Question: Cash Flow Analysis Case. Basic Concepts questions. Please see the pictures below. Cash Flowr Analysis Case: Refer to the attached Cash Flow Statements for Firm

Cash Flow Analysis Case. Basic Concepts questions. Please see the pictures below.

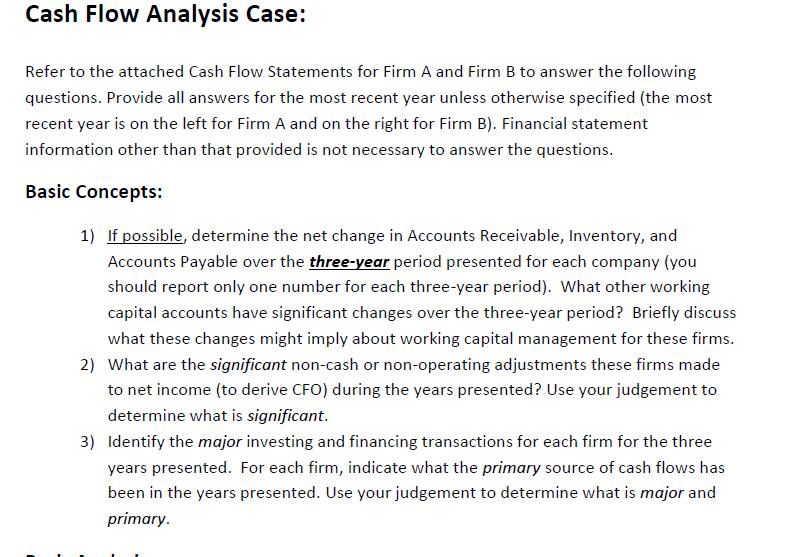

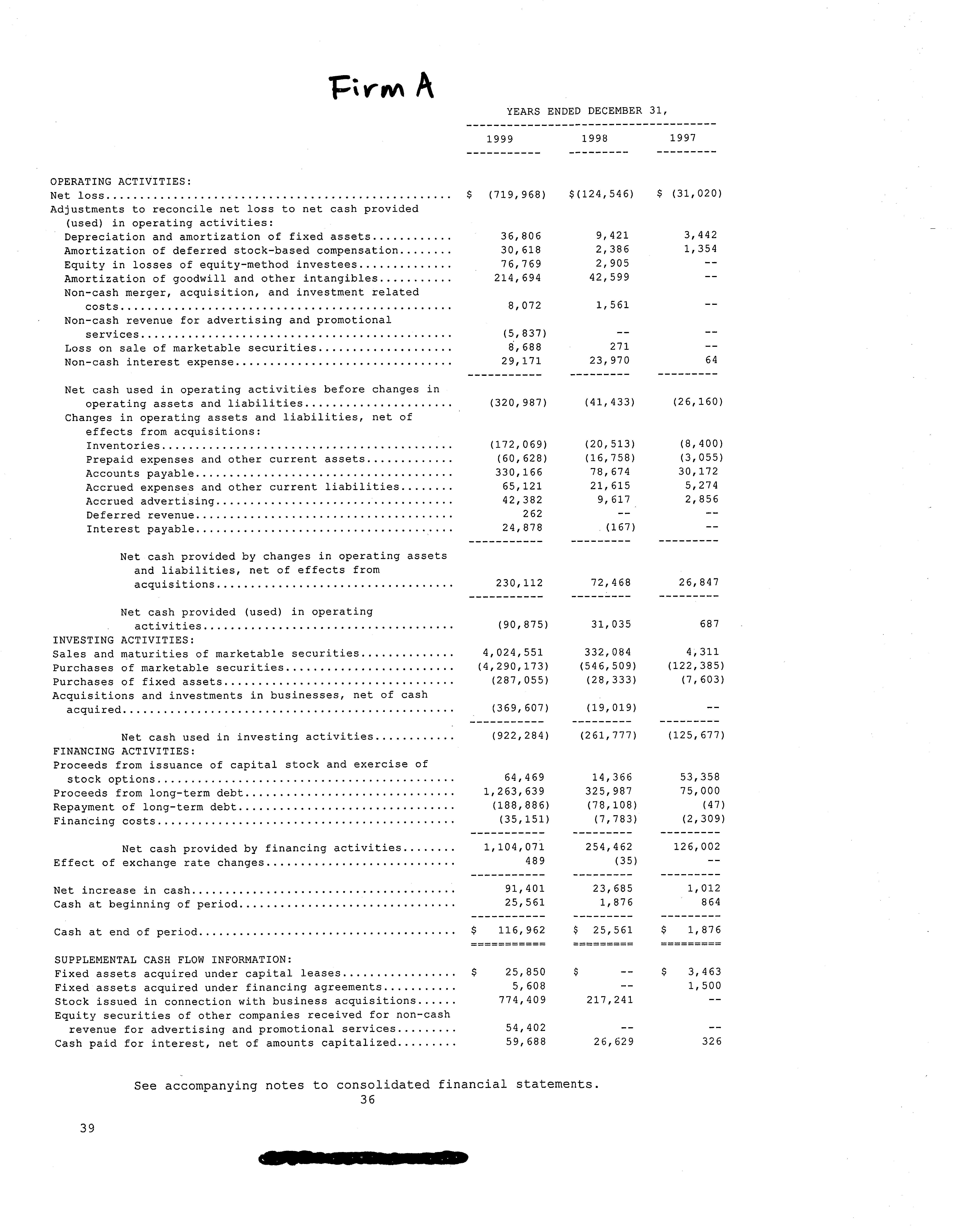

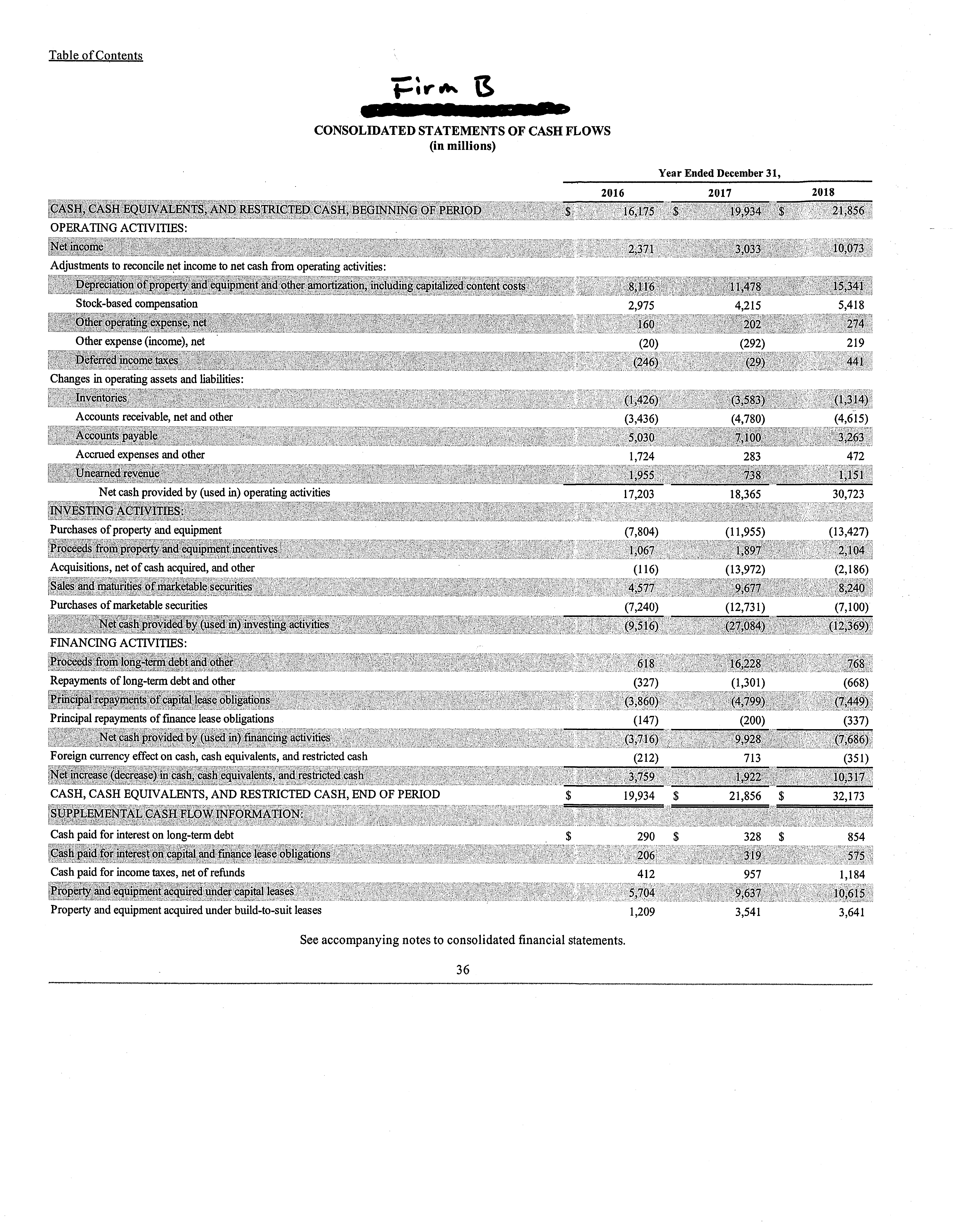

Cash Flowr Analysis Case: Refer to the attached Cash Flow Statements for Firm A and Firm B to answer the following questions. Provide ali answers for the most recent year unless otherwise specified [the most recent year is on the ieft for Firm A ant:I on the right for Firm El]. Financial statement information other than that provided is not necessary to answer the questions. Basic Conce pts: 1) If possibleI determine the net change in Accounts Receivable, Inventory, and Accounts Payable over the three-gear period presented for each company [you should report only one number for each threeyear period]. What other working capital accounts have significant changes over the threeyear period? Briefly discuss what these changes might impiy about working ca pitai management for these firms. 2} 1What are the signicant noncash or nonoperating adjustments these firms made to net income [to derive CFO} during the years presented? Use your judgement to determine what is significant. 3} Identify the major investing and financing transactions for each firm for the three years presented. For each firm, indicate what the primary source of cash flows has been in the yea rs presented. Use your judgement to determine what is major and primary. OPERATING ACTIVITIES: Net loss ............................................... .... Adjustments to reconcile net loss to net cash provided YEARS ENDED DECEMBER 31, $ (719,968) (used) in operating activities: Depreciation and amortization of fixed assets ............ 36,806 Amortization of deferred stock-based compensation ........ 30,618 Equity in losses of equitymethod investees ..... . ........ 76,769 Amortization of goodwill and other intangibles ......... .. 214,694 Noncash merger, acquisition, and investment related costs...... ......... ........ ......................... . 8,072 Noncash revenue for advertising and promotional services ..... ..... .................... ...... .......... (5,837) Loss on sale of marketable securities ............... ..... 8,688 Noncash interest expense ............. ................... 29,171 Net cash used in operating activities before changes in operating assets and liabilities .............. . ....... (320,987) Changes in operating assets and liabilities, net of effects from acquisitions: Inventories ........... . ............................... (172,069) Prepaid expenses and other current assets ............. (60,628) Accounts payable ............................... ....... 330,166 Accrued expenses and other current liabilities ........ 65,121 Accrued advertising ................................... 42,382 Deferred revenue ...................................... 262 Interest payable..... ............ ... ..... . ........... . 24,878 Net cash provided by changes in operating assets and liabilities, net of effects from acquisitions ....... ..... .......... ........ ..... 230,112 Net cash provided (used) in operating . activities.... ........ . ............ ...... ...... (90,875) INVESTING ACTIVITIES: Sales and maturities of marketable securities... ....... .... 4,024,551 Purchases of marketable securities.... ............ . ........ (4,290,173) Purchases of fixed assets. ........ . .......... ....... ...... . (287,055) Acquisitions and investments in businesses, net of cash acquired........... ...... ... ......... . ............. . ..... (369,607) Net cash used in investing activities ........ .... (922,284) FINANCING ACTIVITIES: Proceeds from issuance of capital stock and exercise of stock options ............................................ 64,469 Proceeds from longterm debt....... ... 1,263,639 Repayment of long-term debt ............ (188,886) Financing costs........... ...... . ...................... .... (35,151) Net cash provided by financing activities. ....... 1,104,071 Effect of exchange rate changes.... ........ ...... .......... 489 Net increase in cash ......... . ................ ... ........ .. 91,401 Cash at beginning of period ......... ... ............. ....... 25,561 Cash at end of period...... ................. . .............. $ SUPPLEMENTAL CASH FLOW INFORMATION: Fixed assets acquired under capital leases .......... ....... 5 25,850 Fixed assets acquired under financing agreements ..... . ..... 5,608 Stock issued in connection with business acquisitions ...... 774,409 Equity securities of other companies received for noncash revenue for advertising and promotional services ...... .. 54,402 Cash paid for interest, net of amounts capitalized ......... 59,688 $(124,546) 9,421 2,386 2,905 42,599 1,561 (41,433) (20,513) (16,758) 78,674 21,615 9,617 31,035 332,084 (546,509) (28,333) (19,019) (261,777) 14,366 325,987 (78,108) (7,783) 254,462 (33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts