Question: Cash Flow Estimation and Risk Analysisi Real Options DCF analysis doesn't alnays lead to proper capital budgeting decisions because capital budgeting projects are not-Select- investments

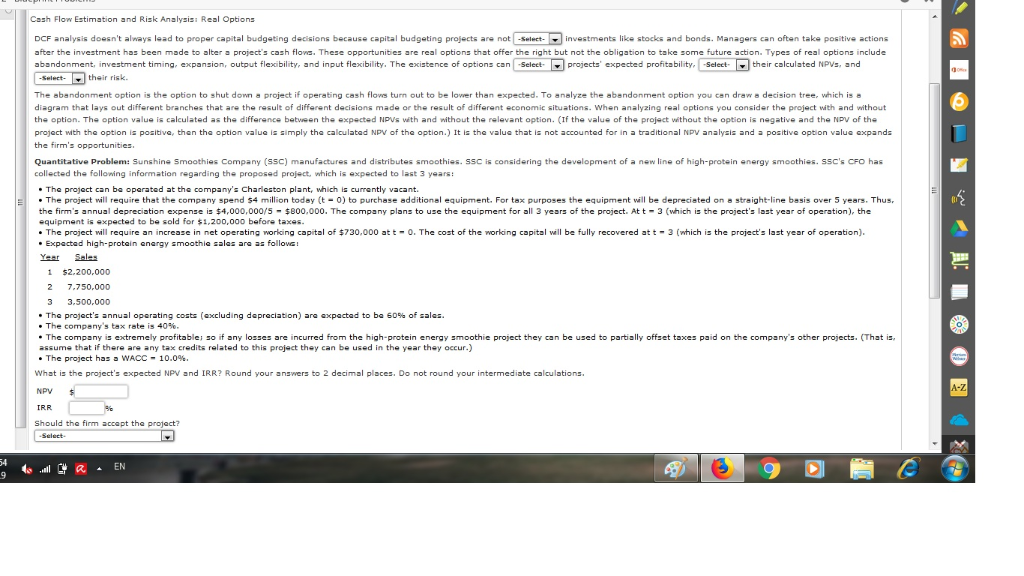

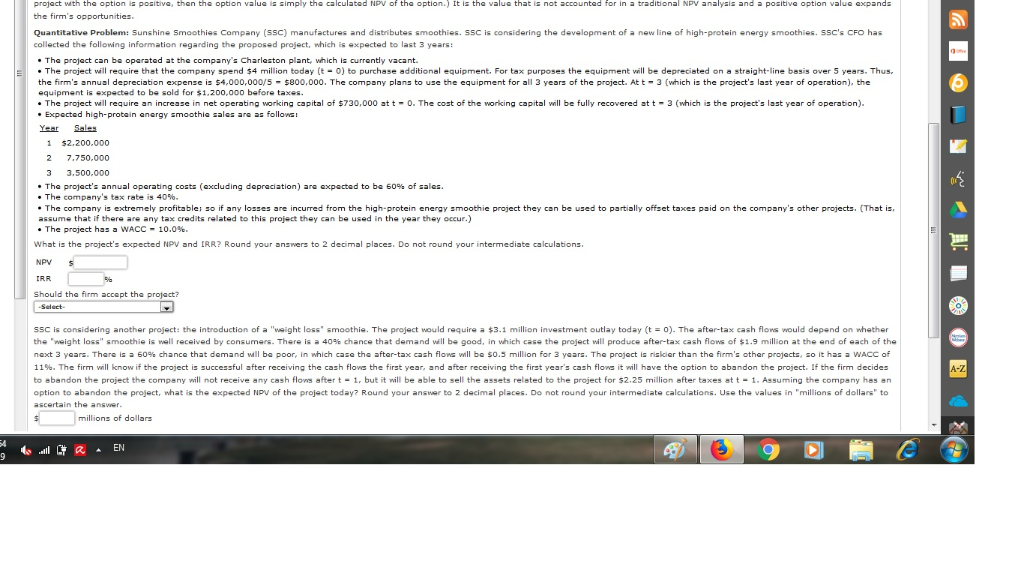

Cash Flow Estimation and Risk Analysisi Real Options DCF analysis doesn't alnays lead to proper capital budgeting decisions because capital budgeting projects are not-Select- investments like stocks and bonds. Managers can often take positive actions after the investment has been made to alter a project's cash flows. These opportunities are real options that offer the right but not the obligation to take some future action. Types of real options include abandonment, investment timing, expansion, output flexibility, nd input flexibility. The existence of options can -select projects expected profitability, Select- their Calculated NPVs, and Selecttheir risk. The abandonment option is the option to shut down a project if operating cash flows turn out to be lower than expected. To analyze the abendonment option you cen draw a decision tree which is e diagram that lays out different branches that are the result of different decisions made or the result of different economic situations. When analyzing real options you consider the project with nd without the option. The option value is calculated as the difference between the expected NPVs with and without the relevant option. (If the value of the project without the option is negative and the NPV of the project with the option is positive, then the option value is simply the calculatad NPV of the option.) It is the value that is not accounted for in a traditional NPV analysis and a positive option value expands the firm's opportunities Quantitative Problem: Sunshine Smoothies Company (SSC) manufactures and distributes smoothies. SSC is considering the development of a new line of high-protein energy smoothies. SSC's CFO has collected the folloming information regarding the proposed project, which is expected to last 3 years: . The project can ba operated at the company's Charleston plant, which is currantly vacant . The project will require that the compeny spend $4 million todey (t-0) to purchase additional equipment. For tax purposes the equipment will be depreciated on a straight-line basis over 5 years. Thus the firm's annual depreciation expense is $4,000,000/5- 800,000. The company plans to use the equipment for all 3 years of the project. Att-3 (which is the project's last year of operation), the equipment is expected to be sold for $1,200,000 before taxes The project will require an increase in net operating working capitol of $730,000 att0. The cost of the working capital waill be fully recovered at t-3 (which is the project's last year of operation). Expactad high-protain enargy smoothie salas ara as followe Y Sales 2 7.750,000 3 3.500.000 * The project's annual operating costs (excluding depreciation) are expected to be 60% of sales. The compeny's tax rate is 40 * The company is extremely profitable; if any losses are incurred from the high-protein energy smoothie project they can be used to partially offset taxes paid on the co pany's other projects. (That is assume that if there are any tax credits related to this project they can be used in the year they occur.) * The project has wACC-10.0%. What is the project's expected NPV and IRR? Round your answers to 2 decimal places, Do not round your intermediate calculations Should the firm accopt the project? project with the option is positive, then the option valug the firm's opportunities imply the, calculated NpV of the option.) It i the value that is not accounted for in a traditional NpV analysis and a positive option value xpand Quantitative Problem: Sunshine Smoothies Company (SSC) manufactures and distributes smoothies. S5C is considering the development of a new line of high-protein energy smoothies. SSC's CFO has collected the folloing information regarding the proposed project, which is expected to last 3 years: . The project can be oparated at the company's Charleston plant, which is currently vacant. The project will require that the company spend $4 million today (t0) to purchase additional equipment. For tax purposes the equipment will be depreciated on a straight-line basis over 5 years. Thus the firm's annual depreciation expense is $4,000,000/S- $800,000. The company plans to use the equipment for all 3 years of the project. Att3 (which is the project's last year of operation), the equipment is expected to be sold for $1,200,000 before taxes The project will require an increase in net operating working capital of $730,000 att 0. The cost of the working capital will be fully recovered att- 3 (which is the project's last year of operation) Expected high-protain anergy smoothle ales ara as follow Year Sales 1 $2.200.000 The project's annual operating costs (excluding depreciation) are expected to be 60% of ales. The comp8ny's tax rate is 40%, The company is extremely profitablei so if any losses are incurred from the high-protein energy smoothie project they can be used to partially offset taxes paid on the company's other projects. (That is assume that if there are any tax credits related to this project they can be used in the year they occur.) * The project has a WACC-10.0%. What is the project's expected NPV and IRR? Round your answers to 2 decimal places. Do not round your intermediate calculations Should the firm accept the projact? SSC is considering another Project the introduction of a weight loss smoothie. The Project would require a $3.1 million investment outlay today t-O The after-ta cash flos would depend on whether the eight loss smoothie is well received by consumers. There is a 40% chance that demand wil be od, in which case the project will produce after-tax cash f ons of $1.9 million at the end o each of the next 3 years. There is a 60% chance that demand wil be poor, in which case the after-tax ca h flows will be so.5 million for 3 years. The project is riskier than the firm's other projects, so it has a WACC of 11%. The firm will know if the project is successful after receiving the cash flows the first year, and after receiving the first year's cash flows it will have the option to obandon the project. If the firm decides to abandon the project the compeny will not receive any cash flows after t- 1, but it will be able to sell the assets related to the project for $2.25 million after taxes at t-1. Assuming the company has an option to abandon the project, what is the expected NPV of the project today? Round your answar to 2 decimal places. Do not round your intermediate calculations. Use the values in "millions of dollars" to A-Z millions of dollars Cash Flow Estimation and Risk Analysisi Real Options DCF analysis doesn't alnays lead to proper capital budgeting decisions because capital budgeting projects are not-Select- investments like stocks and bonds. Managers can often take positive actions after the investment has been made to alter a project's cash flows. These opportunities are real options that offer the right but not the obligation to take some future action. Types of real options include abandonment, investment timing, expansion, output flexibility, nd input flexibility. The existence of options can -select projects expected profitability, Select- their Calculated NPVs, and Selecttheir risk. The abandonment option is the option to shut down a project if operating cash flows turn out to be lower than expected. To analyze the abendonment option you cen draw a decision tree which is e diagram that lays out different branches that are the result of different decisions made or the result of different economic situations. When analyzing real options you consider the project with nd without the option. The option value is calculated as the difference between the expected NPVs with and without the relevant option. (If the value of the project without the option is negative and the NPV of the project with the option is positive, then the option value is simply the calculatad NPV of the option.) It is the value that is not accounted for in a traditional NPV analysis and a positive option value expands the firm's opportunities Quantitative Problem: Sunshine Smoothies Company (SSC) manufactures and distributes smoothies. SSC is considering the development of a new line of high-protein energy smoothies. SSC's CFO has collected the folloming information regarding the proposed project, which is expected to last 3 years: . The project can ba operated at the company's Charleston plant, which is currantly vacant . The project will require that the compeny spend $4 million todey (t-0) to purchase additional equipment. For tax purposes the equipment will be depreciated on a straight-line basis over 5 years. Thus the firm's annual depreciation expense is $4,000,000/5- 800,000. The company plans to use the equipment for all 3 years of the project. Att-3 (which is the project's last year of operation), the equipment is expected to be sold for $1,200,000 before taxes The project will require an increase in net operating working capitol of $730,000 att0. The cost of the working capital waill be fully recovered at t-3 (which is the project's last year of operation). Expactad high-protain enargy smoothie salas ara as followe Y Sales 2 7.750,000 3 3.500.000 * The project's annual operating costs (excluding depreciation) are expected to be 60% of sales. The compeny's tax rate is 40 * The company is extremely profitable; if any losses are incurred from the high-protein energy smoothie project they can be used to partially offset taxes paid on the co pany's other projects. (That is assume that if there are any tax credits related to this project they can be used in the year they occur.) * The project has wACC-10.0%. What is the project's expected NPV and IRR? Round your answers to 2 decimal places, Do not round your intermediate calculations Should the firm accopt the project? project with the option is positive, then the option valug the firm's opportunities imply the, calculated NpV of the option.) It i the value that is not accounted for in a traditional NpV analysis and a positive option value xpand Quantitative Problem: Sunshine Smoothies Company (SSC) manufactures and distributes smoothies. S5C is considering the development of a new line of high-protein energy smoothies. SSC's CFO has collected the folloing information regarding the proposed project, which is expected to last 3 years: . The project can be oparated at the company's Charleston plant, which is currently vacant. The project will require that the company spend $4 million today (t0) to purchase additional equipment. For tax purposes the equipment will be depreciated on a straight-line basis over 5 years. Thus the firm's annual depreciation expense is $4,000,000/S- $800,000. The company plans to use the equipment for all 3 years of the project. Att3 (which is the project's last year of operation), the equipment is expected to be sold for $1,200,000 before taxes The project will require an increase in net operating working capital of $730,000 att 0. The cost of the working capital will be fully recovered att- 3 (which is the project's last year of operation) Expected high-protain anergy smoothle ales ara as follow Year Sales 1 $2.200.000 The project's annual operating costs (excluding depreciation) are expected to be 60% of ales. The comp8ny's tax rate is 40%, The company is extremely profitablei so if any losses are incurred from the high-protein energy smoothie project they can be used to partially offset taxes paid on the company's other projects. (That is assume that if there are any tax credits related to this project they can be used in the year they occur.) * The project has a WACC-10.0%. What is the project's expected NPV and IRR? Round your answers to 2 decimal places. Do not round your intermediate calculations Should the firm accept the projact? SSC is considering another Project the introduction of a weight loss smoothie. The Project would require a $3.1 million investment outlay today t-O The after-ta cash flos would depend on whether the eight loss smoothie is well received by consumers. There is a 40% chance that demand wil be od, in which case the project will produce after-tax cash f ons of $1.9 million at the end o each of the next 3 years. There is a 60% chance that demand wil be poor, in which case the after-tax ca h flows will be so.5 million for 3 years. The project is riskier than the firm's other projects, so it has a WACC of 11%. The firm will know if the project is successful after receiving the cash flows the first year, and after receiving the first year's cash flows it will have the option to obandon the project. If the firm decides to abandon the project the compeny will not receive any cash flows after t- 1, but it will be able to sell the assets related to the project for $2.25 million after taxes at t-1. Assuming the company has an option to abandon the project, what is the expected NPV of the project today? Round your answar to 2 decimal places. Do not round your intermediate calculations. Use the values in "millions of dollars" to A-Z millions of dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts