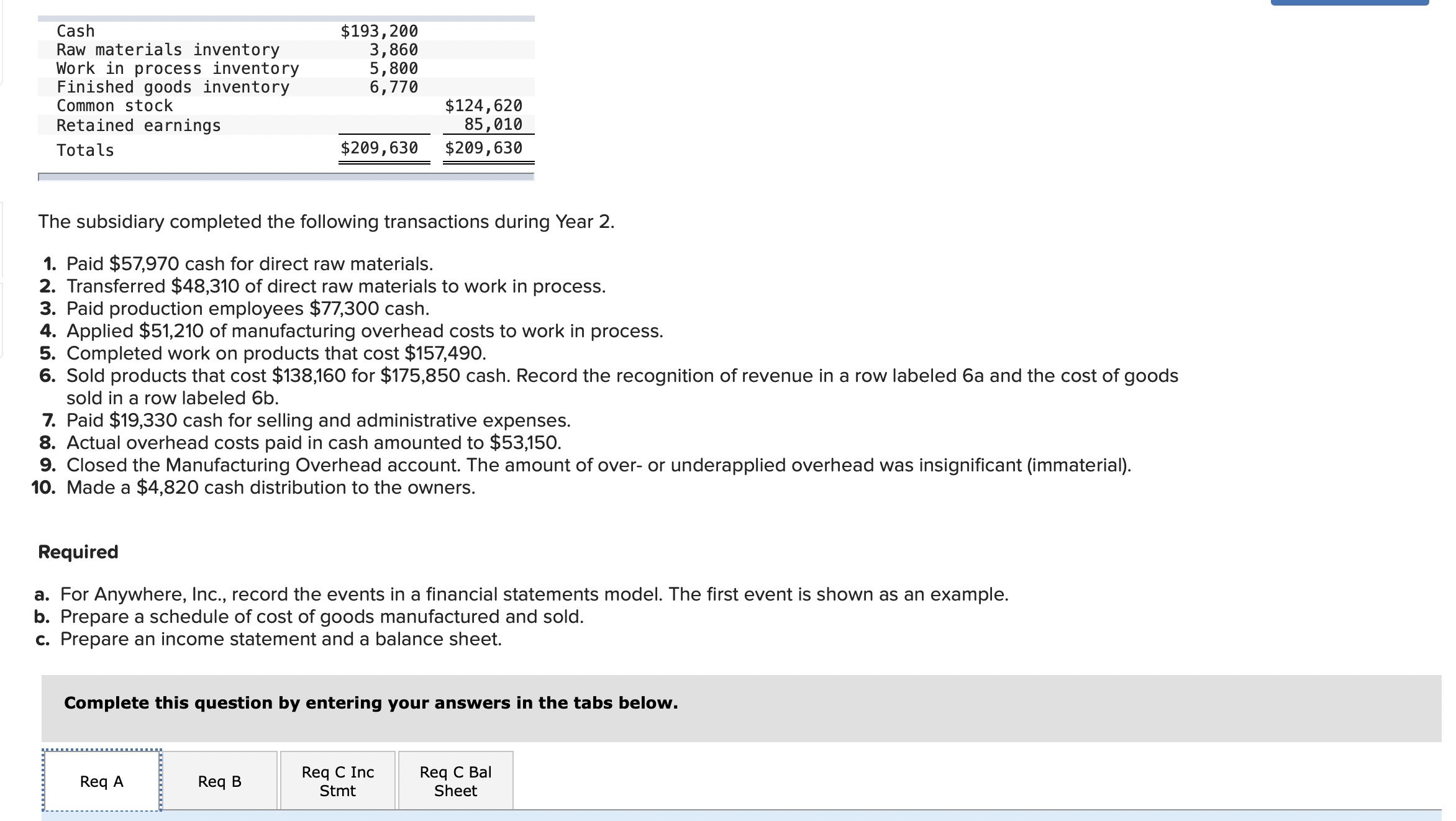

Question: Cash $193,200 Raw materials inventory 3,860 Work in process inventory 5,800 Finished goods inventory 6,770 Common stock $124,620 Retained earnings 85,010 Totals $209,630 $209,630 The

Cash $193,200 Raw materials inventory 3,860 Work in process inventory 5,800 Finished goods inventory 6,770 Common stock $124,620 Retained earnings 85,010 Totals $209,630 $209,630 The subsidiary completed the following transactions during Year 2. 1. Paid $57,970 cash for direct raw materials. 2. Transferred $48,310 of direct raw materials to work in process. 3. Paid production employees $77,300 cash. 4. Applied $51,210 of manufacturing overhead costs to work in process. 5. Completed work on products that cost $157,490. 6. Sold products that cost $138,160 for $175,850 cash. Record the recognition of revenue in a row labeled 6a and the cost of goods sold in a row labeled 6b. 7. Paid $19,330 cash for selling and administrative expenses. 8. Actual overhead costs paid in cash amounted to $53,150. 9. Closed the Manufacturing Overhead account. The amount of over- or underapplied overhead was insignicant (immaterial). 10. Made a $4,820 cash distribution to the owners. Required 3. For Anywhere, |nc., record the events in a financial statements model. The first event is shown as an example. b. Prepare a schedule of cost of goods manufactured and sold. c. Prepare an income statement and a balance sheet. Complete this question by entering your answers in the tabs below. Req C Inc Req C Bal Req B Stmt Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts