Question: Cash Flow Statement Add/(Less) $ $ Decrease in accounts receivable 58,563 Increase in inventory -71,079 Increase in other current assets -11,339 Goodwill written off 30.420

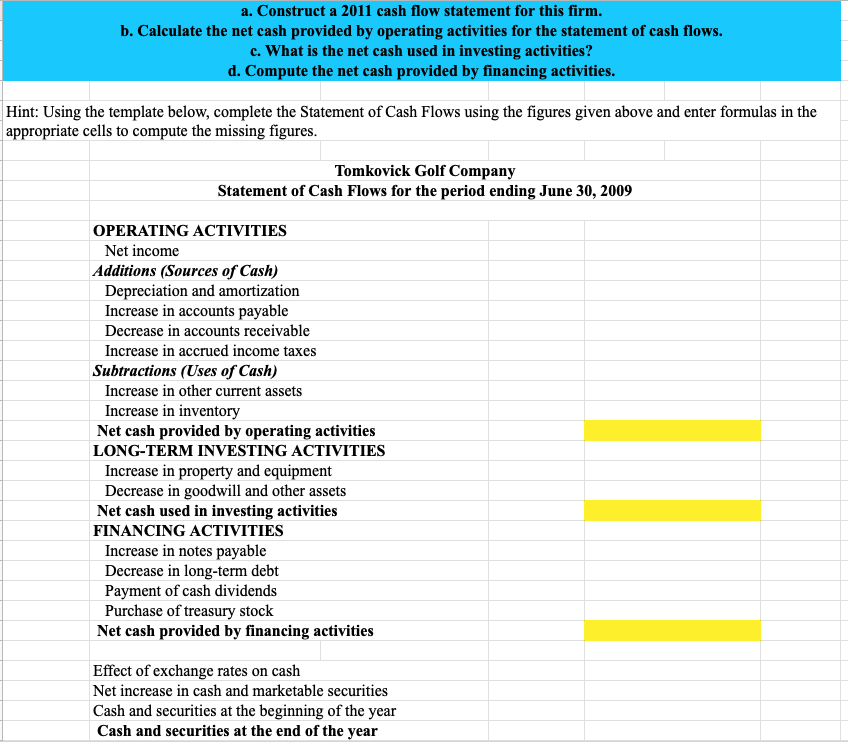

Cash Flow Statement

Add/(Less) $ $

Decrease in accounts receivable 58,563

Increase in inventory -71,079

Increase in other current assets -11,339

Goodwill written off 30.420

Increase in accounts payable 46,232

Increase in notes payable 6,625

Increase in income taxes 4,310

Depreciation 212,366 276,098

Cash from operating activities 3,431,946

Cash from investing activities:

Purchase of plant and equipment -321,821

Cash from investing activities -321,821

Cash from financing activities:

Decrease in long-term debt -113,534

Purchase if treasury stock -13,334

Dividends paid -2,966,412

Cash from financing activities 3,093,280

Increase/(Decrease) in cash 16,845

Opening cash balance 16,566

Closing cash balance 33,411

The last question I asked, some of the answers were left blank or unclear:

Please explain how the answer for payment of cash dividends is determined?

What is the amount for notes payable?

How is opening and closing cash balance determined?

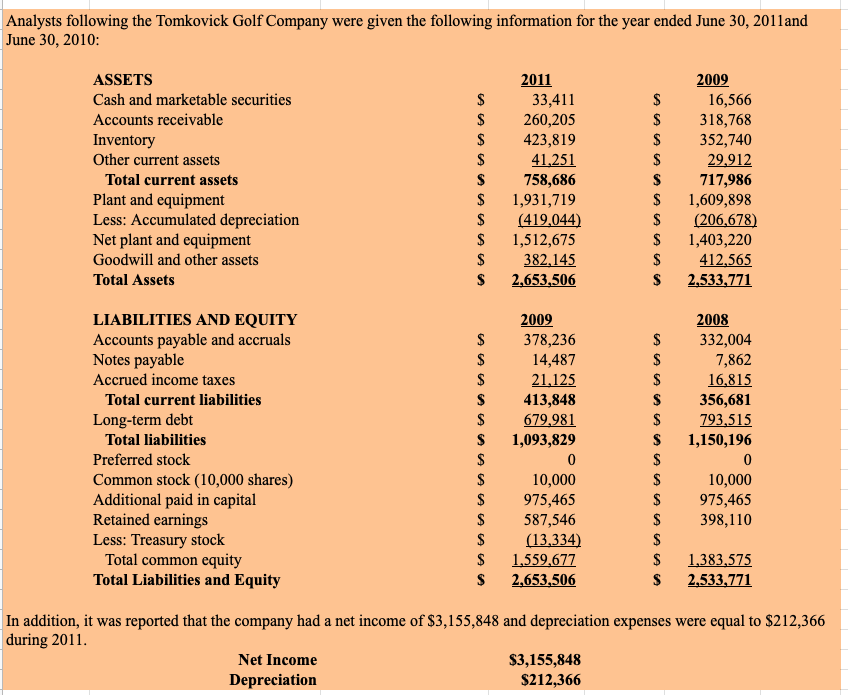

Analysts following the Tomkovick Golf Company were given the following information for the year ended June 30,2011 and June 30,2n1n. In additi during 2011. a. Construct a 2011 cash flow statement for this firm. h Calculata tha nat cach nrovidad hv nnaratina antivitiac for tha ctatamant af cach flowe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts