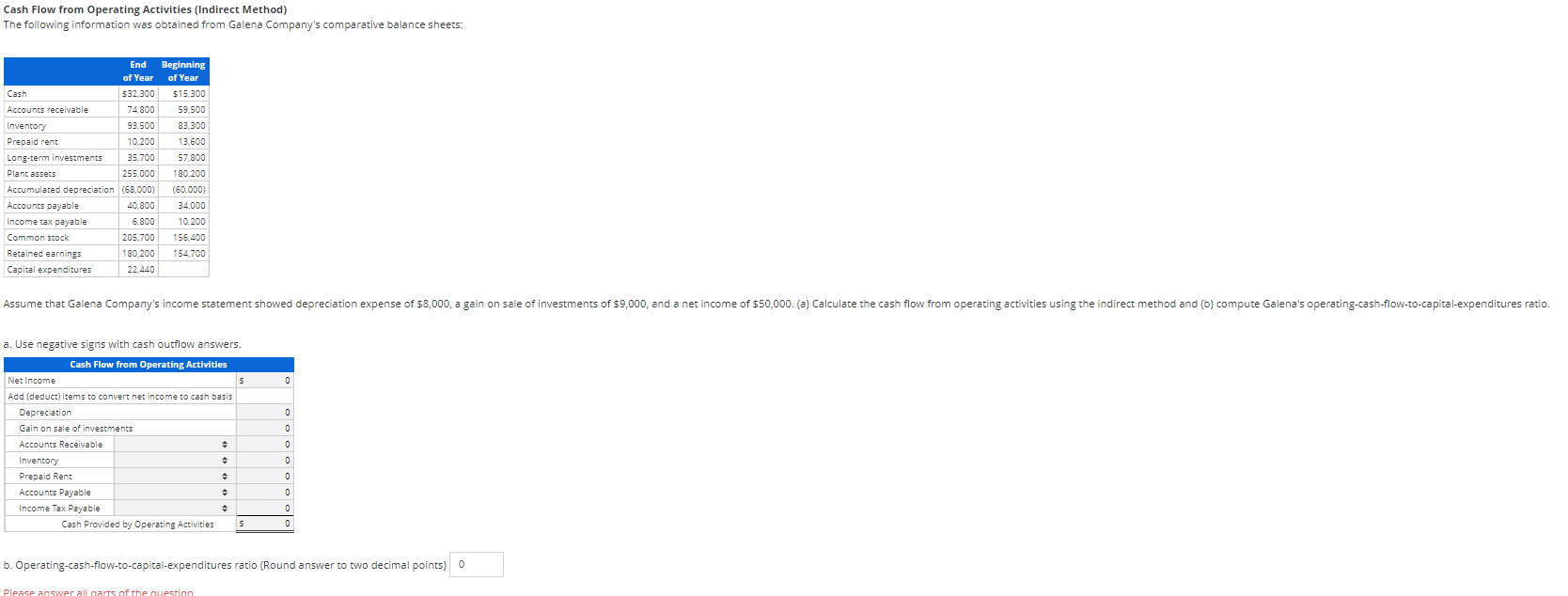

Question: Cash Flow from Operating Activities (Indirect Method) The following information was obtained from Galena Company's comparative balance sheets: End Beginning of Year of Year Cash

Cash Flow from Operating Activities (Indirect Method) The following information was obtained from Galena Company's comparative balance sheets: End Beginning of Year of Year Cash $32.300 $15.300 Accounts receivable 74.800 59.500 Inventory 93.500 83.300 Prepaid rent 10.200 13.600 Long-term investments 35.700 57.800 Plant assets 255,000 180.200 Accumulated depreciation (68,000) (60.0001 Accounts payable 40.800 34.000 Income tax payable 6.800 10.200 Common stock 205,700 156,400 Retained earnings 180,200 154.700 Capital expenditures 22.440 Assume that Galena Company's income statement showed depreciation expense of $8,000, a gain on sale of investments of $9,000, and a net income of $50,000. (a) Calculate the cash flow from operating activities using the indirect method and (b) compute Galena's operating-cash-flow-to-capital-expenditures ratio. 0 0 0 a. Use negative signs with cash outflow answers. Cash Flow from Operating Activities Net Income S Add (deduct) items to convert net income to cash basis Depreciation Gain on sale of investments Accounts Receivable Inventory Prepaid Rent Accounts Payable 2 Income Tax Payable Cash Provided by Operating Activities S 0 0 0 0 U b. Operating-cash-flow-to-capital-expenditures ratio (Round answer to two decimal points) Please answer all parts of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts