Question: Cash flow statement Does your company prepare a direct or indirect cash flow statement for operating activities? In your opinion, which is more important income

- Cash flow statement

- Does your company prepare a direct or indirect cash flow statement for operating activities?

- In your opinion, which is more important income statement or cash flow statement?

- Describe the three primary sections of this statement.

- Where is the source of most of your companys cash? What does this say about the companys financial health?

- What is the primary use of your companys cash? What does this say about the companys priorities?

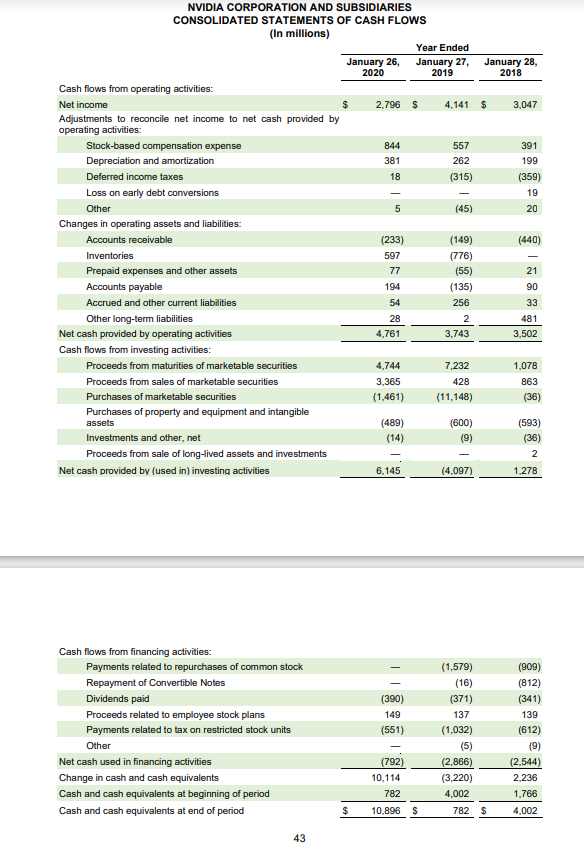

January 28, 2018 $ 3,047 391 199 (359) 19 20 NVIDIA CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Year Ended January 26, January 27, 2020 2019 Cash flows from operating activities: Net income $ 2.796 S 4,141 Adjustments to reconcile net income to net cash provided by operating activities: Stock-based compensation expense 844 557 Depreciation and amortization 381 262 Deferred income taxes 18 (315) Loss on early debt conversions Other 5 (45) Changes in operating assets and liabilities: Accounts receivable (233) (149) Inventories 597 (776) Prepaid expenses and other assets 77 (55) Accounts payable 194 (135) Accrued and other current liabilities 54 256 Other long-term liabilities 28 2 Net cash provided by operating activities 4,761 3,743 Cash flows from investing activities: Proceeds from maturities of marketable securities 4,744 7,232 Proceeds from sales of marketable securities 3,365 428 Purchases of marketable securities (1.461) (11,148) Purchases of property and equipment and intangible assets (489) (600) Investments and other, net (14) (9) Proceeds from sale of long-lived assets and investments Net cash provided by (used in) investing activities 6.145 (4.097) (440) 21 90 33 481 3,502 1,078 863 (36) (593) (36) 2 1.278 - Cash flows from financing activities: Payments related to repurchases of common stock Repayment of Convertible Notes Dividends paid Proceeds related to employee stock plans Payments related to tax on restricted stock units Other Net cash used in financing activities Change in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period (390) 149 (551) (1,579) (16) (371) 137 (1,032) (5) (2.866) (3,220) 4.002 782 $ (909) (812) (341) 139 (612) (9) (2,544) 2,236 1,766 4.002 (792) 10,114 782 $ 10.896 $ 43

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts