Question: Cash Conversion Cycle Negus Enterprises has an inventory conversion period of 79 days, an average collection period of 44 days, and a payables deferral period

Cash Conversion Cycle Negus Enterprises has an inventory conversion period of 79 days, an average collection period of 44 days, and a payables deferral period of 20 days. Assume that cost of goods sold is 80% of sales. Assume 365 days in year for your calculations.

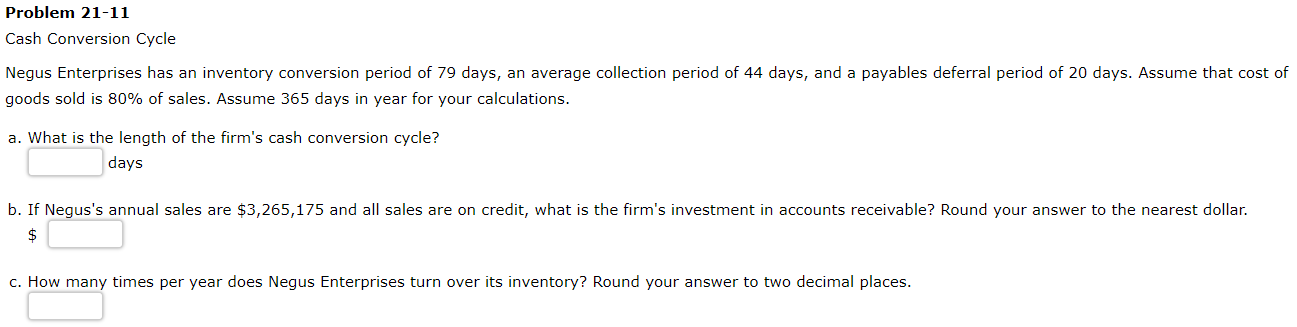

Problem 21-11 Cash Conversion Cycle Negus Enterprises has an inventory conversion period of 79 days, an average collection period of 44 days, and a payables deferral period of 20 days. Assume that cost of goods sold is 80% of sales. Assume 365 days in year for your calculations. a. What is the length of the firm's cash conversion cycle? days b. If Negus's annual sales are $3,265,175 and all sales are on credit, what is the firm's investment in accounts receivable? Round your answer to the nearest dollar. $ c. How many times per year does Negus Enterprises turn over its inventory? Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts