Question: Cash Conversion Cycle Chilo con 9. cash Conversion Cash managemehe Cycle a very important function of managers. Companies need to manage their operations in a

Cash Conversion Cycle

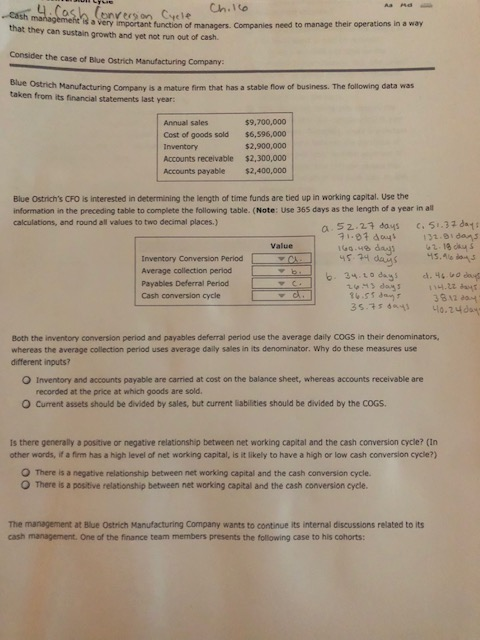

Chilo con 9. cash Conversion Cash managemehe Cycle a very important function of managers. Companies need to manage their operations in a way that they can sustain growth and yet not run out of cash Consider the case of Ostrich Manufacturing Company ve Ostrich Manufacturing Com m ure form that has a stable flow of business. The following data was taken from its financial statements last year: Annual sales Cost of goods sold Inventory Accounts receivable Accounts payable $9,700,000 $6.595,000 $2,900,000 $2,300,000 $2,400,000 Blue Osts CFOs interested in determining the length of time funds are tied up in working capital. Use the Information in the preceding table to complete the following table. (Note: Use 365 days as the length of a year in all calculations, and round all values to two decimal places.) a 52. 27 days 6.51.37 days . 71.87 days 132.81 days Value 160.48 days 62.18 chys Inventory Conversion Period CA 45.74 days MS. Average collection period 6. 34.20 days d. 46.60 days Payables Deferral Period 2643 days 14. Cash conversion cycle 96.5 3811 - 35.75 days 40.24 day Both the inventory conversion period and payables deferral period use the average daily COGS in their denominators, whereas the average collection period uses average daily sales in its denominator. Why do these measures use different inputs? Inventory and accounts payable are carried at cost on the balance sheet, whereas accounts receivable are recorded at the price at which goods are sold. Current assets should be divided by sales, but current abilities should be divided by the COGS Is there generally a positive or negative relationship between networking capital and the cash conversion cycle? (In other words, tra firm has a high level of net working capital, is it likely to have a high or low cash conversion cycle?) There is a negative relationship between net working capital and the cash conversion cycle There is a positive relationship between net working capital and the cash conversion cyde The management at Blue Ostrich Manufacturing Company wants to continue its internal discussions related to its cash management. One of the finance team members presents the following case to his cohorts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts