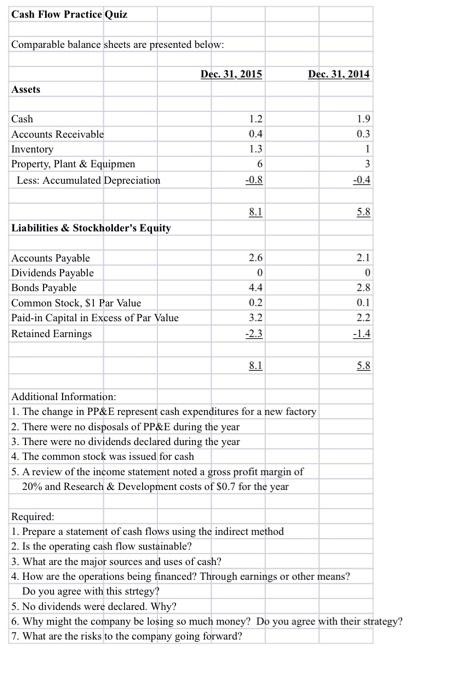

Question: Cash Flow Practice Quiz Comparable balance sheets are presented below: Dec 31, 2015 Dec. 31, 2014 Assets Cash Accounts Receivable Inventory Property, Plant & Equipmen

Cash Flow Practice Quiz Comparable balance sheets are presented below: Dec 31, 2015 Dec. 31, 2014 Assets Cash Accounts Receivable Inventory Property, Plant & Equipmen Less: Accumulated Depreciation 1.2 0.4 1.3 6 -0.8 1.9 0.3 1 3 -0,4 8.1 5.8 Liabilities & Stockholder's Equity Accounts Payable Dividends Payable Bonds Payable Common Stock, S1 Par Value Paid-in Capital in Excess of Par Value Retained Earnings 2.6 0 4.4 0.2 3.2 -2.3 2.1 0 2.8 0.1 2.2 8.1 5.8 Additional Information: 1. The change in PP&E represent cash expenditures for a new factory 2. There were no disposals of PP&E during the year 3. There were no dividends declared during the year 4. The common stock was issued for cash 5. A review of the income statement noted a gross profit margin of 20% and Research & Development costs of S0.7 for the year Required: 1. Prepare a statement of cash flows using the indirect method 2. Is the operating cash flow sustainable? 3. What are the major sources and uses of cash? 4. How are the operations being financed? Through earnings or other means? Do you agree with this strtegy? 5. No dividends were declared. Why? 6. Why might the company be losing so much money? Do you agree with their strategy? 7. What are the risks to the company going forward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts