Question: Cash Conversion Cycle Homework Current inventory = $100,000. Annual sales = $900,000. Accounts receivable = $325,000 Accounts payable = $100,000. Total annual purchases (Cost of

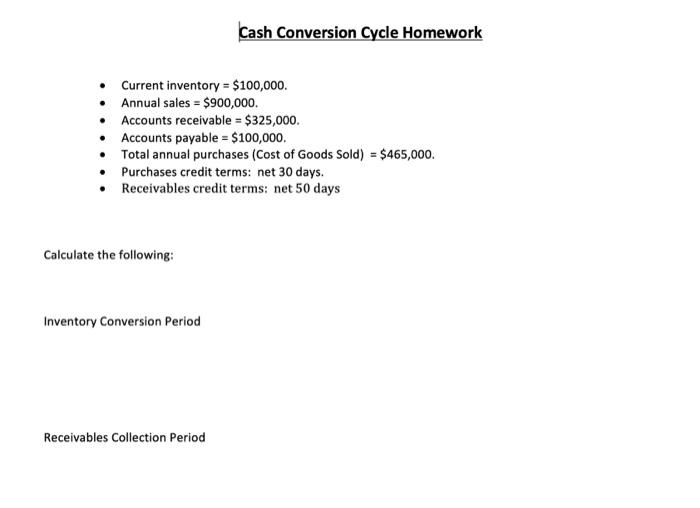

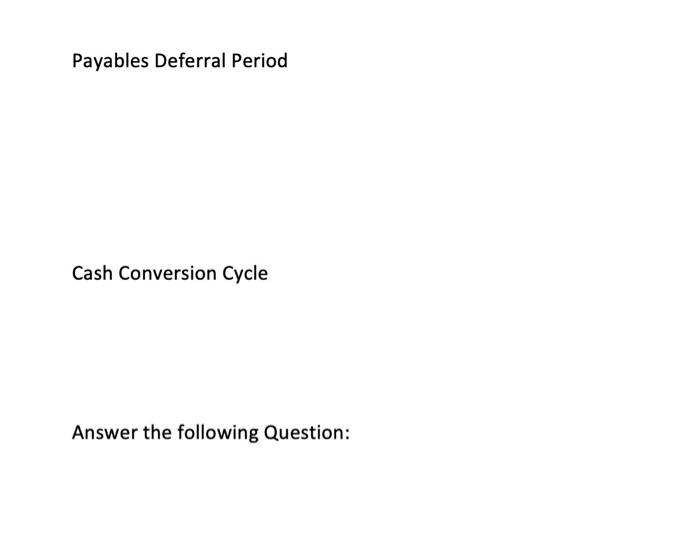

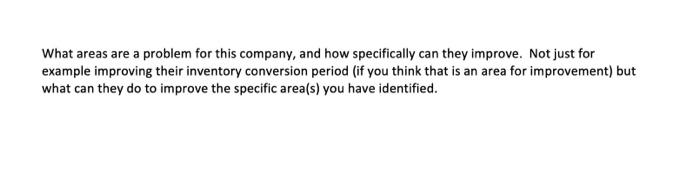

Cash Conversion Cycle Homework Current inventory = $100,000. Annual sales = $900,000. Accounts receivable = $325,000 Accounts payable = $100,000. Total annual purchases (Cost of Goods Sold) = $465,000. Purchases credit terms: net 30 days. Receivables credit terms: net 50 days Calculate the following: Inventory Conversion Period Receivables Collection Period Payables Deferral Period Cash Conversion Cycle Answer the following Question: What areas are a problem for this company, and how specifically can they improve. Not just for example improving their inventory conversion period (if you think that is an area for improvement) but what can they do to improve the specific area(s) you have identified

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts